- MAY NONFARM PAYROLLS +431,000 (CONSENSUS +513,000) VS APRIL UNREVISED AT +290,000

- MAY PRIVATE SECTOR JOBS +41,000, GOVT 390,000, CENSUS JOBS +411,000

- MAY JOBLESS RATE 9.7 PCT (CONS 9.8 PCT) VS APRIL 9.9

- MAY AVERAGE HOURLY EARNINGS ALL PRIVATE WORKERS +0.3 PCT (CONS +0.1) VS APRIL +0.1 PCT, TO $22.57 VS APRIL $22.50

- MAY YEAR-ON-YEAR AVERAGE HOURLY EARNINGS ALL PRIVATE WORKERS +1.9 PCT

- MAY AVERAGE WORKWK ALL PRIVATE WORKERS 34.2 HRS (CONS 34.1) VS APRIL 34.1, FACTORY 40.5 VS 40.2, OVERTIME 3.0 VS 3.0

- U.S. MAY FACTORY JOBS +29,000 (CONS +30,000) VS APRIL +40,000 (PREV +44,000)

- U.S. MAY GOODS-PRODUCING JOBS +4,000, CONSTRUCTION -35,000

- U.S. MAY PRIVATE SERVICE-PROVIDING JOBS +37,000, RETAIL -6,600

- U.S. MAY AGGREGATE WEEKLY HOURS INDEX FOR ALL PRIVATE WORKERS +0.3 PCT VS APRIL +0.4 PCT

- US MARCH NONFARM PAYROLLS REVISED TO +208,000 FROM +230,000

- U.S. NONFARM PAYROLL INCREASE IN MAY LARGEST SINCE MARCH 2000

The Birth/Death model added 215,000 jobs. READ MORE

The initial reaction in markets....

Stocks are selling and bonds are rallying.

S&Ps currently -24 at 1080....

The descending triangle chart formation I talked about on Wednesday has played out as the pattern suggests...with continuation to the downside. READ MORE

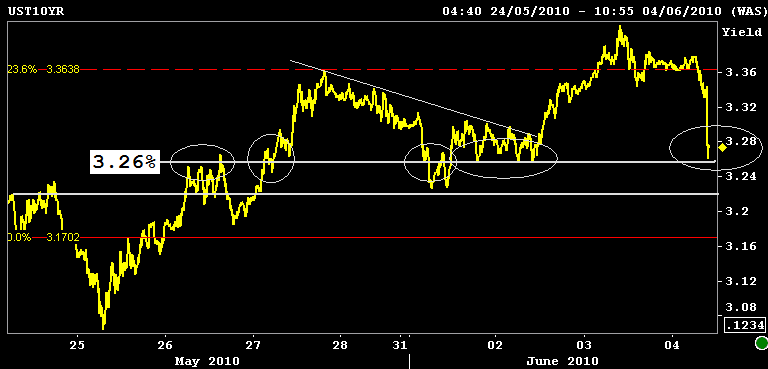

10s +28 at 101-30 yielding 3.268%...

The FN 4.5 is +0-08 at 102-10. The secondary market current coupon is 5.2bps lower at 4.115%. Yield spreads are wider.