Good Morning.

By a narrow margin, President Barack Obama has succeeded in doing something many Presidents have failed to do in the past four decades--- sweeping health care reform

Late last night, the House of Representatives recorded 219 Ayes vs. 212 Nays. The vote, already passed by the Senate, sends the legislation to President Obama's desk for final signature.

The legislation is said to expand health insurance coverage to nearly All-Americans while banning practices that allow insurance companies to refuse coverage to those with pre-existing medical conditions. It also creates a state based exchange that allows shoppers to compare different plans. On the downside, it imposes new taxes on unearned income such as dividends, interest earned, and capital gains on investments.This is basically a tax on the wealthy...

Every Republican opposed the $940 billion bill. It's a shame this reform had so much controversy surrounding it. I am niether a blue or a red and would have liked to see a bit more bipartisanship from our so called "leaders".

The week ahead has much in store for us, especially in terms of housing. We get February Existing Home Sales data on Tuesday as well as New Home Sales on Thursday. In politics, Secretary Geithner will be discussing the future of housing finance on Tuesday before the House Financial Services Committee. On top of it all, the bond market needs to absorb $118 billion in 2 year, 5 year, and 7 year Treasury notes...and the Fed's MBS Purchase Program is heading into its final stretch.

The big question is: How soon and how much will the Fed's exit affect "rate sheet influential" MBS valuations?

All we can do is watch and wait at this point.

READ THE MND WEEKLY RECAP

READ MND'S THE WEEK AHEAD

The econ calendar is essentially empty today, this allows bond traders to price in auction supply concessions to the yield curve whenever the stock lever permits.

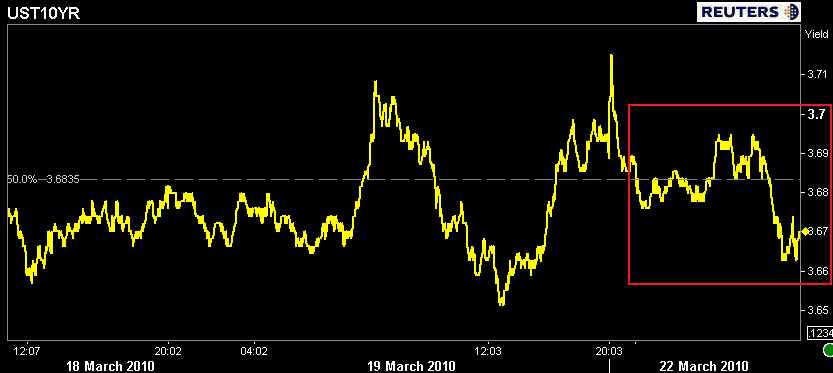

The 3.625% coupon bearing 10 year Treasury note has rallied as much as 3 basis points lower this morning...positive progress has stalled though.

Blame a modest rebound in stocks for the rates rally pause. Friday's high of 1160 will be tough for the S&P to break though, so not all hope is lost for an extension of early FTQ love in the slowly traded bond market. The S&P is currently +0.03% at 1159. The health care sector has led the recovery rally while energy shares are the weakest sector.

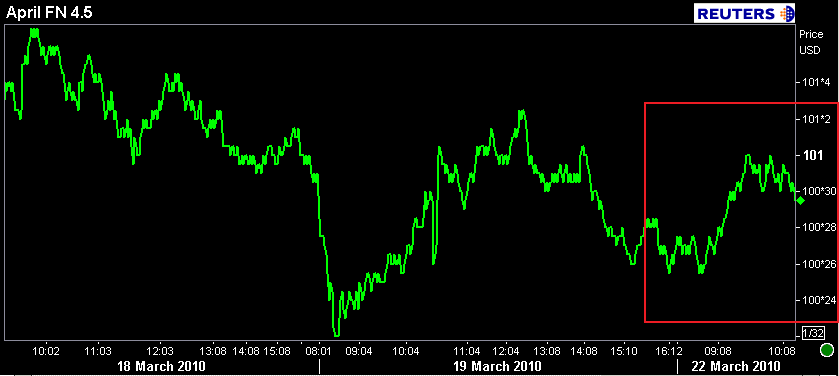

Mortgages opened lower and moved sideways before getting a boost by its benchmark big brother 10 year note. The FN 4.5 is +0-03 at 100-30 yielding 4.395%. The secondary market current coupon is 4.345%.

The big news in the MBS market on Thursday night/Friday morning was Fannie Mae's announcement that provided further clarification on the timing and focus of 120+ delinquent loan buyouts. 6.5 coupons will be bought out first, followed by 6.0s in April, then 5.0s and 5.5s in May. After that, FN will buyout all new 120+ delinquent loans with 5.0 and above coupons. This is seen as a positive for "rate sheet influential" MBS and specified (seasoned) pools as these two coupon clips provide protection from prepayment risk. This will not be a huge net positive for current coupon valuations but it does add demand side support at a time when we will most need it...WHEN THE FED EXITS THE TBA MBS MARKET.

Fannie Mae also announced a new Alternate Modification Program. Here are the details from the release:

"Fannie Mae is introducing the Alternative Modification™ ("Alt Mod™") initiative, which is designed to help borrowers who are current on their HAMP trial payments but who do not qualify for a permanent HAMP modification for reasons other than payment. To be eligible for an Alt Mod, borrowers must have been in HAMP trial plans prior to March 1, 2010. The Alt Mod initiative does not increase the number of trial plans, but is expected to increase the number of HAMP trial plans that become permanent modifications. The HAMP trial plans remaining in MBS pools will convert to permanent modifications to the extent that our efforts on conversion are successful, over the next few months, pursuant to the guidelines set forth in HAMP and as released in our Alt Mod announcement. Trial modifications that become permanent modifications require mandatory purchase from MBS trusts."

We are at the mercy of the stock lever. If stocks can break resistance and rally higher, we will lose this early session positive progress. If equity-siders are quick to question the recent rebound, 10s will likely test Friday's low yield at 3.651% and the FN 4.5 will cross into the 101 price handle.

REPRICES FOR THE BETTER AT 101-05.

REPRICES FOR THE WORSE AT 100-24