A busy day awaits the markets as investors get their first look at second-quarter GDP. Also in the store is the influential Chicago Business Barometer which gives an update on how the economy is recovering in the midwest, plus a consumer sentiment index for the nation at large.

While investors wait for the GDP report, headlines are focusing on an IMF report which said the U.S. financial system may need $76 billion in fresh capital to recover.

“The findings, released today as part of a broader IMF report on the U.S. financial system, suggested that while the nation’s banking system is stable, it remains vulnerable,” reports Bloomberg News. “Home prices, commercial real estate loans and economic growth have the potential to cause shocks that could expose banks to more losses. Under one scenario, small and regional banks as well as subsidiaries of foreign banks would need $40.5 billion in additional capital to meet a benchmark capital ratio of 6 percent Tier 1 common equity from 2010 to 2014. Under the adverse scenario, those needs rise to $76.3 billion, according to the report.”

Commentary from AQ...

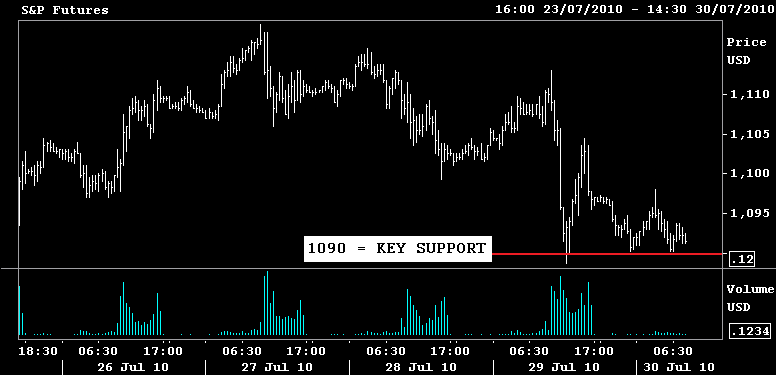

Recent history is starting to repeat itself as risk traders have once again found themselves searching for motivation after stock indexes were squeezed higher by a fresh round of forced buying. Several attempts to break through resistance (200dma & 38% fib. retrace) have failed and S&Ps are now testing support at 1090. This inflection point was revisited overnight but never broken. That technical breakdown will be left in the hands of 830am domestic GDP data.

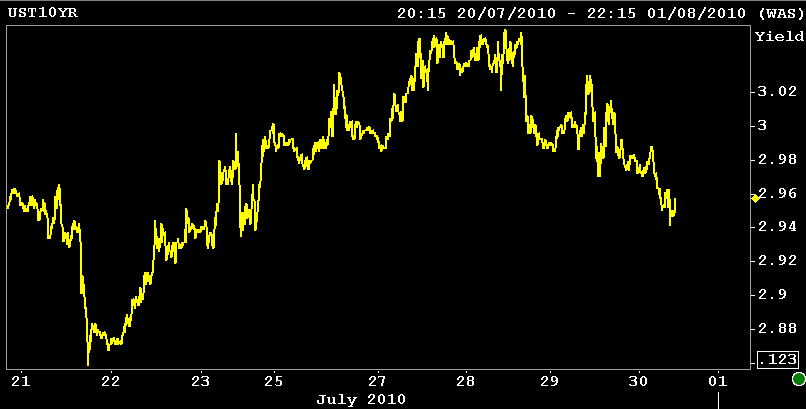

Month end is upon us and the yield curve is moving flatter as index buyers look to add longer dated debt. 10s are once again back under 3.00% and 2.92% is still not far off in the distance as the flight to safety has yet to lose its foothold.

The 2s/10s curve is 2bps flatter at 239bps. The 3.50% coupon bearing 10 year note is 3.1bps lower at 2.957%

Front month FNCL 4.5s closed at 104-14+ yesterday, yet another new record print. Mortgages continue to benefit from a confluence of events including favorable technical conditions (supply shortage), tightening swap spreads (falling LIBOR and huge amounts of swapable corporate issuance), and a generally noncommital group of risk investors who somehow keep getting caught offsides on the pain trade (flight to safety stronghold).

The September delivery FNCL4.0 is +08 at 102-04. The FNCL 4.5 is +04 at 104-07. The secondary market current coupon is another 2bps lower at 3.667%. The CC is 71.9 off the curve. Wider to start to the day.

On a side note, 3.5s traded at par yesterday. Before you get all excited about 4.00% rates (4.25 is paying), this doesn't mean we'll start to see originators hedging their pipeline forward with 3.5 TBAs. I do however remain quite conscious of the street's appetite for duration. Plain and Simple: I'll let you know if anything changes

Key Events Today:

8:30 ― This week’s key report, Gross Domestic Product, is anticipated to report that the recovery slowed down in the second quarter. Economists look for a 2.5% advance from April to June, compared with a 2.7% gain in the first three months of the year. Expectations are pretty mixed though, ranging from just 1.0% to 3.4%.

Among the “slowdown” crowd is Nomura Global Economics, which said the most recent indicators “have consistently surprised” to the downside.

“In particular, retail sales and the real trade balance have proved weaker than expected,” they noted. “With regard to the composition of growth, we expect positive contributions from consumer spending, equipment and residential investment, government spending (helped in part by the Census program), and inventories. Net trade and business structures investment likely subtracted from growth.”

By contrast, the forecasting team at BBVA said not only were fiscal stimulus and inventories supporting economic growth, “but private demand is taking hold as well.”

Somewhere between the two, economists at IHS Global Insight said the economy “entered the second quarter with plenty of momentum, but exited with very little.”

9:45 ― The Chicago Business Barometer might take a hit in July, economists say. The index, which covers both manufacturing and services, is set to fall to 56.0 from 59.1 in June. While anything over 50 indicates growth, the falling headline could inflate fears of a double-dip recession.

Economists at Nomura are looking for a 54.0 score. “Given that the business barometers in other regions already reported earlier this month showed large declines, the index is likely to fall,” they wrote.

10:00 ― The week’s final data release is the Reuters & U of Michigan Consumer Sentiment report. A preliminary look on the 16th showed the index nose-dive 9.5 points to 66.5, marking the lowest score since August 2009. As with so many other indexes this week, predictions are deeply divided. The median estimate is 67.0, not far from the preliminary numbers, but estimates range from an astonishingly low 57.9 to 68.0.

“With high volatility in financial markets and an ‘unusually uncertain’ economic outlook, the final number for the July's consumer sentiment index could worsen from the preliminarily report,” said economists at Nomura, quoting Fed chairman Ben Bernanke. “Even if it improves from the preliminary number, it will likely remain at a lower level relative to the previous month.”

Once again, economists at IHS Global Insight look for a rebound from consumers.

“Sentiment is expected to have improved in the second half of July, as the stock market rebounded and the litany of bad news on the BP oil spill abated somewhat,” they predicted.