The risk of mortgage fraud jumped by 12.4 percent on an annual basis in the second quarter, the seventh consecutive quarter in which it has increased. CoreLogic said its Mortgage Application Fraud Risk Index now puts the rate of fraud at 0.92 percent or one of every 109 mortgage applications received. In the second quarter of last year the index was 0.82 percent or 1 in 122 applications.

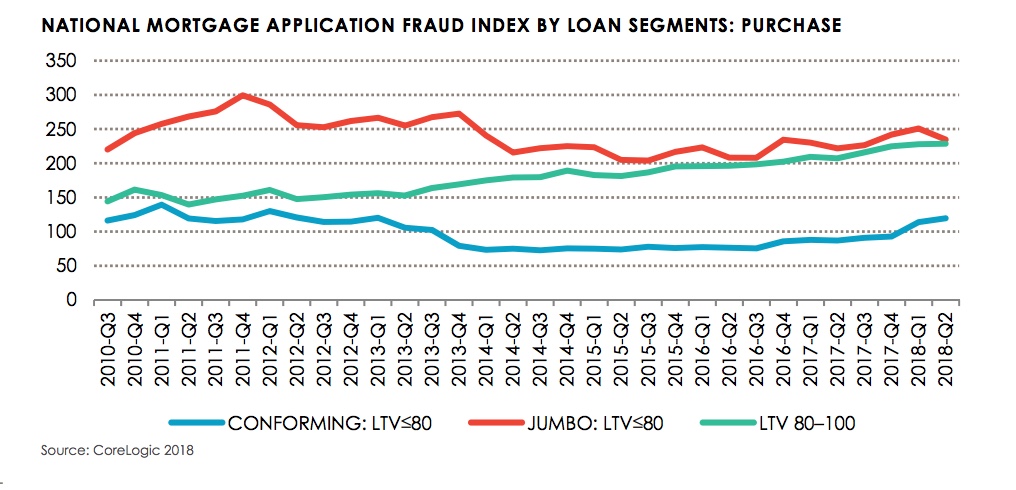

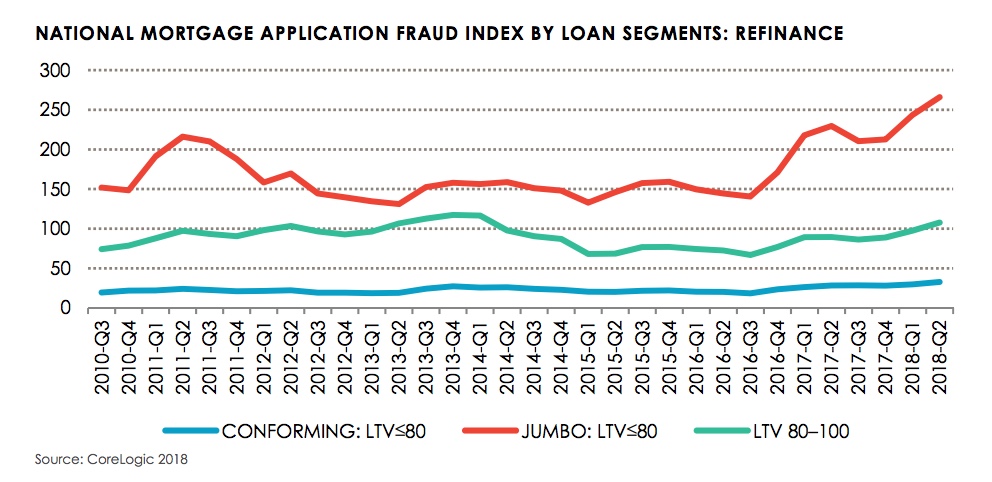

The increase was present in all market segments, but the segment for conforming mortgages with loan-to-value (LTV) ratios of 80 percent or less experienced the largest. Purchase applications overall grew more than refinances with the exception of jumbo refis, possibly because that segment suffered the largest decline in volume. Jumbo refinances had an index of 266 while purchase applications overall were at 235.

