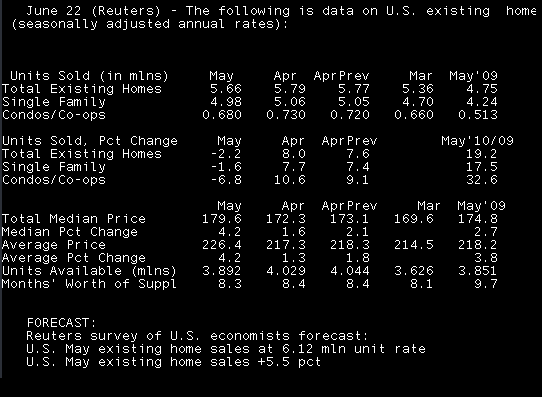

10:00 22Jun10 RTRS-US MAY EXISTING HOME SALES 5.66 MLN UNIT ANNUAL RATE (CONS 6.12 MLN) VS APRIL 5.79 MLN (PRV 5.77)-NAR

10:00 22Jun10 RTRS-US MAY EXISTING HOME SALES -2.2 PCT (CONS +5.5 PCT) VS APRIL +8.0 PCT (PREV +7.6 PCT)-NAR

10:00 22Jun10 RTRS-US MAY INVENTORY OF HOMES FOR SALE -3.4 PCT TO 3.892 MLN UNITS, 8.3 MONTHS' SUPPLY-NAR

10:00 22Jun10 RTRS-US MAY NATIONAL MEDIAN PRICE FOR EXISTING HOMES $179,600, +2.7 PCT FROM MAY 2009-NAR

10:00 22Jun10 RTRS-TABLE-U.S. May existing home sales fell 2.2 pct

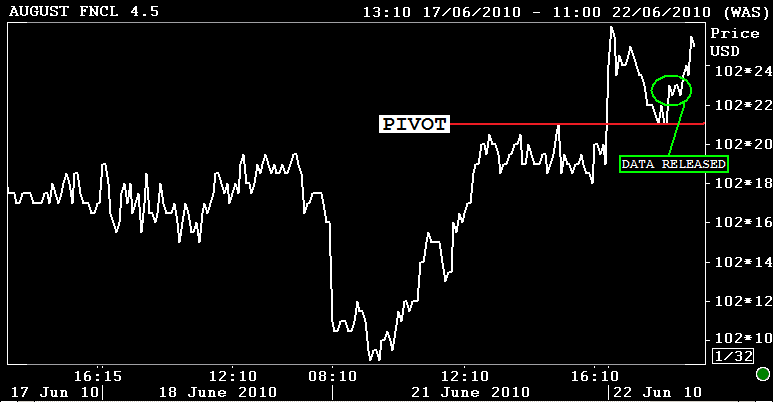

The August FNCL 4.5 MBS coupon bounced at support after the worse than expected EHS print. The August FN 4.5 is +0-05 at 102-24. The secondary market current coupon is 3bps lower at 3.943%. I see 4.375% paying on rate sheets but there is definitely added margin in loan pricing today.

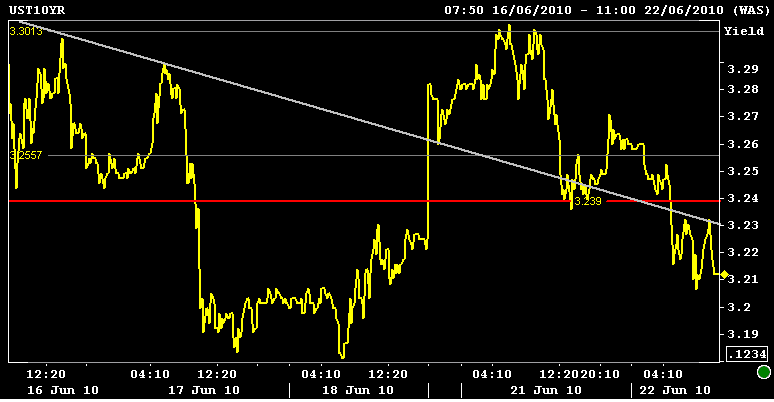

Here is an updated 10yr note yield chart. See comments HERE