The effects of low interest rates continue to echo through the mortgage markets. Those rates can be credited, at least in part, with a change in the risk profile of conventional home purchase loans.

According to CoreLogic's Archana Pradhan, writing in the company's Insights blog, the average debt-to-income ratios for those loans declined during the third quarter of 2019 compared to a year earlier, most likely because of lower mortgage payments. At the same time, loan to value (LTV) ratios for those loans moved higher.

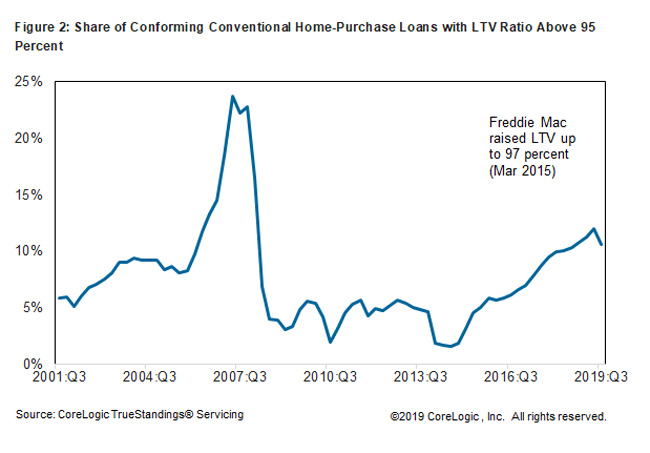

Pradhan says DTI and LTV, two of the three credit-risk attributes of borrowers, have varied dramatically over the last 20 years. Starting in 2014 the government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac loosened their underwriting policies to make loans more available to creditworthy borrowers. Fannie Mae began accepting mortgages with LTV ratios up to 97 percent in December 2014 and Freddie Mac did the same a few months later. To further expand access to credit, Fannie Mae raised its DTI ratio level from 45 to 50 percent in July 2017.

The share of new conventional conforming home-purchase loans with a DTI ratio above 45 percent had held steady at 5 to 7 percent from early 2012 until Fannie enacted its new policy. It then began to rise sharply, reaching a peak of 21 percent in the fourth quarter of 2018 before starting to slip in early 2019. The average DTI ratio for new conventional conforming home-purchase loans dipped by one point to 36 percent from the third quarter of 2018 to the third quarter of 2019.

The percentage of new conventional conforming purchase mortgages with an LTV ratio above 95 percent also responded to the related GSE policy changes, rising from less than a 2.0 percent in 2014 to 12 percent by the second quarter of 2019, its highest post crisis share. The average LTV also moved higher, to 83 percent in the third quarter from 82 percent a year earlier.

Underwriting standards for the third credit-risk attribute, credit scores, have not changed in recent years. During the third quarter of this year the average score for buyers using conventional conforming loans rose by two points on an annual basis and is much higher than before the housing crisis. The average score in 2001 was 705 but it rose sharply during the recession and reached 754 by Q3 of 2019. In addition, the high DTI and LTV loans in 2018 were fully documented, unlike the low and no doc loans prior to the crash.

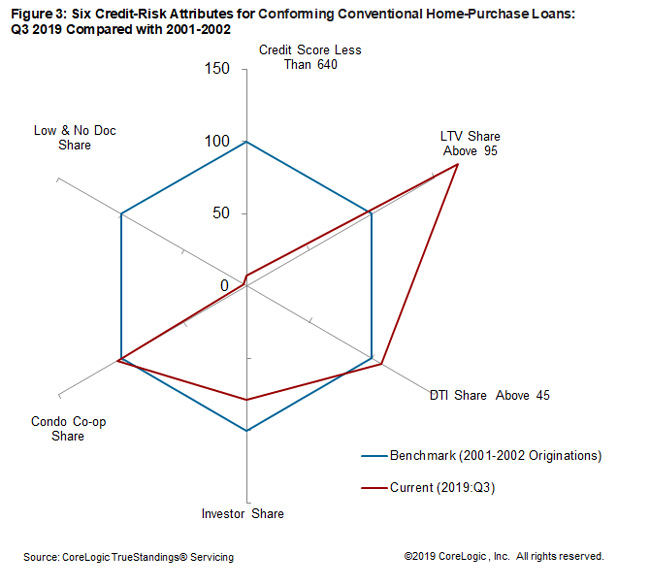

The figure below compares six indicators of underwriting and credit risk using 2001-2002 as a benchmark. The blue hexagon represents characteristics of loans originated during the benchmark period and the red polygon charts those originated in the third quarter of 2019. The share of borrowers with a credit score less than 640 as well as the low/no documentation loan share were both down significantly compared to the benchmark level. In contrast, the shares of new loans with an LTV ratio higher than 95 percent and with a DTI ratio above 45 percent were higher than their benchmarks by 69 percent and 8 percent respectively. The condo/co-op share was 3 percent higher while the investor-owned share was 21 percent lower than their respective benchmarks.

Mortgage rates, which reached a recent peak of around 4.5 percent in November 2018, started to decline early in 2019 and have now dropped about 1 percentage point from that peak. Pradhan says the decline in share of loans with a DTI ratio above 45 percent reflects the improving affordability attributed to low mortgage interest rate throughout the year.