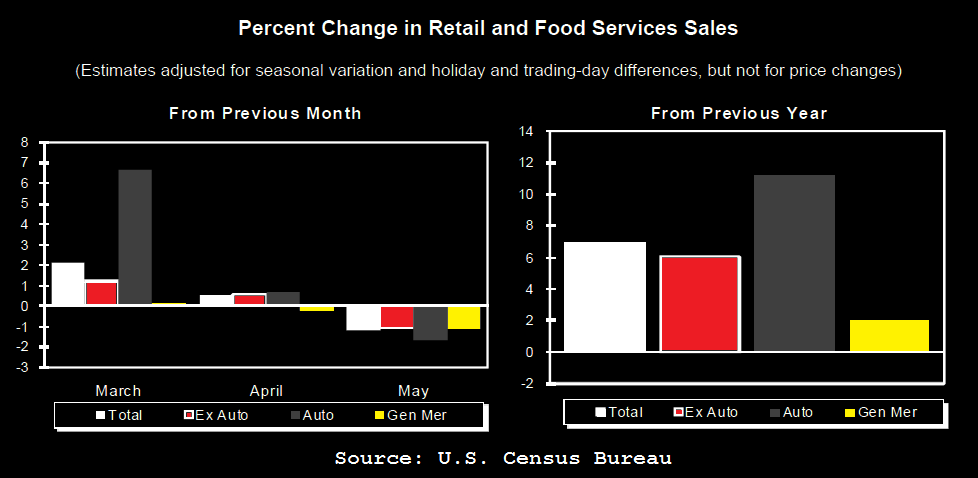

Risk is out of favor again after May Retail Sales data disappointed.

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $362.5 billion, a decrease of 1.2 percent (±0.5%) from the previous month, but 6.9 percent (±0.7%) above May 2009.

From Reuters:

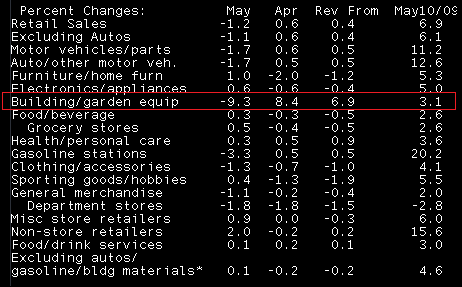

08:30 11Jun10 RTRS-US MAY RETAIL SALES -1.2 PCT (CONSENSUS +0.2 PCT) VS APRIL +0.6 PCT (PREV +0.4 PCT)

08:30 11Jun10 RTRS-US MAY RETAIL SALES EX-AUTOS -1.1 PCT (CONS +0.1 PCT) VS APRIL +0.6 PCT (PREV +0.4 PCT)

08:30 11Jun10 RTRS-US MAY RETAIL SALES EX-GASOLINE -1.0 PCT VS APRIL +0.6 PCT

08:30 11Jun10 RTRS-US MAY RETAIL SALES EX-AUTOS/GAS/BUILDING MATERIALS +0.1 PCT VS APRIL -0.2 PCT

08:30 11Jun10 RTRS-US MAY GASOLINE SALES -3.3 PCT, LARGEST DECLINE SINCE MARCH 2009 (-3.4 PCT), VS APRIL +0.5 PCT

08:30 11Jun10 RTRS-US MAY CARS/PARTS SALES -1.7 PCT VS APRIL +0.6 PCT

08:30 11Jun10 RTRS-US MAY RETAIL SALES EX-AUTOS LARGEST DECLINE SINCE MARCH 2009 (-1.2 PCT)

08:30 11Jun10 RTRS-TABLE-U.S. May retail sales fell 1.2 pct

Another sign of the post tax credit housing downturn: CHECK OUT THE 9.3% DECLINE IN BUILDING MATERIALS/GARDENING EQUIP SPENDING

S&Ps fell 10 handles to the 1076 pivot after the 830 econ print. S&Ps are currently down 7 at 1076

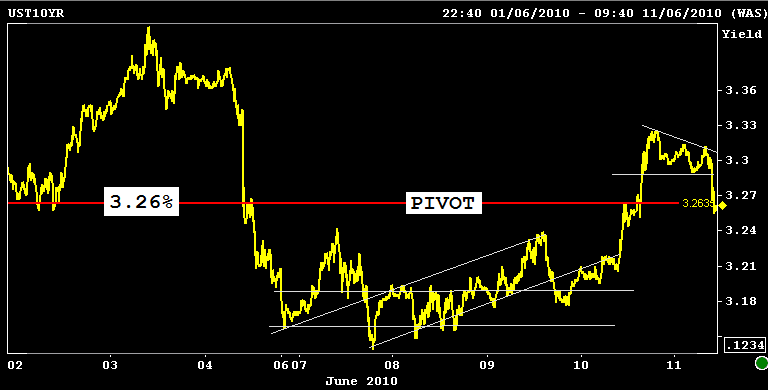

The benchmark 10yr note was spotted 5 bps lower at 3.26% and the 2s10s curve flattened. The 3.50% coupon bearing 10yr TSY note is currently +0-18 at 102-01 yielding 3.26% (-6.5bps).

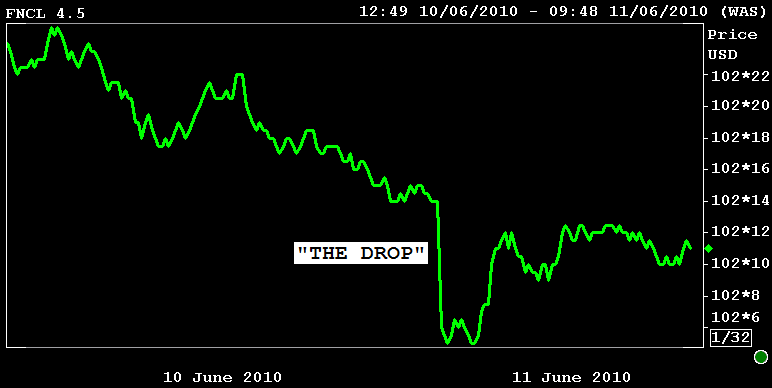

...and rate sheet influential MBS coupon prices are rallying (spreads are steady). The JULY FN 4.0 is +0-08 at 99-16 (99.500). The JULY FN 4.5 is +0-08 at 102-12 (102.375). The secondary market current coupon is 4.09%. Here are yield spreads: +82.8bps/10yrTSY yield and +73.6bps/10yrIRS.

NEXT EVENT: 10AM SOUTH AFRICA VS. MEXICO

oh....the next market event is Consumer Sentiment at 9:55 and Business Inventories at 10:00