(Reuters) - Sales at U.S. retailers posted their largest gain in five months in August on strong receipts at gasoline stations and clothing outlets, further assuaging fears of a double-dip recession.

The Commerce Department said on Tuesday total retail sales rose 0.4 percent following a revised 0.3 percent rise in July. It was the second straight month of gains in retail sales, which are a measure of consumer health. July sales had been previously reported to have increased 0.4 percent.

Analysts polled by Reuters had forecast retail sales rising 0.3 percent last month. Compared to August last year, sales were 3.6 percent higher.

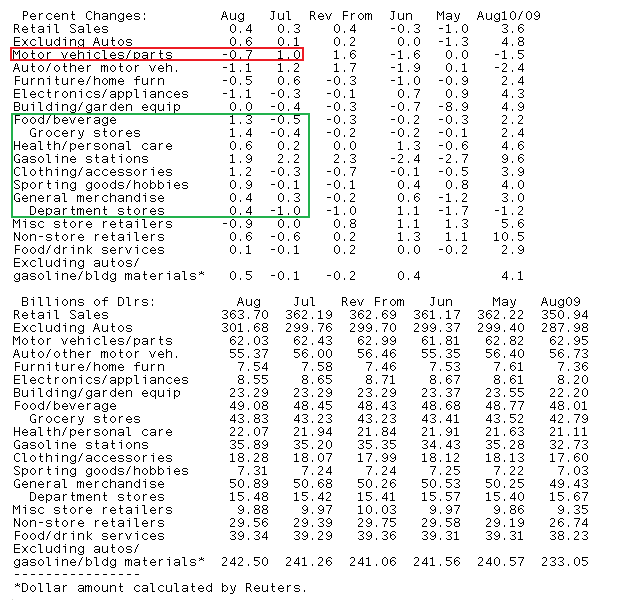

Below is a recap of the data...

08:30 14Sep10 RTRS-US AUG RETAIL SALES +0.4 PCT (CONSENSUS +0.3 PCT) VS JULY +0.3 PCT (PREV +0.4 PCT)

08:30 14Sep10 RTRS-US AUG RETAIL SALES EX-AUTOS +0.6 PCT (CONS +0.3 PCT) VS JULY +0.1 PCT (PREV +0.2 PCT)

08:30 14Sep10 RTRS-US AUG RETAIL SALES EX-GASOLINE +0.3 PCT VS JULY +0.1 PCT

08:30 14Sep10 RTRS-US AUG RETAIL SALES EX-AUTOS/GAS/BUILDING MATERIALS +0.5 PCT VS JULY -0.1 PCT

08:30 14Sep10 RTRS-US AUG GASOLINE SALES +1.9 PCT VS JULY +2.2 PCT

08:30 14Sep10 RTRS-US AUG CARS/PARTS SALES -0.7 PCT VS JULY +1.0 PCT

08:30 14Sep10 RTRS-US AUG RETAIL SALES INCREASE LARGEST SINCE MARCH 2010 (+2.1 PCT)

08:30 14Sep10 RTRS-TABLE-U.S. Aug retail sales rose 0.4 pct

Plain and Simple: first and foremost, this data will help hush the hems and haws of the double dipper crowd. It surely won't silence outcries for added stimulus though. Taking a deeper look at the results, retail sales clearly benefited from a rush of summer vacations and back to school buying. Overall, while the data was better than expected, it doesn't provide new evidence of a faster than forecast economic recovery.

Market Reaction...

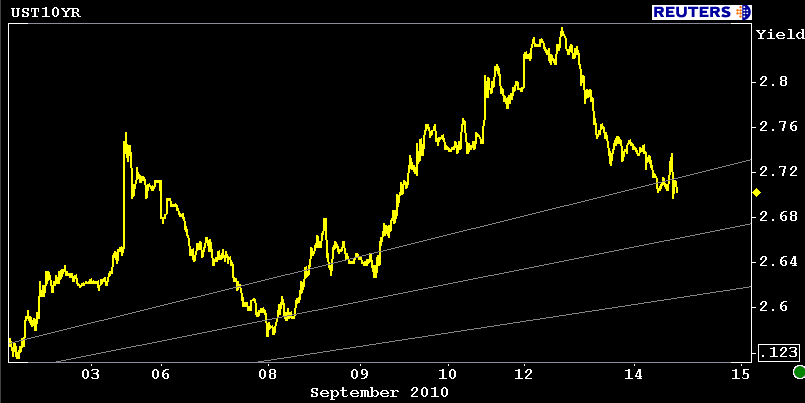

Counterintuitive! TSY longs are keeping a cap on rates....

Bonds traded off as the news flashed but quickly changed course after running into the overnight price lows/yield highs. Trading volume remains low in the long end of the curve though, so real money accounts (who are largely responsible for this recovery rally) have yet to come up against much resistance.

The long end of the curve is leading the improvements. The 2s/10s curve is 4bps flatter at 217 wide. The 2.625% coupon bearing 10 year TSY note is currently +12/32 at 99-11 yielding 2.703% (-4.4bps). I overlaid a fibonacci fan at long standing support (2.85%). If 10s continue to rally, yields should stop to test the inflection points illustrated below.

MBS had a great day yesterday, but there wasn't much size or commitment behind the rally. More or less, a lack of supply offerings from originators helped draw in buyers who were looking to play the range/bargain buy the basis. After a few days of increased hedging (adding pipeline coverage to account for uptick in pull-through), loan supply was less than $2 billion! The MBS market was due a correction from its oversold status...whether or not it lasts depends on TSYs. If benchmarks rally, current coupon MBS prices will follow, but they will lag and yield spreads will widen.

By the way, I am officially rolling to November delivery MBS coupons today. The November FNCL 4.0 is +11/32 at 102-19. Current coupon yield spreads are wider as MBS lag benchmarks (swaps 2bps tighter). Considering who was buying MBS yesterday, we are likely seeing some profit taking this morning, which explains why MBS are lagging TSYs and swaps.

Our strategy is holding up well so far. Don't get too comfy yet though. There still hasn't been much volume to back the recovery rally. Remain cautious. Stay defensive. Play the range...