DID I MENTION THUNDER SNOW!

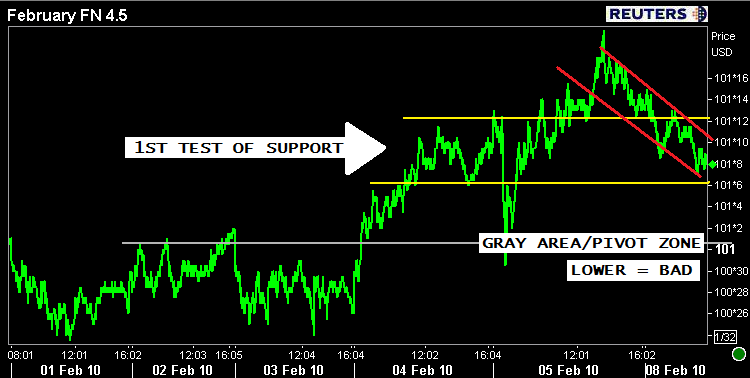

By the look of the charts, it doesnt appear that we should be expecting any noticeable improvements in positive price momentum today. We are extending the downtrend that began midday Friday.

The FN 4.0 is -0-08 at 98-08 yielding 4.169% and the FN 4.5 is -0-05 at 101-08 yielding 4.375%. The secondary market current coupon is 2bps higher on the day at 4.313%. The current coupon yield is 72.4 bps over the 10yr TSY note yield and 62.6 bps over the 10yr swap rate. MBS yields are moderately tighter vs. benchmark yields this morning.

The 3.375 coupon bearing 10 year TSY note is -0-06 at 98-06 yielding 3.594% (+2.3 bps from 5pm marks on Friday).

The 2s/10s curve is unchanged at the 280bp pivot.

The dollar index is weaker vs. a basket of currencies....-0.37% at 80.145.

The S&P is +0.22% at 1068. The DOW is -0.09%, not getting too far over 10,000 today. The NASDAY is +0.39% though...it was +0.79% on Friday.

"Rate sheet influential" MBS coupons and benchmark TSYs are testing the staying power of Friday's FTQ fixed income rally. A solid move below 101-06 would start to raise the odds for a reprice for the worse.