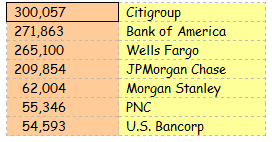

Overwhelmed managing your 40-50 employees? Here's a look at the number of employees at the biggest banks.

A few others are BB&T (32,809), Suntrust (28,015), Comerica (9,385), City National (Los Angeles, 2,891), Sterling Financial (Spokane, 2,601), Umpqua (1,840), Capitol Bancorp (Michigan 1,345).

By the way, if you’re under a certain age, you might stay up night wondering what the heck PNC stands for. It goes back to it’s being Pittsburgh National Bank and then, presumably, Pittsburg National Corp. Now you know.

The loans-to-deposit ratio at individual institutions is always interesting to us, so we looked up some data in the FDIC Quarterly Report. Total loans among all banks amount to $7.28 trillion while total deposits are $9.22 trillion. That’s a 79% loans-to-deposit ratio, and that’s a good target number for most banks.

Those of you who aren’t commercial bankers might ask what the heck is the loans-to-deposit ratio?

Essentially, it’s this: (1) You have $100 in deposits. (2) How many of those dollars do you put into loans? That’s it. Mortgage bankers ask us where the rest of the money goes if not into loans, and the answer is that it should mostly go into highly liquid securities, not necessarily chosen for their yield, but to give you maximum liquidity. Unlike a mortgage bank, the commercial bank has depositors, and when they come in to make a withdrawal, you need liquidity.

We’re really simplifying this, but think of those dark days when people lined up outside Indy Mac branches to pull their money out. If Indy Mac had a loans-to-deposit ratio of, say 60%. Let’s also say they had $10 billion in deposits, then that would have meant $6 billion would have been in loans and $4 billion in highly liquid instruments like T-bills. That low ratio and all that liquidity would have been reassuring and might have prevented or stalled government seizure. We have no idea what the actual numbers or situation was there, but you get the picture.

Okay, are you now starting to see why this is interesting stuff? On one hand, investing your deposits in loans will make you more money than putting too much into T-Bills or Treasury bonds, right? Making 5% loans is better than 1% government paper, obviously. You want to have enough liquidity but not too much, so there’s a balance you need. But this is just Freshman Loans-to-Deposit Ratio Analysis. The Upper Division course also looks at this ratio as a means of managing credit risk. Assuming you have enough liquidity, you also want to lower that ratio going into economic tough times (i.e. make and hold fewer loans). Getting it right is more art than science, but think of those banks that should have lowered that ratio in 2005. Making fewer loans then would have saved a whole lot of pain in the next few years.

Commerce Bank (Cherry Hills, NJ) was one of the nation’s most profitable banks until it was sold to Toronto-Dominion Bank a few years ago, and their stock out-performed Microsoft, Intuit, Apple and everyone else for a 20 year period.

Here’s the interesting part: As successful as they were, their loans-to-deposit ratio was rarely over 35%! They made all their money just getting cheap or free deposits, and they just never made many loans. Put another way, having too high a loans-to-deposit ratio means that a bank either doesn’t know how to get low-cost deposits or has chosen not to seek them out. If it’s the latter, not seeking low-cost deposits means you’ll go for higher rated deposits, and if you do that, you’ll probably have to go after higher yielding loans to make your spread, and that’s typically not a wise thing to do. That’s enough classroom for today, so let’s move on.

Is there going to be a real estate bubble in China? Well, you know all those shiny new high-rises in Beijing? There’s a slide show out there showing 55 of them that are 100% vacant, with another 12 that have to be photographed so they can be added. Not good.

We read a lengthy American Banker article (Feb 24) on Indy Mac and OneWest Bank, and the article said that at the time of its seizure, Indy Mac had the “highest cost funding (i.e. deposits) of any bank in the country.” Along with the Texas Ratio, having extremely high-cost deposits is a good predictor of failure.

Most of you who’re mortgage bankers get 2-3 pages of financials every month. A balance sheet and an income statement, and probably a report showing you production numbers by branch. Those of you who are commercial mortgage bankers have monthly financials (essentially, a Board packet) that’s 100-150 pages in length. We think the composition of Board packages is really important. We could go on for hours about how important presentation is, how the reports look, visuals and the like. The issue is that you’re asking Board members to wade through all these pages and make key decisions that affect issues of risk management. We like seeing tabs, pagination, and having all numbers spread out over 12 months. Graphs can be helpful, but they can also be overdone. We’d love to see what the Board package looks like at a mega-Bank like Wells or Chase. When you have a bank with so many moving parts, it’s critical how you present the information to Board members in a way that doesn’t overwhelm them.