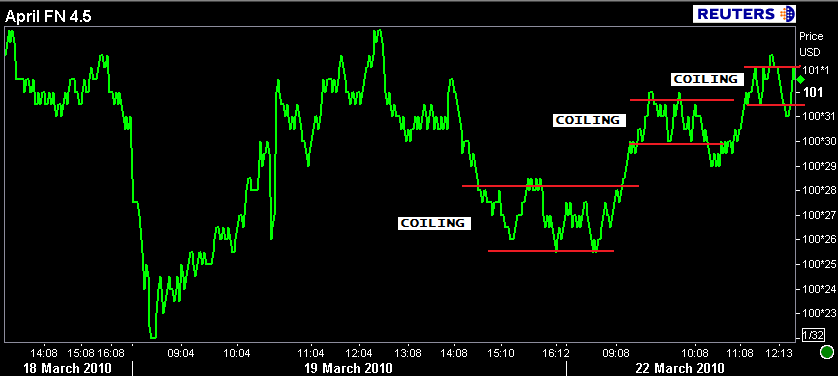

The 10 year note, the FN 4.5, and stocks are all coiling up near their best levels of the day

I called attention to early morning weakness in stocks as a source of stability in the bond market today. This is occurring at a time when one would expect traders to be taking advantage of an opportunity to price in a supply concession ahead of $118 billion in front-loaded debt. Specifically $44 billion 2 year notes tomorrow, $42 billion 5 year notes on Wednesday, and $32 billion 7 year notes on Thursday.

Read "concession" as: the street or dealers looking to cheapen up prices so its easier to sell new inventory at a profit after the auction process

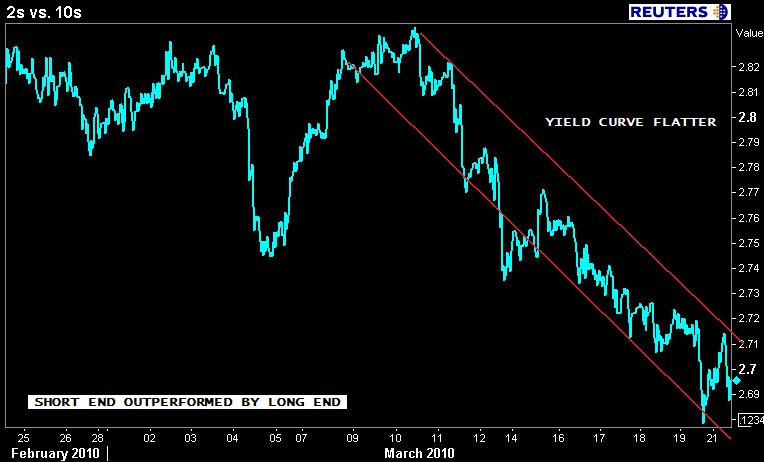

On the other hand, the bond market did a pretty darn good job of cheapening up the curve last week. That concession might be acceptable enough! Check out how much flatter the 2s/10s yield curve is since the previous round of auctions, which were concentrated on the longer end of the yield curve. If you are looking to go a bit deeper into the trade, HERE is a deeper explanation.

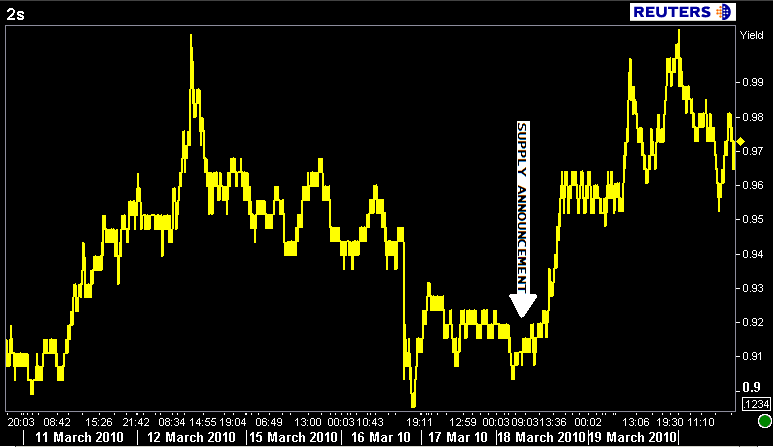

If the "concession" isn't apparent via the 2s/10s flattener, check out how the 2 year note yield reacted to the auction announcement last Thursday. It's up 7 bps in yield.

Some of that curve flattening/weakness in the front end can be attributed to nervousness surrounding the FOMC meeting last week. If another member of the board had decided to vote against zero interest rate policy (ZIRP)...the corresponding knee jerk rates sell off would have been nasty as traders would have looked to liquidate arbitrage positions in the short end of the yield curve. Adding anxiety to already skittish sentiment were rumors that the Fed was considering another bump in the discount rate, which was increased from 0.50% to 0.75% on February 18.

Either way, the resulting effect was noticeable weakness via weakness in the part of the yield curve that bears the majority of auction supply this week, in the 2 to 5 year maturities.

Earlier in the post I referred to price patterns as "coiling"...think of coiling as a sideways grind to the right in a tight price/yield range. When stocks or bonds coil up like this, energy is being stored. Usually this energy will is waiting to be released in one direction or another depending on the event or scheduled data that triggers the breakout of the sideways channel.

The 10yr has been coiling up since Thursday morning...waiting for an event to spark a move.

The same can be said for stocks...mostly sideways last Wednesday and Thursday before a breakdown on Friday...followed by a return to the same sideways range we traded in the middle of last week.

I don't like to present technical analysis on MBS prices as much as I do on MBS yield spreads, but the concept can still be applied to prove a point. The FN 4.5 has been coiling up in shorter periods before trending to another price level where the slow sideways move to the right has resumed.

The FN 4.5 is currently +0-06 at 101-01 yielding 4.384%. The secondary market current coupon is 4.337%. The current coupon yield is 67.3 basis points over the 10 year Treasury note and 63.8 basis points over the 10 year swap rate. Rate sheet influential MBS coupons are at their price highs of the day and yield spreads are flat.

Plain and Simple: coiling represents "waiting for guidance" in the marketplace

This fits in well with the financial atmosphere today. There is a lack of meaningful data to trade, the Greece situation is what it is..an ongoing saga with mixed messages and unclear official guidance, and on top of it all...our Congress just passed a historic health care bill that takes three hours just to print (and I have a LaserJet!) much less read and translate.

Volume is low and market participants are spending their time wishing it was still Sunday and the Terps had pulled off an amazing comeback. While there is potential for chopatility in this illiquid environment....energy is being stored, the market is waiting for more meaningful guidance.

EITHER WAY..

THE FN 4.5 IS AT ITS PRICE HIGHS OF THE DAY. LENDERS WHO PUBLISHED RATE SHEETS EARLY IN THE SESSION MAY REPRICE FOR THE BETTER