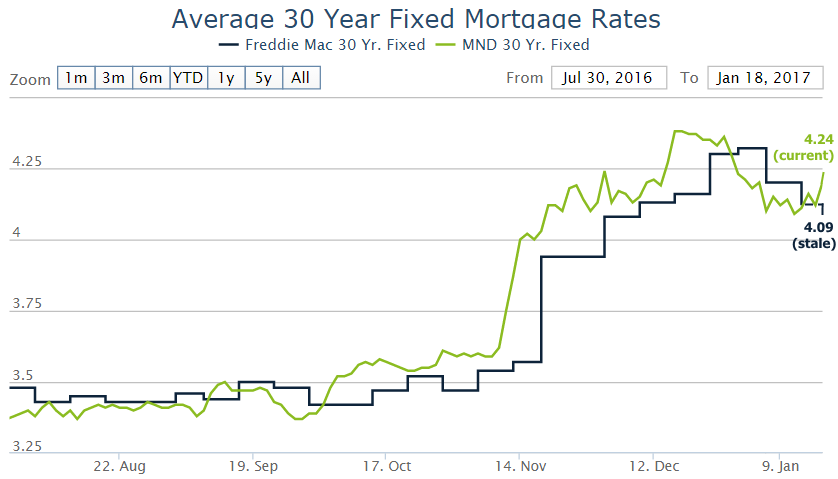

Freddie Mac's weekly mortgage rate survey came out this morning showing the lowest rates in 3 weeks (don't get excited). This happens due to the survey's methodology, which unfortunately relies on Monday/Tuesday rates almost exclusively. With lenders closed for business on Monday and with Tuesday legitimately being in line with the lowest rates of the year, Freddie's headline is perfectly defensible--assuming we're not talking about yesterday or today. If we are, then things are much worse.

After an abrupt increase yesterday, mortgage rates shot higher again today, bringing them even further into the worst territory of the month. In fact, apart from December 14th through 28th, today's rates are the highest in more than 2 years. Whether this is as dramatic as it sounds depends on your perspective. While it's true that rates are at 2017 highs, the range has been fairly narrow so far this year. Specifically, rates have only risen about .125% since Tuesday's 3-week lows. That equates to roughly $21/month on a $300,000 loan.

A more tangible consequence of the rate spike could be seen in the form of higher closing costs for borrowers wishing to lock the same rates quoted yesterday or the day before. On average, you'd need to pay an extra $650-750 (per $100k financed) upfront to lower your rate by .125%. In that sense, if you opted not to lock a $300k loan on Wednesday, the past 2 days cost $1950-$2250. For most scenarios, it will simply make more sense to move up .125% in rate.

Loan Originator Perspective

Our recent range has been officially busted. Hopefully you were able to lock in yesterday prior to the carnage in the bond market. What to do now? My rate sheets appear to have priced in a larger selloff, so it looks like we have some cushion. As long as you can afford to be wrong, floating overnight might be worth the risk. If you are close to the maximum debt to income ratio to qualify, then lock in now. -Victor Burek, Churchill Mortgage

For those who failed to stay defensive while in the range, bad news, the range has been broken. That's not to say that we won't find ourselves back in the range, or that rates are only going higher, but unfortunately now the pattern of momentum driving rates lower has evaporated. Because the uncertainty surrounding our new administration is so high, combined with the rhetoric of the FED leaning towards rate increases, the argument to not lock-in and wait it out becomes very weak. There are some rare instances that floating is a viable option, but for most, the smart thing to do is lock in and move on. -Gus Floropoulos, VP, The Federal Savings Bank

Today's Best-Execution Rates

- 30YR FIXED - 4.125-4.25%

- FHA/VA - 3.75%

- 15 YEAR FIXED - 3.25-3.375%

- 5 YEAR ARMS - 2.75 - 3.25% depending on the lender

Ongoing Lock/Float Considerations

- Rates had been trending higher since hitting all-time lows in early July, and exploded higher following the presidential election

- Some investors are increasingly worried/convinced that the decades-long trend toward lower rates has been permanently reversed, but such a conclusion would require YEARS to truly confirm

- With the incoming administration's policies driving a large portion of upward rate momentum, mortgage rates will be hard-pressed to return to pre-election levels until well after Trump takes office. Rates can move for other reasons, but it would take something big and unexpected for rates to get back to pre-election levels.

- We'd need to see a sustained push back toward lower rates (something that lasts more than 3 days) before anything less than a cautious, lock-biased approach makes sense for all but the most risk-tolerant borrowers. The beginning of 2017 may be bringing such a push, but there's no telling how long it will last.

- As always, please keep in mind that the rates discussed generally refer to what we've termed 'best-execution' (that is, the most frequently quoted, conforming, conventional 30yr fixed rate for top tier borrowers, based not only on the outright price, but also 'bang-for-the-buck.' Generally speaking, our best-execution rate tends to connote no origination or discount points--though this can vary--and tends to predict Freddie Mac's weekly survey with high accuracy. It's safe to assume that our best-ex rate is the more timely and accurate of the two due to Freddie's once-a-week polling method).