The Treasury just cut off bidding on $13bn 30yr bonds. The auction went well...

85% of the issue was awarded at the high yield of 4.182%. This was slightly below the yield the market was expecting prior to 1pm bid cutoff....again signaling strong demand, albeit at a higher yield/cheaper price. (concession)

The bid to cover ratio, a measure of auction demand, was 2.87 bids submitted for every one bid accepted by Treasury. This is above average, signaling a strong turnout for the long bond...but who was buying?

Primary dealers took home 43.7% of the issue and 23.2% of what they bid on...this is decent long bond supply support from the street but only at a healthy concession (lower prices higher yield).

Direct buyers were awarded 20.3% of the competitive bid 49.5% of what they bid on...indicating they were willing to buy but only if Tsy was willing to lower the price. Too much dv01 for these accounts?

Indirects on the other hand were hungry for some duration, grabbing 36% of the auction and 62.2% of what they bid. These buyers are responsible for me being able to say this auction went well. They were the aggressive bidders.

After the strong auction benchmark TSYs yields are at their highs of the day after the auction and "rate sheet influential" MBS are at their lows. (bassackwards right?)

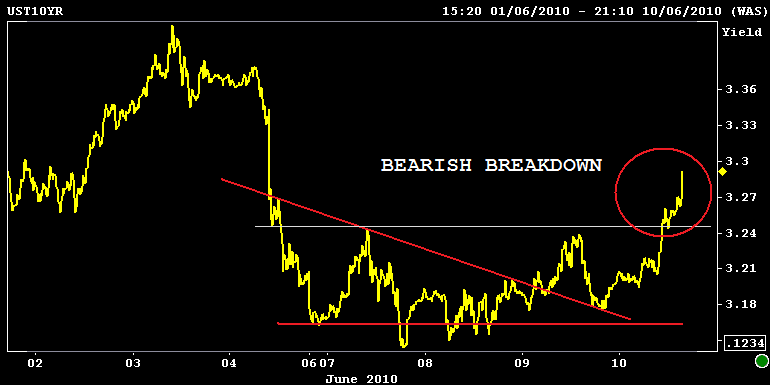

The 3.50% coupon bearing 10-year TSY note is -0-30 at 101-25 yielding 3.292%. This is a bearish breakdown of range support. The next pivot is 3.31%. The 2s/10s curve is 7bps steeper today...which makes no sense given demand for $13bn

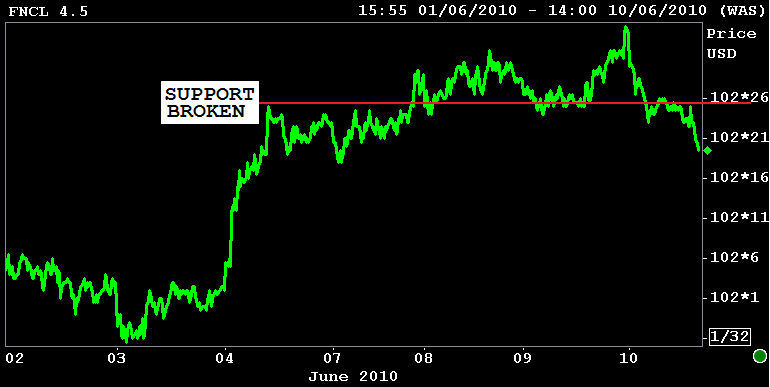

The FN 4.0 is -0-20 at 99-24. The FN 4.5 is -0-14 at 102-20. The secondary market current coupon is 6bps higher at 4.04%.

REPRICES FOR THE WORSE ARE POSSIBLE

I smell something fishy floating around stock markets. Open interest has fallen and volume is low. Price action and participation is indicative of a SHORT COVERING RALLY but if 1080 is broken and we see some follow through....stocks may extend the interest rate unfriendly trend.