The Treasury has successfully auctioned $44 billion 2 year notes. This was the 7th consecutive offering at this size and likely one of the last times as the Treasury is expected to reduce auction sizes in the months ahead.

The bid to cover ratio, a measure of auction demand, was 3.03 bids submitted for every one accepted by the Treasury. This is below the ten auction average of 3.10 and the five auction average of 3.11

Bidding stopped out at a high yield of 1.024%. This is slightly above the 1pm "when issued" bid.

Primary Dealers, aka the street, took 47.6% of the issue. This is above the ten auction average of 44.2% of the total auction award and above the five auction average of 46.4%. This is a negative as it implies dealers were forced to offset a lack of bidding interest from another account. Furthermore we do not want the street taking down higher percentages of the auction because they will need to get rid of unexpected supply...and the market will not let dealers do so without raising costs (lower prices = higher yields).

Direct bidders, aka domestic fund managers like Vanguard and PIMCO, were awarded 21.4% of the issue. This is WELL ABOVE the rising ten auction average of 10.6% and the five auction average of 11.4% of total auction.

Indirect bidders were awarded a paltry 31.0% of the auction. This is WELL BELOW both the five and ten auction averages of 42.2% and 45.2% respectively. This is the poorest indirect turnout since December 2008 when the financial crisis really picked up momentum.

Plain and Simple: Direct bidders offset a continued reduction in indirect demand while primary dealers mopped up the remaining mess. It always makes me nervous when dealers have to step up and take down more inventory than usual. We would rather have the debt in the hands of direct and indirect accounts instead of dealers who now need to distribute debt into a market that was just hit with a fresh "flight to safety" allocation. If today's 2 year note rally unwinds in the near future...dealers will be even further underwater on their new 2 year note holdings. Basically the bond market needs to stay at these levels long enough to allow the street to sell excess inventory....if not, selling "down the ladder" could snowball and force mortgage rates higher.

Since the S&P downgraded Greece, making it even harder for them to repay their creditors, trading flows in the bond market have slowed down considerably.

The 3.625% coupon bearing 10 year note is currently above its yield lows of the day, now +0-25 at 99-08 yielding 3.715%. After bouncing right at the Dec.21 selloff 50% retracement level, 10s are right back to the middle of the 3.57 to 3.85 range.

The FN 4.5 is +0-15 at 100-20 yielding 4.432%. The secondary market current coupon is 7.2bps lower at 4.412%. The current coupon yield is 70.7 basis points over the 10 year TSY note and 70bps over the 10 year interest rate swap. As TSY yield backup, "rate sheet influential" MBS yield spreads are off their widest levels of the day.

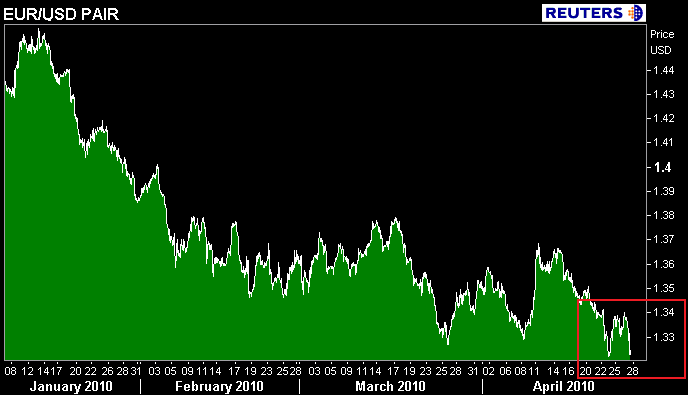

S&P's downgrade of Greece and Portugal has taken a toll on the value of the Euro....currently at 1.332 vs. the US Dollar.

Most lenders have repriced for the better. Higher MBS prices should spur on originator loan locking. If this does occur, MBS yield spreads may get beat up a bit but that has probably already been accounted for in rate sheets. Again...mortgage rates will not keep up with TSY rallys.

The Goldman Sachs hearing hasn't made any progress. We know nothing new about the situation. The frustration of the Senate subcommittee is actually entertaining...the angry sentiment it instills in the hearts of our lawmakers is however not amusing in anyway.