- FNCL 4.5: +04 at 102-05

- Current Coupon -2.2bps at 4.136%

- Yield Spreads Go Out UNCH vs. Benchmarks

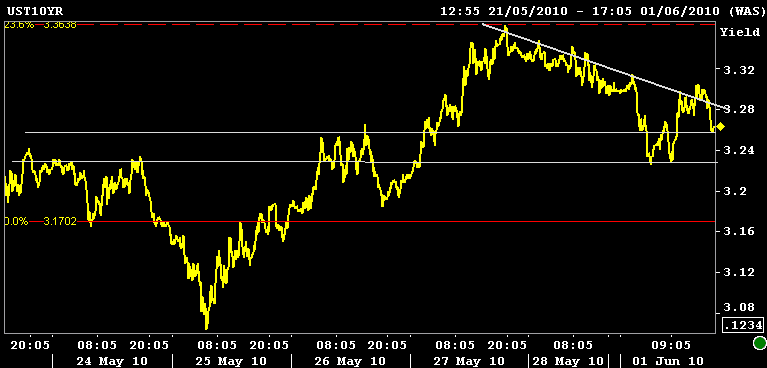

- UST10YR YIELD: -4bps at 3.263%. PRICE: +0-11 to 102-00. 2s/10s 1bp flatter at 249bps

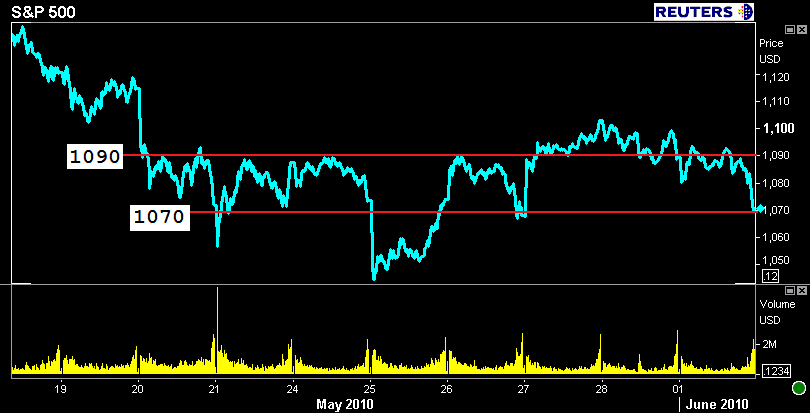

- S&P Open: 1089.36. High: 1094.52. Low: 1069.88. Close: -1.72% at 1070.71

- Better Than Expected Econ Data. Mortgage Rate Recap READ MORE

The pendulum swings one way and then the other...

U.S. Treasuries opened on a strong note thanks to overnight weakness in global equity indexes but flows quickly turned against rate sheet influential benchmark yields following two better than expected 10am economic releases that sent the S&P soaring to the highs of the session. Benchmark interest rates then spent the afternoon bouncing around between pivot points before the stock lever pushed Treasuries back into the middle of the recent range at the close.

The S&P ended the day -1.72% at 1070.71. Trading volume was below average and a lack of liquidity made a boring day seem not so boring. Energy stocks took a pounding thanks to the deep water oil drilling moratorium and general pessimism surrounding the oil spill in the Gulf. The materials and utilities sectors were also subject to an excessive amount of weakness...these sectors and financials are the primary targets of day trader tactics. Last but def. not least, in the mid-day post I illustrated the close connection between the value of the Euro currency and the directional movements of the S&P: CHECK IT OUT

The trading range is still defined by 1090 resistance and 1070 support. Anything below 1070 s/be viewed as a buying opportunity while moves through 1090 will likely bring out profit takers.

The 3.50% coupon bearing 10 year TSY note ended the day at 3.263%, right in the middle of the recent range (120-00 is major pivot in 10yr TSY futures). The 10 yr note continues to consolidate around 3.25%. Directional guidance is offered by the stock lever.

Rate sheet influential mortgage-backeds traded quietly sideways for most of the day thanks to a continued lack of loan supply from originators and generally supportive flows from real money bankers and fast money basis buyers. The FN 4.5 went out +0-04 at 102-05. The secondary market current coupon fell 2.2 basis points and yield spreads were UNCHANGED vs. benchmarks at 5pm (moved tighter all day but lost ground in after hours trading). 3m10y implied volatility was 1bp higher. Volume, as reported by Tradeweb, was just over $250bn vs. $203bn on Friday and $238bn on Thursday.

While TSYs and stocks chopped around a volatile range, the FN 4.5 was cool, calm, and collected. The chart below is a bit cluttered but the red circles call attention to larger price swings within the context of consolidating ranges. These patterns are indicative of "energy storage" or coiling....typically the larger price swings occur after prices move sideways around a pivot or repeatedly test resistance/support while making higher lows or lower highs (descending or ascending triangles). WELL...the FN 4.5 went sideways around a pivot point today, expect to see a bit more chopatility in the near future....

While there were a few news headlines to account for in valuations today, price action and trading flows really didn't teach us anything new about the market's long term bias. Market participants continue to exhibit noncommittal behavior. Institutional fast money traders are dominant while retail investors ride the pine....

I offer the same LOCK/FLOAT guidance I shared last week...

Thanks to a lack of liquidity in the 4.0 TBA MBS market, securitizing 4.5 and 5.0 MBS is a lender's best execution option (how do you hedge 4.0s right now? Against the long bond?) This implies it is unlikely that we see mortgage rates move much lower than current levels. Considering the amount of volatility in the marketplace and the tightly wound correlation between the stock lever and interest rates....passengers in the float boat s/be waiting it out for a shorter lock period at most. Besides that...the risk that rates rise far outweighs the minimal reward one would see if stocks sell and benchmarks rally. When/if stocks break 1090 and confirm, interest rates will move higher in a violent manner.