CoreLogic's Fraud Risk Index represents the collective level of risk the mortgage industry is experiencing in that time period based on the share of applications with a high risk of fraud. Each 1 point change in the index, which was set at 100 in the third quarter of 2010, represents a 1 percent change in the share of mortgage applications having a high risk. The National Index grew from 133 to 149 year-over-year.

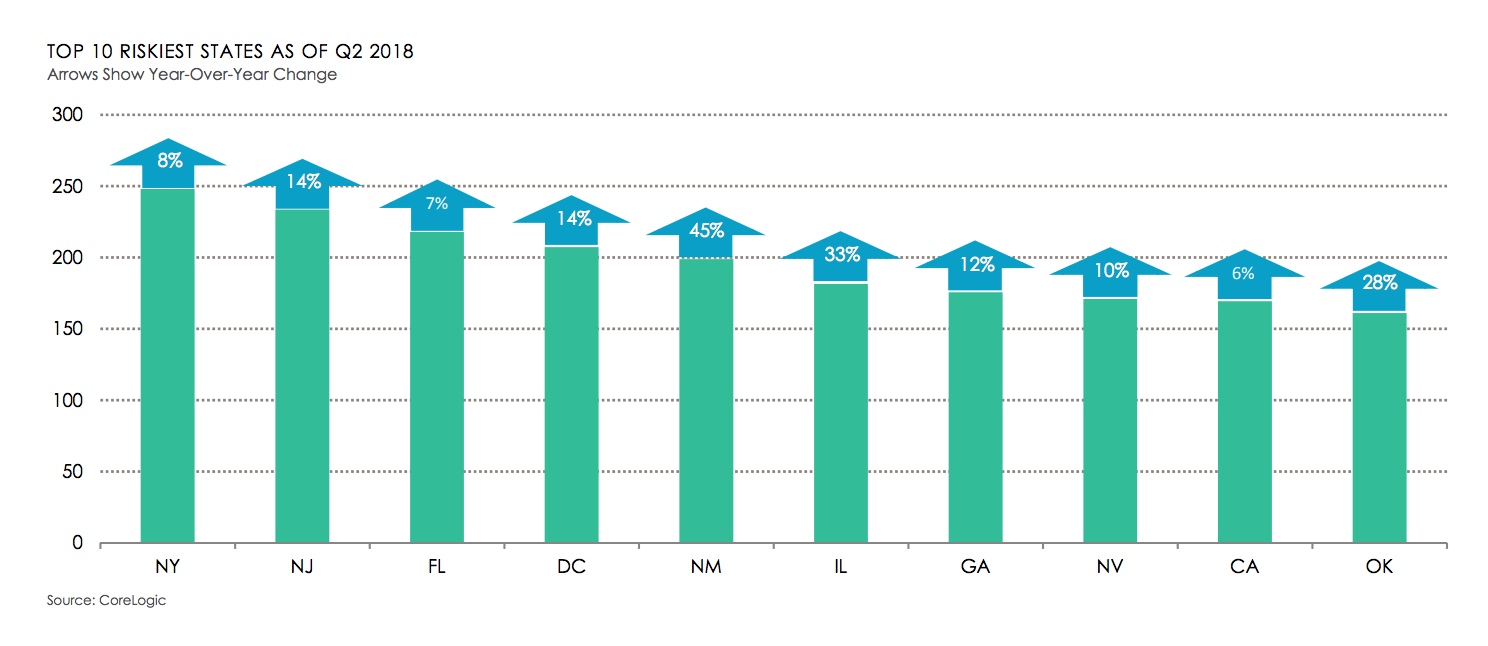

New York, New Jersey, and Florida maintain last year's one, two, three positions as the top states for fraud risk and levels of risk increased for each of the states ranked in the top ten. The greatest year-over-year increases were in New Mexico, Mississippi, Illinois, Oklahoma, and Texas. New Mexico, Illinois, and Oklahoma have index levels higher than the National Index.

