After serving as a fairly accurate directional guidance giver over the past few weeks, the stock lever disconnected from the rates market yesterday. Instead, "rate sheet influential" MBS prices and benchmark TSY yields chose a choppy path of random price action within their well defined range MBS prices closed toward the top of that range while Treasuries continued to grind out it to the right in a sideways trend channel. Mortgage rates were mostly unchanged on the day as the majority of lenders did not recall rate sheets/republish for the better when FN 4.5 prices ticked into the 101-00 handle.

The disconnected stock lever. The chart below compares S&P futures prices to Treasury futures prices. When the stock lever is connected, rising equity valuations usually bring about falling Treasury prices and higher rates. This was not the case yesterday...

The FN 4.0 finished the day +0-04 at 98-01 yielding 4.191% and the FN 4.5 went out the door +0-03 at 101-01 yielding 4.395%. The secondary market current coupon was 4.364%. In terms of relative value vs. benchmarks, the CC outperformed. At 5pm, the CC was 72.5 basis points over the 10yr TSY yield and 60.9 basis points over the 10yr swap rate. Yield spreads were not tighter all day though, traders took profits in the AM session and did some short covering/bargain buying as the day progressed.

MG came up with a great analogy to describe the relationship between benchmark yields and the direction of mortgage rates. READ MORE

As you can see in the chart above, in the overnight session, both stock futures and TSY futures gave back some of yesterdays gains...but were mostly sideways. That is until the 830 release of ADP EMPLOYMENT DATA.

The market was expecting 30,000 job losses...only 22,000 were reported

From the release...

Nonfarm private employment decreased 22,000 from December 2009 to January 2010 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from November to December 2009 was revised by 23,000, from a decline of 84,000 to a decline of 61,000. The January employment decline was the smallest since employment began falling in February of 2008."

January’s ADP Report estimates nonfarm private employment in the service-providing sector increased by 38,000, the second consecutive monthly increase. However, this employment growth was not enough to offset continued losses in the goods-producing sector. Employment in the goods-producing sector declined 60,000, with employment in the manufacturing sector dropping 25,000. The employment decline in the manufacturing sector was the lowest since January of 2008.

Large businesses, defined as those with 500 or more workers, saw employment decline by 19,000 while small-size businesses with fewer than 50 workers, declined 12,000. Employment among medium-size businesses, defined as those with between 50 and 499 workers, increased by 9,000, the first increase in employment since January of 2008.

THE ADP EMPLOYMENT REPORT WAS BETTER THAN EXPECTED, BUT WITHIN THE RANGE OF ESTIMATES. THE DECEMBER RELEASE WAS REVISED FOR THE BETTER. After this ADP report, expect to hear increased whispers for an NFP print around +50,000 jobs. Consensus is +5,000.

Below is a chart comparing NFP to ADP.

This puts rates traders on the defensive as a positive NFP in January would confirm November's +4,000 read and add momentum to the theory that our economy is really stabilizing. Job creation is the one thing that could really add optimism to macroeconomic outlooks. Consequently, the rates market has not had a great reaction to the data.

The 3.375 coupon bearing 10yr Treasury note is -0-10 at 97-17 yielding 3.678%. Overhead support at 3.68% is holding for now thanks to a round of short covering in the futures market. Some relief was provided at 9AM when the Treasury Department announced next week's auction supply terms. Auction amounts were $2 billion less than anticipated. We get $40 billion 3s (as expected), $25 billion 10s ($1bn lower), and $16 billion 30s ($1bn lower). Unfortunately, while less debt supply is a positive for benchmark valuations, it only lasted a few moments...ADP and NFP overruled. If Friday's Employment Situation Report (NFP) is worse than expected, less TSY supply could be a more supportive influence heading into next week. For now...it didn't do much to slow selling. 10s are testing 3.68 still....

If you read MGs train analogy you already know how MBS prices have reacted...they are lower. The FN 4.0 is -0-12 at 97-21 yielding 4.226% and the FN 4.5 is -0-08 at 100-25 yielding 4.425%. The secondary market current coupon is 3 basis points higher at 4.395%.

Just as 10s are testing the outer limits of their recent range, so too are FN 4.5s. 100-24 is our initial level of support. After that we see bounce potential at 100-20. If we move below that ahead of NFP, and the data is as expected, you can bet we will remain below 100-20 and the best mortgage rates in the market will creep closer to 5.00%.

We have been pretty firm about locking on strength and willing to float at the outer limits of the range...at this point that is getting very risky. All is dependent upon NFP on Friday. If 10s fail to hold 3.68 and the FN 4.5 breaks 100-24...I would be strongly considering a lock. 3.68 and 100-24 seem to be the farthest traders will push the envelope though, if the range holds and we see a bounce, hope that lenders boost rebate in an effort to pick up some business. If they do....take profits on your pipeline and get to the sidelines before NFP.

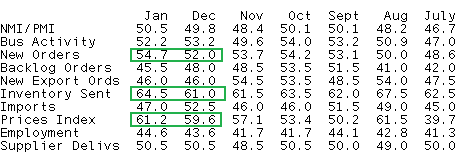

1015 UPDATE: NON-MANUFACTURING ISM HAS BEEN RELEASED

The market was expecting 51.0 in January vs. 49.8 in December

ACTUAL RELEASE: 50.5. SLIGHTLY WORSE THAN EXPECTED....there were some positives to be taken. New Orders picked up. The employment index rose again (TEMP LABOR). Businesses have cut costs and cut costs again...they are ready to work but waiting for consumer demand to pick up. Obama must create jobs!

The 10yr is still at 3.679 and the FN 4.5 is at 100-28.