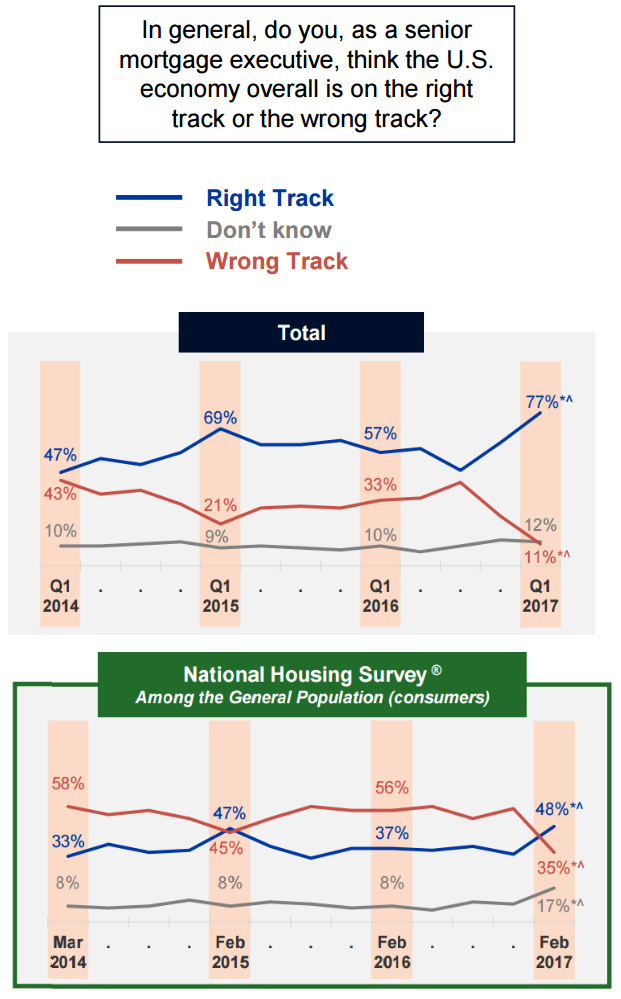

Mortgage lenders contacted in the first quarter of 2017 by Fannie Mae's Mortgage Lender Sentiment Survey expressed the highest expectations for the economy and for home prices since the survey began in the first quarter of 2014. In the first respect, they shared the same sentiments about the economy being on the right track as those articulated by consumers in Fannie Mae's recent National Housing Surveys (NHSs.)

Seventy-seven percent of respondents said they saw the economy being on the right track while only 12 percent said it was on the wrong track. The results were essentially the same whether reported by representatives of small, medium, or large institutions. Forty-eight percent of respondents, a gave the right track answer in the most recent NHS, a high for that survey as well.

Lenders however, had diminished expectations about demand for purchase mortgages. The net share expecting increased demand over the next three months for conventional purchase mortgages fell to the lowest level recorded in any first quarter in the survey's history, with the net expecting an increase falling under 10 percent for all three loan types, GSE eligible, non-eligible, and government-backed. Growth expectations for refinancing demand rose slightly from the prior quarter, which had registered the survey's worst performance. Lenders reporting demand for refinancing over the prior three months was, on net, the lowest since the first quarter of 2014.

The most common reason given for the lowered demand was unfavorable interest rates. This was cited by at least 74 percent of respondents across all loan types.

Lenders' profit margin outlook rose from its three-year low last quarter (Q4 2016), but remains significantly lower than this time last year (Q1 2016) and two years earlier (Q1 2015). Those expecting a lower profit outlook point primarily to competition from other lenders and market trend changes as the top reasons. Government regulatory compliance, which has historically been a top reason for lenders' decreased profit outlook, stayed near its survey low from last quarter.

"This quarter, lenders' optimism toward the overall economy and home price appreciation hit survey highs, mirroring the consumer confidence seen in our February Home Price Sentiment Index," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "However, lenders' profit margin outlook remains significantly less positive than this time last year and two years ago. Lenders cite competition from other lenders and a market shift from refinance to purchase - both of which reached survey highs - as the top reasons for the weak profit margin outlook. With mortgage rates expected to rise, we expect refinance activity will fall and purchase affordability will tighten, increasing competitive pressure in a shrinking mortgage market. Lenders may choose to adjust their production capabilities and staff resources given their profitability outlook."

While the majority of respondents said they expect their credit standards to stay about the same, a small net reported some easing over the last three months and a slightly smaller net said they expected easing over the next three months. In both cases the largest numbers were reported for GSE-eligible loans, but even there the nets were in the low teens.

Many lenders say they think mortgages are difficult to obtain, a much higher percentage of responses than those from consumers on the same subject. A total of 65 percent of lenders, across all mortgage types, said it was difficult while only 40 percent of respondents to the NHS though they would have trouble obtaining one. The difficult responses were particularly high among representatives of the largest institutions; 73 percent.

On net, lenders continued reporting they expect to grow GSE and Ginnie Mae shares and reduce portfolio retention and whole loan sales shares, although to a lesser extent. The majority also reported they expected to maintain their MSR execution strategy although slightly more reported they expected to increase rather than decrease the shares sold and to decrease rather than increase the retained share serviced by a sub-servicer.

The Mortgage Lender Sentiment Survey by Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The Fannie Mae first quarter 2017 Mortgage Lender Sentiment Survey was conducted between February 1, 2017 and February 13, 2017.