- FN 4.5 off 3 ticks at 100-11. 8 ticks below high of day.

- 10yr Tsy at 3.767..5bps off yield lows of day

- Current Coupon at 4.457%. Yield Spreads off wides of day into sell off. Normal event.

- Stocks down (1196.44 in the S&P, almost 10 points down)

- Nothing definitive (YET), but technical levels doing their job and big down volume in futures

The charts speak a thousand words....

Yesterday's Version:

How It Panned Out Today:

There's still a chance to be "saved" by a horizontal level at 3.75. In other words, this brief back up in yields could hit support at 3.75 and move lower, but as far as the diagonally-drawn trends above (which have been pretty reliable), yields are doing what they're supposed to be doing. Moving on to futures...

Yesterday's Version:

Today's Version:

Again, I wouldn't necessarily say this is a DEFINITIVELY failed attempt to breakout, but it's looking more and more like a reversal. We had a longer term treasury chart as well.

Yesterday's Version:

Today's Version:

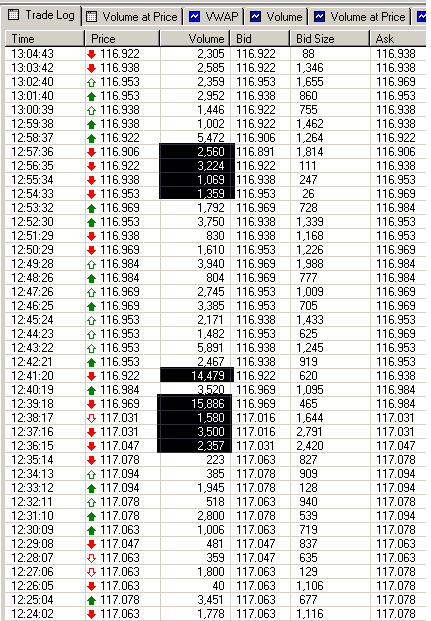

If that doesn't illustrate the bearish sell side volume (adds support to bearish argument), the chart below does. Check out trade flows. Look at the size of those sell tickets...

Here, I'm tempted to say that we'd need prices to fall just a bit more before giving up on the breakout attempt, but for now, the hesitation is more bad than good... More "confirmation of the bearish caution" than refutation thereof.

Finally, there was one other chart I put together yesterday showing a longer term upward trend channel in treasury yields. Yesterday's didn't have the MBS part, but that looked significant to add today. Perhaps more than any other chart, that one is speaking to the various forms of resistance for bonds at the moment, here she is:

Yesterday's version:

Incidentally, a longer term treasury chart seems to agree with futures in principle. Note that yields would have to break through a well established uptrend if they do not go higher tomorrow.

Today's Version:

If you already locked, you're good.

If you haven't, and HAVE seen a reprice for the worse today, you can afford to wait and hope for a not-as-likely turn around. If you HAVE NOT seen a reprice for the worse today, it may be coming soon!