The Treasury has successfully auctioned $21 billion more 5/15/2020 maturity 10 year notes (reopening).

The bid to cover ratio, a measure of auction demand, was 3.24 bids submitted for every one accepted by the Treasury. Compare that to the five auction average of 2.63 and the 10 auction average of 2.95.

Bidding stopped out at a high yield of 3.24%. This is "on the screws" vs. the 1pm "when issued" bid. 87.2% of the issue was awarded at the high yield.

Primary Dealers, aka the street, took 46.4% of the issue. This is above the five auction average of 38.0% but below the ten auction average of 47.4%.

Direct bidders, aka domestic fund managers like Vanguard and PIMCO, were awarded 13.5% of the re-opening. This is the lowest direct buyer turnout since the February 2010 auction, but still above long term averages.

Indirect bidders were awarded 40.2% of the auction vs. the five auction average of 32.3% and the ten auction average of 41.5%.

Non-dealers (indirects and directs) took home 53.7% of the auction.

Plain and Simple: Auction demand was strong but only at higher yields and lower prices. Primary dealers took down more inventory than usual to offset a decline in direct buyer interest. Indirect participation wasn't aggressive nor was it apathetic...

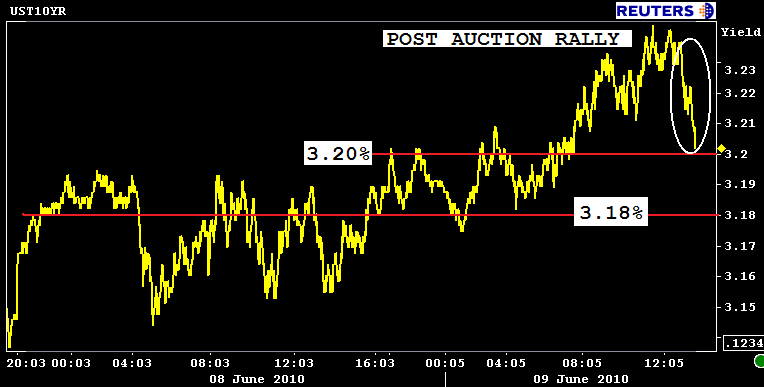

After the results were released at 1pm the 10yr note ticked sideways briefly before moving down to re-test 3.20%. A break below this layer of resistance would lead to a test of 3.18%

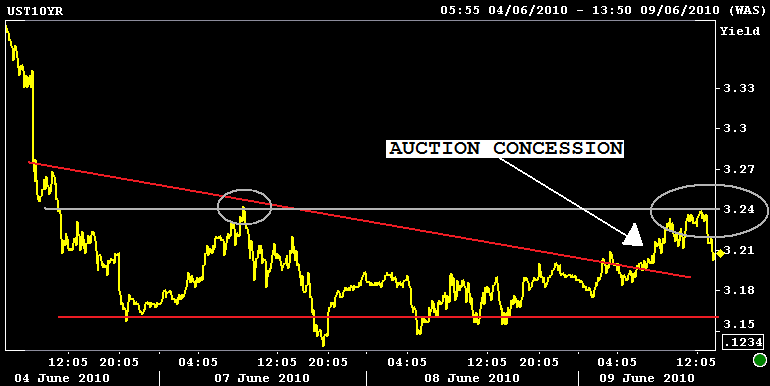

The auction concession is apparent when looking at 10s on a longer timeline. Traders pushed the high yield all the way up to the high side of the recent range...

