The 7-year note auction went well...but benchmark yields are still on the rise.

I would characterize the behavior of the 10yr note as "indecisive consolidation followed by continuation". In other words, the 10yr note was trending upward in a choppy manner and when the ascending triangle ran out of room to consolidate...energy was released in the form of continuation.

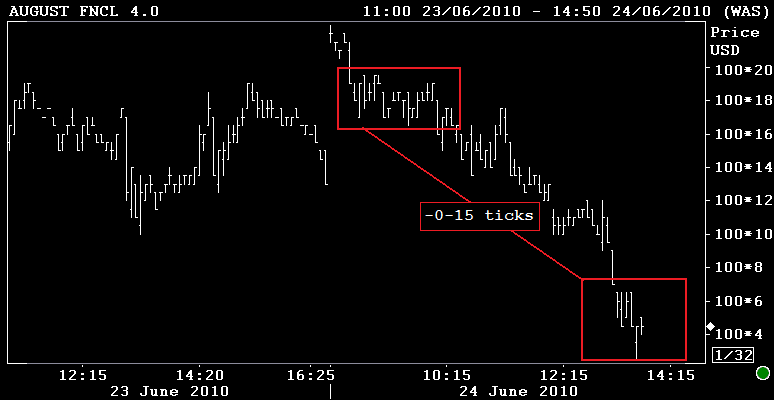

These events are not working out to an originator's advantage. The August delivery FNCL 4.0 MBS coupon is -0-11 at 100-02. This is well off the highs of the day and deep into reprice for the worse territory.