The main theme in the rates market this morning has been a set up for the last Treasury auction of the week :$13 billion 30s. Results to be released at 1pm. The auction supply concession is obvious when looking at both price action outright as well as the long bond's performance relative to the rest of the yield curve.

The chart below is 30 year bond prices. Notice the initial concession that was able to be built in after the Employment Situation Report was released last Friday. This theme carried over to this week...bond prices have continued to fall ahead of today's auction.

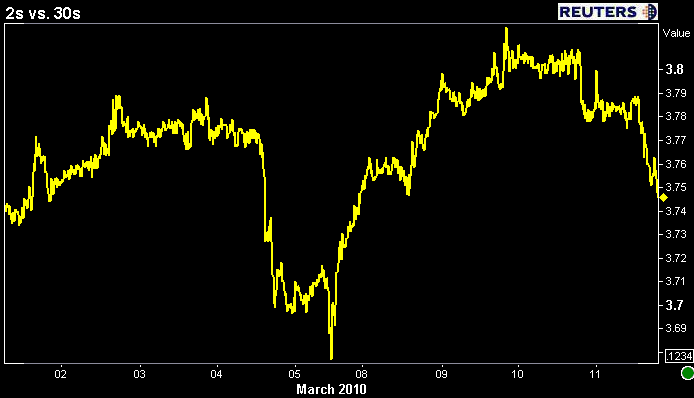

Looking at the long bond's performance relative to the rest of the yield curve makes the auction concession even more obvious. 30s got their butts whipped by 2s after jobs data last Friday and the curve steepened modestly (30yr bond yields rose more than 2 year note yields). This happened the day after the auction announcement.

In regard to our closely related benchmark big brother 10 year Treasury note, I would like to revisit yesterday's "position resistance" discussion. Notice where 10 yr futures contract prices lost positive progress this morning: RIGHT WHERE THE SELL OFF TOOK PLACE YESTERDAY. This layer of position resistance will be our first major test if 10s attempt to rally.

Looking at the spot market 10 year note, overnight yield highs are serving as support in what has been a thinly traded marketplace. You can see there was an attempt to rally this morning, which as explained above lost momentum at yesterday's high volume marks. The markets willingness to push yields passed two major levels of support (3.71 lower range limit, 3.734% 38% retracement) implies weakness is likely a function of a lack of liquidity and pre-auction positioning. Based on huge demand for the 3.625% coupon bearing 10 year note auction yesterday...I am speculating on a recovery rally bounce down to 3.71% followed by a test of 3.68%. If the long bond auction is undersubscribed...this move may be delayed and we could see 10s test 3.78% and 3.80%.

Also playing a role in the stock lever....equities moving higher have not helped our cause.

The mortgage market has generally been insulated by pre-auction weakness thanks to minimal MBS supply, a down in coupon bias, and lower volatility. The FN 4.5 has been sideways over the past two sessions...

Considering the extent to which concessionary 2s/30s steepening has taken place over the past week..it would make sense for the steepener to reverse course after auction supply is taken down...of course that assumes auction demand is firm and dealers don't take down more debt than expected which might force them to liquidate inventory (they would be selling into a buyers because aka "selling down the ladder"). If the auction does go well...look for dealers to attempt to push prices higher to profit from bond purchases (buy low, sell high)...this would help flatten the yield curve and add an indirect positive influence to "rate sheet influential" benchmark yields and MBS prices. I say "indirect influence" because long bond cash flows do not match up well with current coupon MBS cash flows (different durations).

The results of the $13 billion bond auction will be released at 1pm. If MBS prices plummet afterward I will alert, if not I will add a comment on this blog post and publish auction results and reactions as fast as possible.