Its been a wild week in mortgage rate land. Lenders have repriced for the better, they have repriced for the worse, only to reprice for the better again! And that's just two days of action. Its been a roller coaster ride to say the least, but some how we've managed to end up right back where we started: MORTGAGE RATES HAVE HELD NEAR 2010 LOWS ALL WEEK

The economic calender provided plenty of reason for mortgage rates to move today.

The first set of data to be released was Weekly Jobless Claims. This report provides three measures on the health of the labor market:

- Initial Jobless Claims: totals the number of Americans who filed for first time unemployment benefits

- Continued Claims: totals the number of Americans who continue to file for benefits due to an inability to find a new job

- Extended Benefits: totals the number of Americans who have exhausted their traditional benefits and are now receiving emergency benefits

While an increase in jobless claims is a bad sign for the economy, weak data generally helps mortgage rates move lower. Higher rates of unemployment reduce income levels and strain consumer spending. Less spending erodes corporate profits and forces investors to sell stocks. When investors sell stocks they usually look to re-allocate funds into safer assets like U.S Treasuries. When Treasury yields fall mortgage rates usually follow their lead.

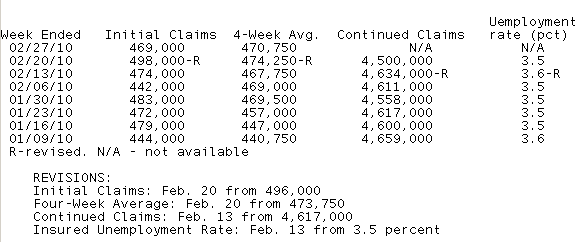

Last week's claims numbers were much worse than expected, increasing by 24,000 from the prior week to 498,000. This week's report came in right on expectations, new jobless claims declined by 29,000 to 469,000. Continued claims fell 134,000 to 4.50 million while the number of Americans receiving extended benefits rose 198,000 to 5.87million.

Here is a table summarizing the results:

Released at the same time was a revision to a previously released Productivity and Costs Report. This data measures how efficient our work force is at producing our nation’s goods and services. A more productive work force means employers do not need to hire additional staff to increase production, while unit labor costs measures the labor cost of producing each unit of output. Higher productivity lowers the unit cost of producing goods and services which helps to keep inflation in check.

The release indicated that 4th quarter productivity and costs were revised for the better by more than expected. Nonfarm productivity increased 6.9% vs the previouslyreported 6.3% while unit labor costs declined by 5.9% vs. the 4.5% fall that was reported a month ago. Higher productivity should help increase corporate profits, which benefits stocks, while the lower unit costs benefits the fixed income sector as it indicates less inflationary pressures. With unemployment around 10%, it is clear to see that the American worker continues to be more productive in hopes of keeping their current job. While there are positives to be taken from this report, the fact that labor force productivity remains so high may have negative effects on hiring in the future. If firms need less workers to fill orders, it makes sense that hiring would not increase as much as many expect when consumer spending increases down the road.

The National Association of Realtors released the monthly Pending Home Sales report. This data shows the monthly change in the amount of existing homes, not new construction, in which a contract has been signed, but is yet to close. This is a leading indicator of housing activity and economic momentum as consumers would have to feel pretty confident about their own finances to purchase a home. Additionally, when a home is purchased, there are many other items needed to furnish the home, this adds to consumer spending which benefits the overall economy. The data in this report has a two month lag time, so today’s data is also for the month of January. Economists surveyed prior to the release expected Pending Home Sales to post a 1% month over month increase matching December's increase.

The NAR reported Pending Home Sales for January declined a whopping -7.6%, much worse than expected. While some of the decline is being blamed on the wintry weather across the country, today's release indicates the housing sector is still in trouble. READ THE MND STORY

The final report on the day let us know how busy manufactures might be in the coming months: Factory Orders. This data represents the dollar amount of new orders for both durable and non-durable goods. Durable goods are products that have a life expectancy of at least three years such as autos, computers, machinery. Non-durable goods are products that can only be used one time or a product with less than a three year life expectancy. If orders are increasing, it indicates manufactures will be busier in the months ahead as they ramp up production to meet the demand. Busier factories can lead to additional hiring which is good for the overall economy and the equities market. This report has a two month lag, so today’s data is for the month of January.

Factory orders in January rose 1.7%, slightly lower than expectations for an increase of 1.8%. The December data was revised higher from a first reported rise of 1% to an increase of 1.5%.

Reports from fellow mortgage professionals indicate lender rate sheets to be unchanged from yesterday afternoon. The par 30 year conventional rate mortgage remains in the 4.75% to 5.00% range for well qualified consumers. To secure a par interest rate you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee.

Tomorrow we get the official government numbers on the employment situation. This is the most influential report offered on a monthly basis. Job creation is crucial to our overall economic recovery; if more people are out of work, there will be less consumer spending. This is bad for corporate profits and our economy. I have been saying all week to lock ahead of this report, I am sticking with that guidance. If tomorrow's report is better than expected, rates will rise and rise quickly. If it is on the screws or slightly worse, mortgage rates will probably hold steady near current levels, even if MBS prices rise. if much worse than expected, rates could dip another .125% for a brief amount of time. With rates holding at the best levels of the year and not much to gain by floating, the wise move is to lock ahead of this report.