The metro areas with the largest year-over-year increases in application fraud risk were Oklahoma City, El Paso, Springfield, Massachusetts; Albuquerque, and Spokane.

CoreLogic says the continued shift from a refinance-heavy market to one that is predominantly a purchase market is a key factor in the increase of fraud risk. Purchase transactions, which increased from a 66 to a 72 percent share of applications over the course of a year, have shown a higher risk profile than refinancing.

The second factor is a 16.8 percent increase in the share of loans originated through wholesale channels, from 7.32 percent in Q2 2017 to 8.55 percent in the second quarter of this year. Wholesale applications have shown a higher risk level than other channels and the increase in this lending continues to impact the National Index.

Another factor is the current environment where home prices are rising and demand for homes is strong. In this type of market much of the fraud is driven by bona fide borrowers trying to qualify for a mortgage. Undisclosed real estate liabilities, credit repair, questionable down payment sources, and income falsification are the most likely misrepresentations.

CoreLogic categorizes risk types as:

- Income Fraud - misrepresentation of the existence, continuance, source, or amount of income used to qualify.

- Occupancy Fraud - a deliberate misstatement of the buyers' intended use of the property as a primary or secondary residence or an investment.

- Transaction Fraud - a misrepresentation of the nature of the transaction such as an undisclosed agreement between parties, falsified downpayments, non-arm's length sale or use of a straw buyer.

- Property Fraud - intentional misreporting information about the property or its value.

- Undisclosed Real Estate Debt - failure to disclose additional real estate debt or previous foreclosures.

A sixth type of risk, Identity Fraud, occurs when an applicant's identity or credit history is altered, created, or a false identity is used. CoreLogic said major data breaches since 2017 have caused many consumers to put freezes on their credit files which impacted the consistency of its data, so the company is not reporting it for this period.

The largest increase in risk by type during the 12 month period was in Income Fraud. This was up 22.1 percent, with the biggest part of the increase coming in the first quarter of this year. Massachusetts, Colorado, Utah, Nevada, and Kansas had the largest gains in this type of risk.

Occupancy Fraud risk also increased, but not nearly as dramatically. It rose slightly during each quarter of the period, building to a 3.5 percent annual gain. The biggest increases were in Vermont, Alaska, New Mexico, Hawaii, and Mississippi. Transaction Fraud risks increased only a slight 0.6 percent.

The other two types of risk were down over the period. Property Fraud ticked 0.1 percent lower and Real Estate Debt Fraud fell 11.4 percent.

Corelogic also looks at markets where there are spikes in the risk index and often finds one reason is an increase in applications for out-of-state investors (OOSI). These are often turnkey investment companies which fix and flip, selling homes to investors and then managing the properties for a fee. Because OOSI is increasing (it rose 25 percent from 2013 to 2017) the company analyzed loan applications, performance, and fraud rates to gain insights about the risks.

It found that as the concentration of OOSI in a market increases so does the default risk on investment loans in that market. Where the concentration was highest, the 90-day delinquency rate and the foreclosure rate were 80 percent and 114 percent higher respectively than where concentrations were low. Fraud rates for investment properties are 88 percent higher than the baseline and are 140 percent higher when investors are from out-of-state. In markets with high concentrations of OOSI, fraud rates were 303 percent above the baseline.

Fannie Mae issued an alert in May about a three-year trend of fraud involving fake employers in California and involving mortgage brokers. CoreLogic says it has seen similar activity across the country and in all channels. The typical scenario is for an applicant to claim a new job with a significant pay increase or a high-paying first job out of college. Because it is new employment the lender cannot verify salary through the IRS. Some of these schemes are well organized, providing applicants with fake pay stubs, phone verifications, and VOE returns. Some scams are openly advertised on-line.

CoreLogic analyzed applications, looking for borrowers with less than one year tenure in their current job and found a low, but increasing incidence, especially in purchase transactions. The company advises that lenders ensure their underwriters are educated about this type of scam.