ALERT ALERT ALERT ALERT ALERT....

LENDERS MAY REPRICE FOR THE WORSE

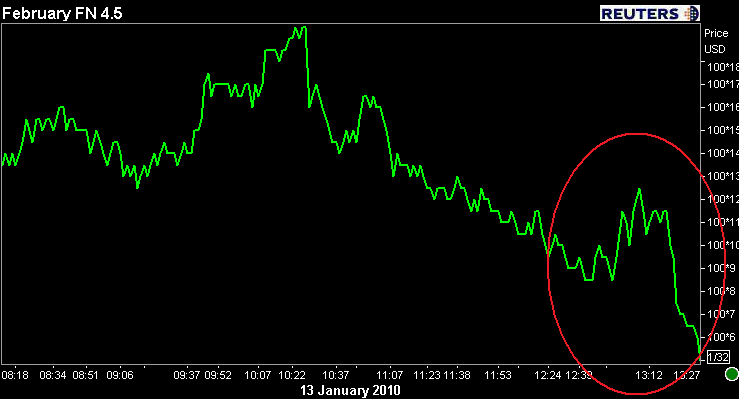

The 10 year note auction is done. While there was initially a small bounce in "rate sheet influential" MBS prices...the floor has fallen out from under the long end of the yield curve.

9-YR 10-MO NOTES

YIELDS

High 3.754 pct

Median 3.700 pct

Low 3.618 pct

PRICE/ACCEPTANCES

Price 96.900805

Accepted at high 49.95 pct

Bid-to-cover ratio 3.00

AMOUNTS TENDERED AND ACCEPTED (dollars)

Total accepted 21,000,014,000

Total public bids tendered 62,919,126,500

Competitive bids accepted 20,833,507,500

Noncompetitive bids accepted 66,506,500

Fed add-ons 815,373,700

Primary Dealer Tendered 44,168,000,000

Primary Dealer Accepted 11,182,387,500

Primary Dealer Hit Rate 25.3% of what they bid on

Primary Dealer Overall Award 53.2% of issuance

Direct Bidder Tendered 7,165,000,000

Direct Bidder Accepted 3,606,000,000

Direct Bidder Hit Rate 50.3% of what they bid on

Direct Bidder Overall Award 17.2% of issuance

Indirect Bidder Tendered 11,419,620,000

Indirect Bidder Accepted 6,045,120,000

Indirect Bidder Hit Rate 52.9% of what they bid on

Indirect Bidder Overall Award 28.8% of issuance

The eight auction bid tocover ratio average is 2.76%. A 3.00 btc is great demand.

In the last eight auctions, Dealers have been awarded an average of 51% of the issuance. Last month they took home 56.1% though. While 53.2% is above average its not terrible.

In the last eight auctions, Direct bidders have been awarded an average of 6% of the issuance. Direct bidders are way above average at 17.2% of the issuance.

In the last eight auctions, Indirect bidders have been awarded an average of 43% of the issuance. Clearly 28.8% is WAY BELOW AVERAGE.

Direct bidders took home 11% more than average. Indirect Bidders got 14% less. Not quite offsetting...Dealers picked up the rest of the tab.

Overall this was not a bad auction...it was actually fine! Direct bidders made up for absent indirect bidders. The bid to cover ratio, a measure of auction demand, was well above average. The high yield was right at the 3.75% pivot. What continues to make me really nervous is declining participation from indirect bidders aka foreign central bankers.

The negative reaction is likely a function of the market setting up for tomorrow's 30 year bond auction and dealers distributing this round of supply to accounts....

NEXT EVENT: BEIGE BOOK AT 2PM