I was feeling terribly unmotivated earlier today...until Pandora played THIS. Now I feel compelled to buy the curve and get long the MBS basis ahead of a normally supportive week for MBS valuations. Well done Pandora, well done. READ MORE: SUPPORTIVE WEEK

Hmmm...that statement may have been a bit misleading.

Do not read that as: "AQ expects MBS prices to improve next week".

Read as: "AQ expects MBS to outperform TSYs next week".

The direction mortgage rates head is more a function of Treasury yields at the moment. And no...that does not count as me speaking in third person because I am pretending to be you.

For now...after almost two days of consistently failing to break 100-24, "rate sheet influential" MBS coupons have re-entered their recent range. Given early morning weakness, these price appreciations probably warrant better rate sheets, but its a Friday and NFP is next week so lenders may not jump the gun on rebate improvements. (YSP=rebate..yeh, i said it, they are the same exact thing. The only difference is brokers have to disclose it and bankers dont). The price leader of course has repriced twice already....if you guys start getting more, let everyone else know so they can try and pick up a few bps before locking in their loans later today.

Anyway...the FN 4.5 is at the highs of the day, currently +0-04 at 100-30+ yielding 4.408%. The secondary market current coupon is 4.378%.

WHY AM I BUYING THE CURVE?

First of all "buying the curve" means I am selling longer duration TSYs ("rate sheet influential") and buying shorter duration TSYs (the ones more impacted by monetary policy and the Fed).

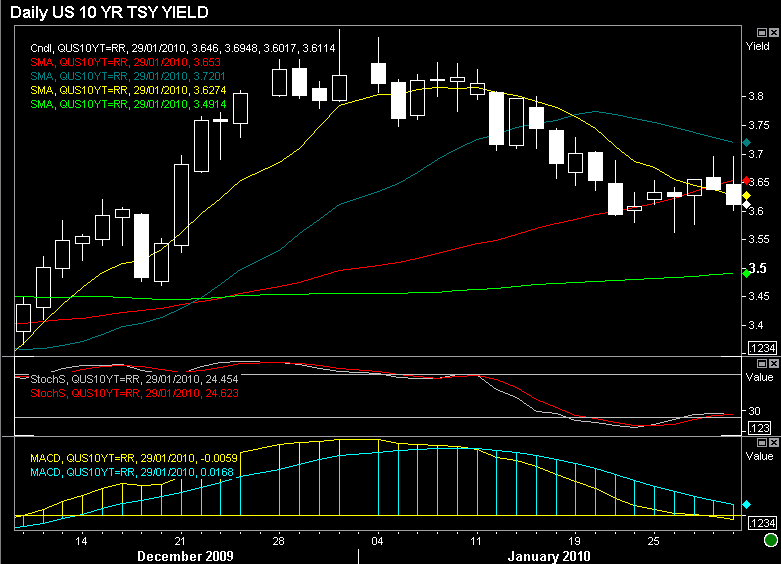

Besides the fact that everyone else already did that after the FOMC statement (EXPLANATION), 10s are telling us to sell into strength. The chart below has a variety of overlays and indicators...nothing crazy, a few moving averages and two momentum indicators. Check out how 10s are not moving below 3.65%...that is the 40 day moving average. While current market is 3.62% (as of 130), we are looking to see if 10s can hold progress below 3.65%. If they do...we are still selling into strength. WHY? Momentum is telling us that 10s are due a reversal. (if you are technician, I am using yields, so crossing the 20 line = overbought instead of oversold).

Plain and Simple: charts are telling us to sell 10yr notes

I think today's rates rally started as one of those "sell the rumor, buy the news" aka FADE THE DATA moves. The bond market knew GDP would be strong, so they opened SHORT positions. Those positions were then covered at 3.68% (117-16 in TY) and now we're seeing bargain buyers take advantage of their 0% funding rates at month's end...there are index extension buyers out there looking to buy duration. This is all being done in relatively thin trading conditions (volume was concentrated around econ data), this implies today's improvements are not a fundamental shift in sentiment...but it doesnt mean we wont see the above described environment hold steady for the rest of the day.....

If 10s break 3.62 and hold progress below there, MBS prices should tick over 101-00. If that happens, your chances at a reprice for the better will increase. Just remember, we are selling into strength. If you have been floating and you pick up a few extra bps this afternoon....take some profits on your pipeline. Its a trader's world still, trader's love techs, techs say SELL INTO STRENGTH,

THOUGHTS? AM I NUTS? ARE YOU STILL FLOATING?

PS..if you havent noticed. I was born and raised on classic rock. Sorry if its just "rock" to some of you, I was born in the 80s.

PPS...MG is going to give me hell for being too technical