Good Morning. HAPPY FRIDAY

My parents can cross an item off their "things to do before I die" list. They just returned from a two week coast to coast and back trip across the United States...on their motorcycle! All the "riders" out there know how big of a deal this is...Congrats Mom and Dad. What an accomplishment!

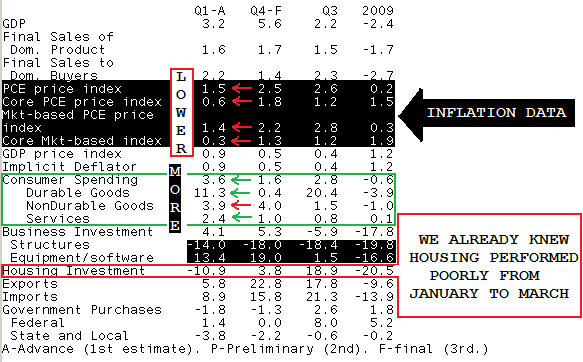

Today we got the "ADVANCE" read on Q4 GDP. I say "ADVANCE" because this report will be revised two more times. The "second" estimate for the first quarter, based on more complete data, will be released on May 27, 2010.

The market was expecting Q1 GDP to come in around +3.4%.

The actual print: +3.2%. Just slightly worse than anticipated but well within the range of estimates.

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, and nonresidential fixed investment that were partly offset by decreases in state and local government spending and in residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the first quarter primarily reflected decelerations in private inventory investment and in exports, a downturn in residential fixed investment, and a larger decrease in state and local government spending that were partly offset by an acceleration in PCE and a deceleration in imports

A few observations...

THIS WAS THE LARGEST QoQ RISE IN CONSUMER SPENDING SINCE Q1 2007. Funded by what?

From the release....

Personal saving -- disposable personal income less personal outlays -- was $340.8 billion in the first quarter, compared with $429.3 billion in the fourth. The personal saving rate -- saving as a percentage of disposable personal income -- was 3.1 percent in the first quarter, compared with 3.9 percent in the fourth.

Less Savings = More Spending OR More Jobs = More Spending?

REDUCTIONS IN BUSINESS INVENTORIES HAVE BEEN A HUGE CONTRIBUTOR TO GAINS IN GDP: In Q4 2009, inventory cutting added 3.79 percentage points to GDP. We knew this would not last much longer.

From the release...

The change in real private inventories added 1.57 percentage points to the first-quarter change in real GDP after adding 3.79 percentage points to the fourth-quarter change. Private businesses increased inventories $31.1 billion in the first quarter, following decreases of $19.7 billion in the fourth quarter and $139.2 billion in the third.

HOW DID THIS AFFECT OVERALL GDP?

Q4 2009 GDP GROWTH: +5.6%

Q4 2009 BUSINESS INVENTORY CONTRIBUTION: +3.79%

Q1 2010 GDP GROWTH: +3.2%

Q1 2010 BUSINESS INVENTORY CONTRIBUTION: +1.57%

DIFFERENCE IN Q4 2009 and Q1 2010 GDP GROWTH: -2.4%

DIFFERENCE IN Q1 2010 BUSINESS INVENTORY CONTRIBUTION:-2.2%

INTERESTING...

When consumer demand started falling businesses cut back on production of goods to align their output of supply with consumer demand. This affects the entire supply chain as purchase managers slow orders of the raw and intermediate materials necessary to complete their finished widget. This affects consumers in a few ways, the most obvious being LESS JOBS.

Why?

When firms slow production, they need less labor to fill orders, so they stop hiring and cut hours and positions. Businesses will continue cutting inventory until they have none left or demand increases enough to warrant forward looking inventory accumulation. The more businesses are cutting inventories, the worse it is for GDP. In Q1 businesses stopped reducing inventories and began rebuilding as consumer spending ticked higher, this is a good sign but in order for it to continue we need continued job growth so businesses have reason to start accumulating inventory. If they don't...GDP growth will be SLOOOOW. It was good to see

WHICH LEADS ME TO....

