Heading into the after hours session, the FN 4.0 is +0-05 at 99-17 yielding 4.053% and the FN 4.5 is +0-05 at 101-30 yielding 4.263%. The secondary market current coupon is 4.095%. The CC is +73/10yr TSY and +61/10yr swap.

Several lenders have repriced for the better as price improvements have held since the choppy reaction the 2 yr note auction. In the MBS market, trading flows have been slow and volume below average. "Rate sheet influential" yield spreads are marginally tighter as supply from originators has been muted.

As the FN 4.5 tests the 102 price handle expect to see profit taking pick up...especially when benchmarks are benefiting from a bid (offers getting lifted). All this means is we dont expect to see MBS prices venture too far into the 102-00 price handle (without spreads getting wider at least).

Here is the FN 4.5 ...

Not much to observe in the rates market besides day trading today. Early selling pulled prices down to previous high volume area support at 119-10, outside last week's recent range, but a wave of sporadic buying managed to push prices back towards the outer limits of last week's range support (119-19) . I emphasize a lack of directional bias here and restate the observation that today's price action was largely a function of day trading/profit churning strategies.

Here's how it looks in yield (spot market/cash market)....3.38 was broken early in the session, however yields have ventured back towards Friday's going out levels. All that commotion and we're flat on the day again....

Although I have not been trading pairs lately (currencies) , I have been watchful of the recent trends. Below is a zoomed out view of the dollar index, the dollar trade continues to be a catalyst in this marketplace as the dollar's weakness has yet to correct

And Gold continues to trade higher because of it.

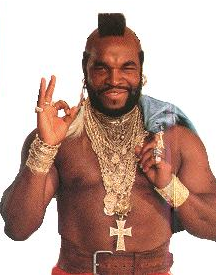

Time to pawn your Mr. T starter kit for some extra cash....