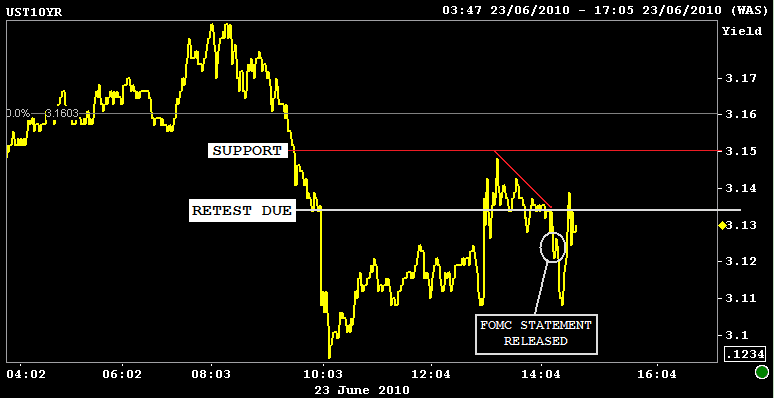

The FOMC Statement has been released..

The subtle alterations made to the statement were skewed to the bearish side of the BIG PICTURE storyline. This includes a reference of weakness abroad and definite dovish tone on inflation ("underlying inflation has trended lower" = deflationary concerns). Overall, the Fed didn't offer up any surprises. They did remove a portion of the text that said housing starts had picked up but they left the verbiage "remain at depressed levels" in tact. There was no change in the "low rates for an extended period" phrase and resource slack continues to prevent producers from passing along higher costs to consumers.

Below are the important points that flashed across my viewer.

- FED REPEATS TO KEEP RATES EXCEPTIONALLY LOW FOR AN EXTENDED PERIOD, KEEPS FED FUNDS RATE IN ZERO TO 0.25 PCT RANGE

- FED SAYS FINANCIAL CONDITIONS HAVE BECOME LESS SUPPORTIVE OF GROWTH ON BALANCE, LARGELY REFLECTING DEVELOPMENTS ABROAD

- FED SAYS ECONOMIC RECOVERY PROCEDING, LABOR MARKET IMPROVING GRADUALLY

- FED SAYS PRICES OF ENERGY, OTHER COMMODITIES HAVE DECLINED SOMEWHAT, UNDERLYING INFLATION HAS TRENDED LOWER

- FED REPEATS INFLATION LIKELY TO BE SUBDUED FOR SOME TIME AS SUBSTANTIAL RESOURCE SLACK RESTRAINS COST PRESSURES

- FED REPEATS PACE OF RECOVERY LIKELY TO BE MODERATE FOR A TIME, ANTICIPATES GRADUAL RETURN TO HIGHER LEVELS OF RESOURCE USE

- FED SAYS HOUSING STARTS REMAIN AT DEPRESSED LEVEL; INVESTMENT IN NONRESIDENTIAL BUILDINGS STILL WEAK

- FED SAYS VOTE ON POLICY WAS 9-1 WITH HOENIG DISSENTING, CITING CONTINUED PLEDGE OF LOW RATES FOR EXTENDED PERIOD COULD LEAD TO IMBALANCES, TIES FED'S HANDS

- FED SAYS WILL CONTINUE TO MONITOR OUTLOOK,FINANCIAL DEVELOPMENTS, WILL EMPLOY POLICY TOOLS AS NECESSARY

- FED SAYS BANK LENDING HAS CONTINUED TO CONTRACT; HOUSEHOLD SPENDING IS INCREASING, STILL CONSTRAINED BY HIGH UNEMPLOYMENT

HERE is color on the April FOMC Statement

Stocks traded immediatly lower, quickly rebounded, and have since begun to lose momentum again. S&P futures are now -0.25 at 1090.25 and the S&P 500 index is -0.06% at 1094.70.

Overbought benchmark Treasuries are watching patiently as equities chop about in search of direction. The 3.50% coupon bearing 10yr note is currently +0-10 at 103-05 yielding 3.128%.

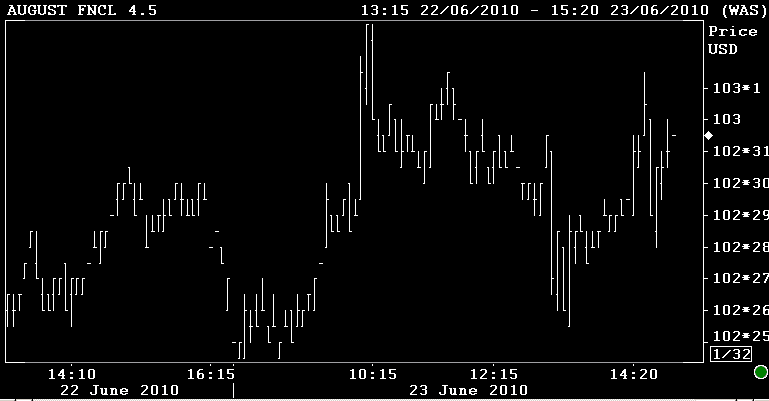

"Rate sheet influential" MBS coupons are playing follow the leader. The August FNCL 4.5 is +0-05 at 103-00, well above reprice for the worse territory.

Reprices for the worse are not a concern at the moment. Stay tuned....