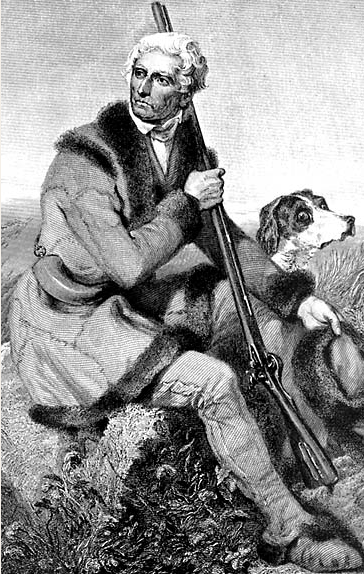

I recently read a biography on Daniel Boone. Most of us know him as a frontiersman and hunter who blazed the Wilderness Road into Kentucky. He founded Boonesborough one of the first English-speaking settlements beyond the Appalachian Mountains. Kentucky was the hunting grounds of various Indian tribes and Boone was confronted with many adversities being a pioneer in uncharted territories. His eldest son was brutally murdered and his daughter was kidnapped by a group of Shawnee. The kidnapping and subsequent rescue by Boone was used as an episode in James Fenimore Copper’s book, The Last of the Mohicans.

Daniel Boone ventured into unchartered territories more than once. Not particularly adjusting very well to civilization, he continued moving further west until he eventually settled and died in Missouri. In addition to his frontier experiences, he was a surveyor and served three terms in the Virginia State Legislature.

As I finished the book, it made me think of the events and changes going on in our industry. The business landscape has dramatically changed in the past 18 months and there is uncertainty about the future. We have all become explorers today as we venture into new and challenging territories because of the drastic changes in the mortgage industry.

I’ve been interviewing candidates for a secondary market position for one of our clients. A key question I asked each candidate was how they see the future of our industry.

Here are a few comments and predictions:

- The professional mortgage broker will survive. They may bolt onto an entrepreneurial regional mortgage banker, but they won’t be joining large institutional mortgage lenders anytime soon.

- Community banks will become more active in warehouse lending, mortgage banking and acquirers of loan servicing.

- The demonizing of the FNMA and FHLMC by the government is very negative. The government needs to be involved in residential housing to ensure liquidity in the capital markets. Without liquidity, we could revert back to the days when banks / savings & loans provided most of the residential lending to the market place.

- Barriers to entry are high today and probably moving higher in the future. Capital requirements are now $2.5 million to become a seller to FNMA/FHLMC. FHA capital requirements will be $2.5 in 3 years. Warehouse leverage ratio requirements continue to drop and high liquidity is more important than ever before

- There is a wide spread between market and economic value of servicer rights today. It makes a lot of sense to acquire or hold servicing rather than selling it.

- There will be more regulations in the industry and mistakes are going to be costly to loan officers and owners of companies.

We have become pioneers regardless if we want to be one or not. We will have to adapt, adjust and expect the unexpected to survive and thrive. Do you have any insights or thoughts on what the future might look like for the mortgage business?