The Treasury has successfully auctioned $21 billion, 2/15/2020 maturity 10 year notes (reopening). Four out of the last five 10 year note offerings have been at this size.

The bid to cover ratio, a measure of auction demand, was 3.72 bids submitted for every one accepted by the Treasury. This is WAY ABOVE both the ten auction average of 2.61 and the five auction average of 2.91 and also the highest 10yr note turnout I have on record. HUGE DEMAND!

Bidding stopped out at a high yield of 3.900%...this is more than 2 basis points below the 1pm "when issued" bid. BIDDING WAS AGGRESSIVE!

Primary Dealers, aka the street, took 40.6% of the issue. This is below the five auction average of 51.7% and the ten auction average of 45.4%. This is a positive...we do not want the street taking down higher percentages of the auction because they will need to get rid of unexpected excess supply...and the market will not let dealers do so without a cost.

Direct bidders, aka domestic fund managers like Vanguard and PIMCO, were awarded 16.3 % of the re-opening. This is above the ten auction average of 8.5% and the five auction average of 12.2% . This is the fourth consecutive 10 year note auction where direct bidder participation was WELL ABOVE historical averages.

Indirect bidders were awarded 43.1% of the auction. This is a BIG IMPROVEMENT from the last 10 year note auction which saw 34.9% of the auction awarded to indirects. It is also above the ten auction average of 37.1% and the five auction average of 36.3%.

Non-dealers (indirects and directs) took home 59.4% of the auction. That is WAY BETTER than recent averages and another indicator of STRONG AUCTION DEMAND

Plain and Simple: THIS WAS A FANTASTIC AUCTION!!!

Here is a recap of the auction statistics...

| YIELDS | |

|---|---|

| High | 3.900 pct |

| Median | 3.874 pct |

| Low | 3.820 pct |

| PRICE / ACCEPTANCES | |

| Price | 97.763192 |

| Accepted at high | 99.62 pct |

| Bid-to-cover ratio | 3.72 |

| AMOUNTS TENDERED AND ACCEPTED (dollars) | |

| Total accepted | 21,000,258,700 |

| Total public bids tendered | 78,076,074,700 |

| Competitive bids accepted | 20,897,524,100 |

| Noncompetitive bids accepted | 102,734,600 |

| Fed add-ons | 1,537,283,200 |

| Primary Dealer Tendered | 48,756,000,100 |

| Primary Dealer Accepted | 8,477,492,000 |

| Primary Dealer Hit Rate | 17.4% of what they bid on |

| Primary Dealer Total Award | 40.6% of total auction |

| Direct Bidder Tendered | 10,336,000,000 |

| Direct Bidder Accepted | 3,410,825,200 |

| Direct Bidder Hit Rate | 32.9% of what they bid on |

| Direct Bidder Total Award | 16.3% of total auction |

| Indirect Bidder Tendered | 18,881,340,000 |

| Indirect Bidder Accepted | 9,009,206,900 |

| Indirect Bidder Hit Rate | 47.7% of what they bid on |

| Indirect Bidder Total Award | 43.1% of total auction |

The bond market is rallying....

The 3.625% coupon bearing 10 year TSY note is +0-15 at 97-25 yielding 3.90%. Currently testing the previous high water mark set in early January....

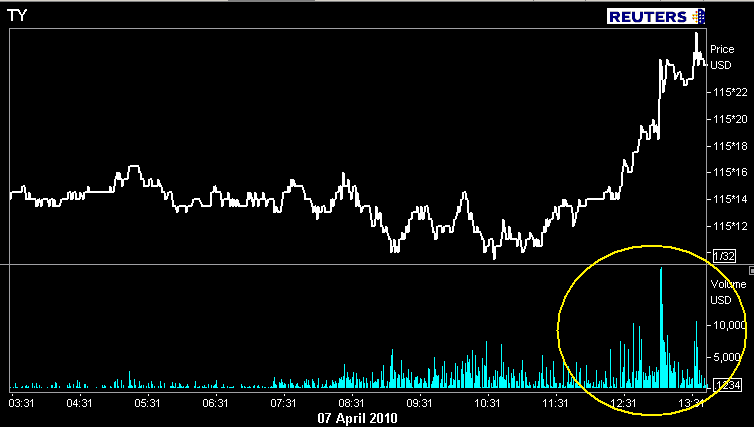

Check out the volume spike behind the Treasury rally in the futures market. This puts a level of positional support under TSY prices. This is a positive development toward our hopes for a test of the 3.57 to 3.85% range.

The FN 4.5 hit a new intraday price high of 100-01 immediately after the results were released. We are off those price highs but still well in the green on the day. Currently the FN 4.5 is +0-11 at 99-27 yielding 4.525%. The secondary market current coupon is 4.541%. The current coupon is +63.9 basis points over the 10 year TSY note yield and +66.3 basis points over the 10 yr swap. THESE ARE THE WIDEST YIELD SPREAD LEVELS OF THE DAY. But it's OK...mortgages are supposed to lag Treasuries into a rally.

If you have been nervously sitting at your computer with your mouse hovering over the "SUBMIT LOCK" button....slowly back away. REPRICES FOR THE BETTER ARE DUE