Good Morning.

Once again, rate futures prices moved modestly lower in the overnight session...albeit in below average volume (again). What is obvious to me is the 10 yr contract's failiure to break through what I have been calling "position resistance". This is the price range where the most recent high volume sell off occurred 116-24 and 116-30

I suppose it is appropriate to take some solace from the fact that 10s are not doing worse, especially when you consider that stock futures made further gains overnight.

After four days of a limited data, which made it easy for traders to bake in a concessionary backup in TSY yields, the week's most important econ event is upon us: RETAIL SALES

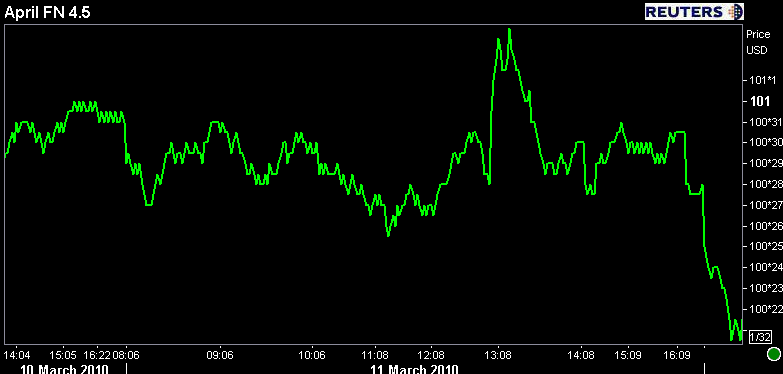

In the MBS CLOSE, MG called attention to a technical crossroads in benchmark 10s, "rate sheet influential" FN 4.5s, and stocks as well. Retail sales are expected to provide the guidance necessary to either jump start my speculative rally or push benchmark 10 year note yields even further to the other half of the 2010 trading range (3.71 to 3.85).

Mortgage prices are lower and yield spreads are wider to start the session (DOUBLE WHAMMY!!!)The FN 4.5 is -0-07 at 100-20 yielding 4.432%. The secondary market current coupon is 4.381%. The CC yield is +62.1bps/UST10YR and +57.5/10yr IRS.