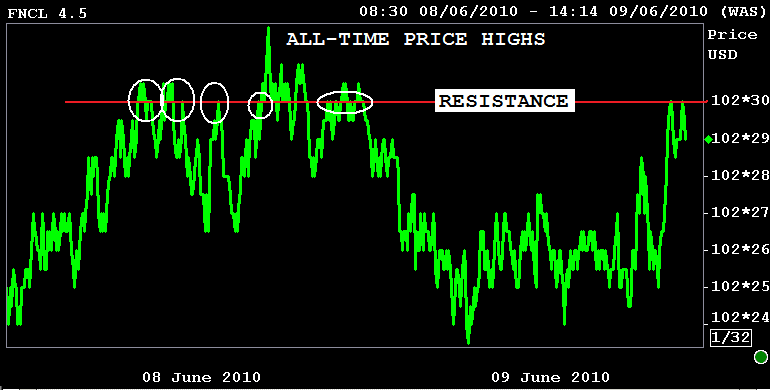

This decline in benchmark TSY yields led rate sheet infleuntial MBS prices to the highs of the day. The FN 4.0 is currently +0-02 at 100-07 and the FN 4.5 is +0-02 at 102-30. The secondary market current coupon is less than 1bp lower today at 3.991%. After moving tighter all morning, CC yield spreads have gapped out following the post-auction benchmark yield rally. It is normal for production MBS coupons to lag a TSY rally.

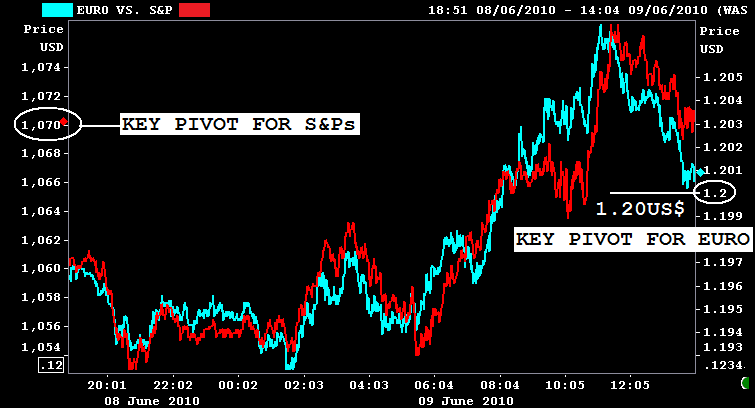

Making the post auction rally possible was a modest downtrade in the Euro and the S&P. The Beige Book has been released, S&Ps are testing 1070 support while the Euro is poking and prodding at the 1.20US$ pivot.

Here are some talking points from the Beige Book.

14:00 09Jun10 RTRS-U.S. ECONOMIC ACTIVITY IMPROVED IN ALL 12 DISTRICTS IN LATE APRIL/MAY-FEDERAL RESERVE'S BEIGE BOOK

14:00 09Jun10 RTRS-FED-MANY DISTRICTS DESCRIBED PACE OF GROWTH AS 'MODEST'

14:00 09Jun10 RTRS-FED-SOME CONTACTS CITED CONCERNS OVER POTENTIAL IMPACT OF EUROPEAN FISCAL CRISIS ON FINANCIAL, BUSINESS CONDITIONS

14:00 09Jun10 RTRS-FED'S BEIGE BOOK-LABOR MARKET CONDITIONS IMPROVED SLIGHTLY, PERMANENT EMPLOYMENT LEVELS EDGED UP IN MOST DISTRICTS

14:00 09Jun10 RTRS-FED SAYS CONSUMER SPENDING, TOURISM GENERALLY INCREASED, BUSINESS SPENDING INCREASED MODERATELY

14:00 09Jun10 RTRS-FED SAYS HOUSING WAS BUOYED BY APRIL DEADLINE FOR HOMEBUYER TAX CREDIT

14:00 09Jun10 RTRS-FED: FINANCIAL ACTIVITY LITTLE CHANGED SINCE APRIL BEIGE BOOK

14:00 09Jun10 RTRS-FED SAYS COMMERCIAL AND INDUSTRIAL LENDING REMAINED WEAK IN MOST DISTRICTS ALTHOUGH SOME NOTED LOAN DEMAND FIRMING

14:00 09Jun10 RTRS-FED-LOAN QUALITY STABILIZING OR GRADUALLY IMPROVING IN MOST DISTRICTS; REAL ESTATE EXPOSURE STILL AN ISSUE

14:00 09Jun10 RTRS-BEIGE BOOK PREPARED BY CHICAGO FED, BASED ON INFORMATION COLLECTED THROUGH MAY 28

14:00 09Jun10 RTRS-U.S. economy improved in May-Fed's Beige Book

2 hours to go into the close. Interest rates are taking their guidance from the stock/forex lever.