State and Local governments are REDUCING their spending....with 6.5 million jobless Americans (not counting underemployed and discouraged) it is downright scary to see state and local governments spending less. WHY? Because they are cutting education funding, snow budgets, police overtime, parks and rec allocations, fire fighter training, etc, etc, etc....

This reduction in state and local government spending will reduce the quality of life for local residents. Obama needs to stay focused on ensuring we continue to educate our children and out of work labor base.

One reason I call attention to this is: Businesses are investing in their future. Check out how much business investments in Equipment and Software grew in Q1...these investments are being made in technology that will help increase productivity. This implies in the future there will be less need for human brawn. We must educate our young to ensure they are able to carry on the American tradition of innovation

CONSUMER LEVEL INFLATION IS STILL NOT AN ISSUE: The price index for gross domestic purchases, which measures prices paid by U.S. residents,increased 1.7 percent in the first quarter, compared with an increase of 2.0 percent in the fourth. Excluding food and energy prices, the price index for gross domestic purchases increased 1.1 percent in the first quarter, compared with an increase of 1.5 percent in the fourth. The federal pay raise for civilian and military personnel added 0.2 percentage point to the change in the first-quarter gross domestic purchases price index. (Producer level inflation is however on the rise...at some point those costs will be passed along to consumers....or increases in productivity are doing enough to reduce costs)

Housing Investment was no good but we already knew this was the case...one might look back and call Q1 2010 the bottom in housing. (Yeh I just went there)

Ok enough big picture talk, onto the markets...

The 3.625% coupon bearing 10 year TSY note is +0-07 at 99-11 yielding 3.705%. The reaction to 830AM data and 955AM data is obvious....

The FN 4.5 is +0-08 at 100-25 yielding 4.414%. The secondary market current coupon, the yield lenders use to determine mortgage rates after servicing and gfees are stripped, is 3.8 basis points lower at 4.414%. Yield spreads are slightly tighter this morning.

BoA is better. Wells is better. Chase is better. GMAC is better. Citi is better. All improved 10 to 15bps.

REPRICES FOR THE BETTER ARE BAKED IN

REPRICES FOR THE WORSE AROUND 100-15

This might seem odd that GDP was essentially "on the screws" and Consumer Sentiment was BETTER THAN EXPECTED (72.2 vs. 71.0). However the S&P appears to be nervous about the "officialness" of GREEK BAILOUTS and therefore unwilling to push the index to deep in the 1200 handle. It is hard to ignore the technical manner in which the bond market has traded lately. MG has been discussing the chart below for a few weeks now. The downward trend channel continues to extend and extend and extend. 3.71% was our initial target. That level was broken and 3.68%, which is the 50% retracement of the December 21 10 year note sell off, is now being tested.

The big question is: NOW THAT THE TREND CHANNEL IS RUNNING INTO LONG STANDING RANGE RESISTANCE, WILL THE ORIGINATOR FRIENDLY TREND CHANNEL EXTEND EVEN LOWER?

I was a seller at 3.71% and am still a seller at 3.68%. While there is room to move lower, market fundamentals in the form of tapebombs (flight to safety) have played a big role in the extension of this rally. If the EU and IMF are able to come to a clear cut resolution on Greece in the near future (this weekend), it would result in flight to safety allocations exiting the benchmark bond market and higher yields. This would be bad timing considering the technical landscape is in overbought territory and looking for a catalyst to test the other side of the range.

This is exactly why we have been preaching the fundamentals of GUTFLOP so much lately. PLAY THE RANGE UNTIL THE RANGE PLAYS YOU and LOCK AT THE PRICE HIGHS FLOAT AT THE PRICE LOWS again echoes in my ears.

3.68% is the target!

LAST BUT NOT LEAST: EDUCATION!!!!! (see state and local government discussion above)