Good Morning. The Caps beat the Pens last night. :-D

Yesterday was brutal. The long end of the rates market got caught with its pants down. Short swap positions in the long end of the curve capitulated, forcing long Treasury positions in the "rate sheet influential" side of the curve to be liquidated IN SIZE. This pushed more debt inventory into a market (TSY longs stopped out) that was already flush with supply. We call this "selling down the ladder". Seller offers were there, buyer bids were not....no one wanted to catch the falling knife. Selling led to more selling. Then more supply came in the form of the 5 year note auction....demand was weak and the street had to step up to support the Treasury (street = dealers). Weakness intensified...selling led to more selling and higher benchmark yields.

Mortgages held their own against benchmarks (TSYs not swaps) for most of the day before implied volatility spiked in after hours, which brought out a new wave of MBS sellers that not even the Fed cared to offset. This pushed MBS yields wider heading into 5pm "going out" marks. Contrary to what many might believe, the Fed was working yesterday. While the end of the MBS Purchase Program may have played an indirect role in yesterday's face numbing meltdown, the Fed was busy putting remaining funds to work yesterday---supporting originator supply ($2.5 to $3bn) in the lower end of the MBS coupon stack.

While current coupon MBS yield spread valuations vs. TSYs held relatively steady for most of the session yesterday...the same cannot be said for prices. MBS prices plummeted. The FN 4.0 lost 34 ticks (34/32 or 1-02) and the FN 4.5 fell 28/32 (0-28). Lenders repriced for the worse....more than once. After all was said and done you lost in the neighborhood of 75 to 100bps in rebate.

I apologize for the technical explanation...but it was a highly technical knee jerk sell off. If you are looking to tie fundamentals to the move. Pick your poison: government and corporate debt supply, growing budget deficits (domestic and abroad), financial reform, angry overseas bidders who are being forced to revalue their currency, financial year end in Japan, the Fed's exit from quantitative easing, FN/FRE delinquency buy outs, double-dip debates, reds vs. blues, and so on and so on. The economic, political, and financial atmospheres are ripe with reasons....but one thing is constant: It's still a trader's world and we're still living in it...and traders were caught in a bad spot.

The question everyone is asking: IS THIS THE BEGINNING OF THE END OF LOW RATES?

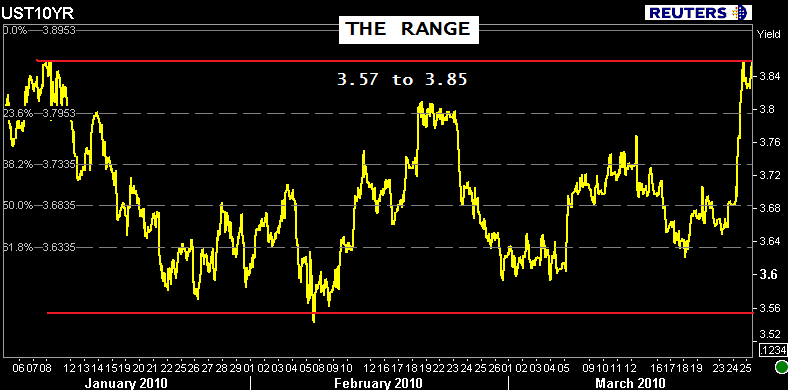

It could be. Let's give the dust a chance to settle before making any assumptions though. Our 2010 (first half) range guidance called for 10s to trade between 3.57 and 3.85% with tests of 4.00% possible in times of increased bond market bearishness. The market must take down $32 billion 7 year notes today...after that we will be watching for buying at the lows as the bond market needs to test the resolve of this sell off.

I am reminded of our motto: PLAY THE RANGE UNTIL THE RANGE PLAYS YOU. While "the outer outer limits of the range are being tested, the range hasn't played us. Lets get past today's 7 year note auction and see where flows take us.

WOOOSAAAAAAAAA WOOOOSAAAAAAA

The 3.625% coupon bearing 10 year TSY note is currently -0-02 at 98-03 yielding 3.858%. Right at the outer limits of the range.....

The FN 4.0 is -0-05 at 96-25 yielding 4.312% and the FN 4.5 is -0-02 at 100-03 yielding 4.495%. The secondary market current coupon is 4.491%. The current coupon yield is 63.8 basis points over the 10 yr TSY note and 69.9 basis points over the 10 yr swap rate. "Rate sheet influential" yield spreads are wider to start the session.

A picture is worth a thousand words...and 100bps in rebate.

NEXT EVENT: $32 billion 7s. Final bids submitted at 1pm

Also affecting flows, at 10am Federal Reserve Chairman Bernanke testifies on the Fed's exit strategy before the House Financial Services Committee

How are NMLS tests going?