Mortgage rates moved up yesterday after the first of three treasury auctions scheduled this week failed to match expectations.

Weak demand for $40 billion 3 year Treasury notes and the beginnings of a recovery bounce in stocks were cited as the driving force behind rising interest rates. There were a few reports of lenders recalling rate sheets, but for the most part, reprices for the worse were not widespread.

The Mortgage Bankers Association today released the Weekly Survey on Mortgage Application Activity for the week ending February 5, 2010.

The MBA survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. Furthermore, in a low mortgage rate environment, such a trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

In last week's release, mortgage applications increased 21%. Refinance apps were up 26.3% while purchase applications improved 10.3%. These gains were impressive but the MBA warned of rising rates.

In today's survey release, overall mortgage loan demand declined 1.2%.

Here is a recap of this week's survey:

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier.

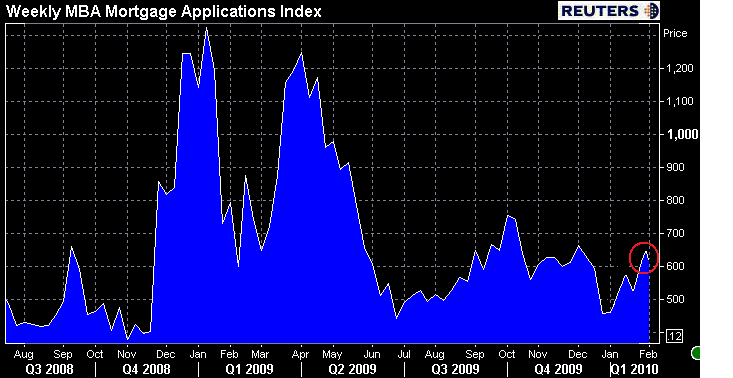

The Refinance Index increased 1.4 percent from the previous week. This is an improvement, but demand failed to gain traction even as mortgage rates fell to 2010 lows last week. The refinance share of mortgage activity increased to 69.7 percent of total applications from 69.2 percent the previous week. The chart below highlights how higher borrower loan demand was in early 2009. Current levels are considerably slower.

The Purchase Index decreased 7.0 percent from one week earlier. The unadjusted Purchase Index decreased 1.1 percent compared with the previous week and was 7.5 percent lower than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 5.01 percent, with points increasing to 1.06 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

The only other report on the day was the release of International Trade data. The Trade Balance report measures the monthly difference between what our nation imports and what our nation exports. The report showed that our trade deficit widened much more than expected to $40.2billion from $36.4billion last month. Economists had forecasted a decline in our trade deficit to $35.8billion. The main cause of the wider trade gap was the recent rise in commodities, which have since declined indicating next month’s report should show some narrowing. One positive note from the report was an increase in exports, which can lead to more jobs here. This was the eighth consecutive monthly gain in exports. The larger than expected widening of the Trade Balance means a downward revision is due for Q4 2009 GDP data.

The main event on the day was the second of three US Treasury auctions scheduled for this week. Today's auction offered $25 billion 10 year notes. The 10 year is more influential over mortgage rates than the 3 year Treasury note. Unfortunately, much like the 3 year note auction, this auction was weaker than anticipated, which consequently pushed mortgage rates higher afterwards. Matt and AQ covered the results shortly after the auction. You can see, they issued a reprice for the worse alert immediately. REPRICE ALERT

Mortgage Rates moved higher today.

Reports from fellow mortgage professional indicate the par 30 year conventional rate mortgage has moved up to the 4.875% to 5.125% range for well qualified consumers. To secure a par rate you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee. If you are seeking a 15 year term, you should expect par in the 4.25% to 4.50% range with similar costs.

I continue to advise locking.

In 2010, mortgage rates have proven unable to push lower than 4.75%. I continue to believe that 4.75% will be the lowest we will see this year, unless there is a major shift in investor sentiment and economic outlooks.