Good Morning. I hope everyone had a safe Memorial Day holiday. My internal clock always gets thrown off kilter after a three day weekend. Remember: Today is Tuesday...not Monday.

Treasuries backed away from a ledge last Friday thanks to two tapebombs and modest month-end index extension buying. While short term technical studies are still in overbought territory, the longer term originator friendly trend channel remains intact after a flight to safety led benchmark yields back toward the outer limits of the recent trading range on Friday afternoon.

The two tapebombs that disturbed what was supposed to be a leisurely stroll into month-end:

- Fitch Ratings cut Spain's credit rating one notch on Friday from AAA to AA+, saying the government's efforts to reduce debt will weigh on economic growth in coming months. WATCH VIDEO or READ MORE

- North Korean Major General Pak Rim Su disputed the results of the international investigation into the sinking of a South Korean warship and said “any accidental clash that may break out in the waters of the West Sea of Korea or in areas along the Demilitarized Zone will lead to all-out war,” WATCH VIDEO or READ MORE

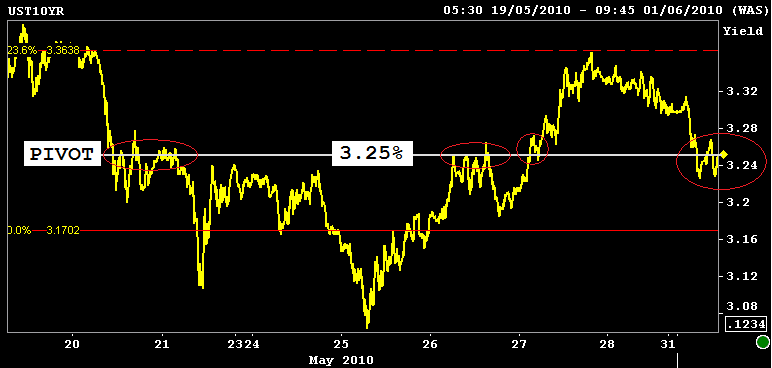

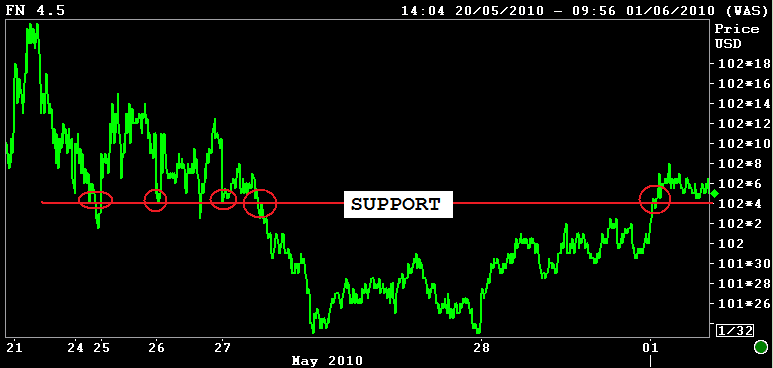

Equity valuations declined around the globe last night which helped U.S. Treasury yields move another leg lower in overseas trading. Bullish short term momentum was however unable to carry yields through the 3.25% pivot. This is a key resistance level. The 3.50% coupon bearing 10yr note is currently +0-15 at 102-04, down 5.5bps in yield to 3.248%.

While mortgage-backeds are lagging the positive progress of their directional guidance givers, rate sheet influential MBS prices are higher to start the week. The FN 4.5 is +0-04 at 102-05. The secondary market current coupon is 2.6bps lower at 4.132%. The current coupon yield is 88 basis points over the 10yr TSY note yield and 78.7bps over the 10yr interest rate swap. Yield spreads are wider.

The WEEK AHEAD is busy with the release of NonFarm Payrolls on Friday (The Official Employment Report) headlining the schedule. Over the last month, data releases were generally ignored in favor of short term technical momentum and impulsive reactions to unexpected events. After the S&P made its run through 1090 resistance last week it is possible that we see the market refocus on fundamentals and some sense of normalcy. Unfortunately with no new BIG PICTURE developments having been presented in the last few days, price action is likely to continue to chop around in a volatile manner until at least Friday morning. Regardless of the rationale behind the behavior of equity indexes, the stock lever remains the primary influence over interest rates. S&P PIVOTS TODAY: 1070 is support. 1090 is resistance