Not too many changes to report since the morning post...

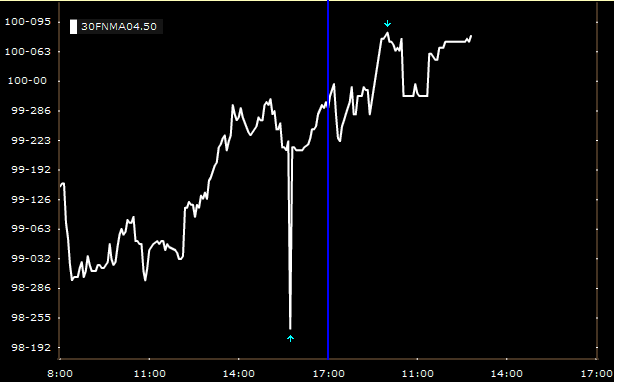

FN 4.5 +12/32 at 100-09

FN 5.0 +6/32 at 101-07

FN 5.5 +3/32 at 101-18

As you can see from the price above we are in the midst of another down in coupon day. The lower end of the coupon stack is tightening up to the belly of the yield curve and to swaps. We saw a brief sell off in the 4.5 but prices quickly recovered. The market is indicating that it believes Ben and Hank are serious about paying the underlying problem at hand, falling asset prices (real estate), some focused attention.

It appears that lenders are hestitant to move rate sheets much lower than 4.875 right now. There are several reasons behind this but the theme is essentially that they are protecting themselves from a change in sentiment followed by volatile movements in the more convex 4.5 and 5.0 coupons