The first monthly report on the status of the COVID-19 related forbearance programs was released by the Mortgage Bankers Association (MBA) on Monday. MBA ceased weekly reporting on program participants effective October 31 at which time there were an estimated 1 million homeowners remaining in the program.

During the month of November, the forborne share of the 36.5 million mortgages in servicer portfolios declined by 39 basis points to 1.67 percent. This would leave approximately 835,000 loans in forbearance as of November 30. Of those loans, 18.3 percent are in their initial forbearance plan stage, while 68.4 percent are in an extension. The remaining 13.3 percent are re-entries to the program, including re-entries with extensions.

Fannie Mae and Freddie Mac forborne loans declined 16 basis points to 0.76 percent of those combined portfolios while the share of Ginnie Mae (FHA, VA, and USDA) loans dropped 42 basis points to 2.10 percent. The largest change was in portfolio loans and private-label securities (PLS). They declined 106 basis points to a 3.94 percent share.

"The share of loans in forbearance in November declined - albeit at a slower pace than October - as borrowers continued to near the expiration of their forbearance plans and moved into permanent loan workout solutions," said Marina Walsh, CMB, MBA's Vice President of Industry Analysis.

Total loans serviced that were current, that is not delinquent or in foreclosure, rose to a non-seasonally adjusted 94.58 percent of servicer portfolios in November from 94.32 percent in October. Of the total completed loan workouts, including repayment plans, loan deferrals/partial claims, loan modifications, completed from 2020 and forward, 83.69 percent were current as of November 30. That is down from 84.04 percent at the end of October.

"More borrowers were current on their mortgage payments in November compared to October. This coincides with continued improvement in the labor market - faster wage growth and the unemployment rate dropping to 4.2 percent," said Walsh. "While there was some deterioration in the performance of borrowers in post-forbearance workouts, four out of five overall remained current through November."

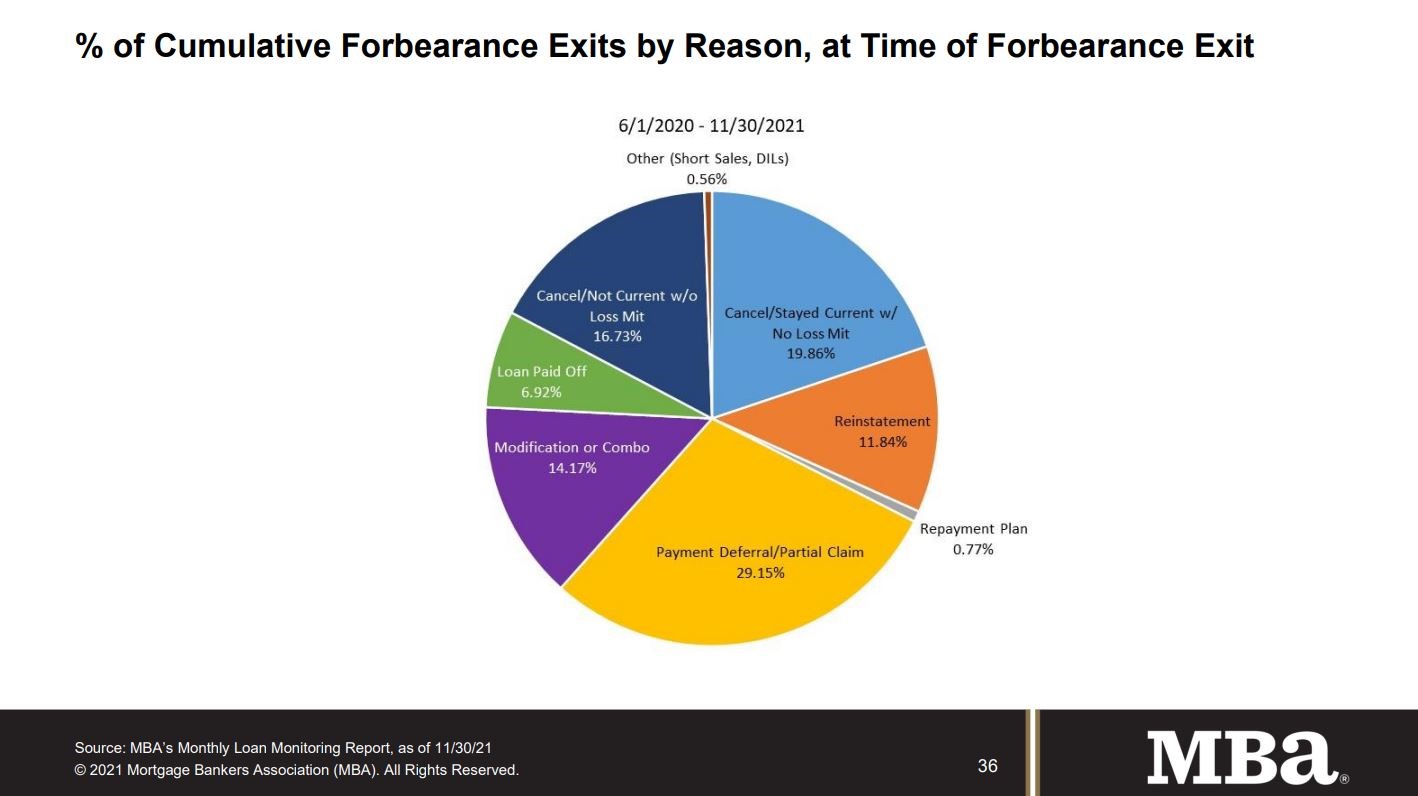

Of the cumulative forbearance exits for the period from June 1, 2020, through November 30, 2021:

- 29.1 percent resulted in a loan deferral/partial claim at the time of their exit.

- 19.9 percent were borrowers who continued to make their monthly payments during their forbearance period.

- 16.8 percent were borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

- 14.1 percent resulted in a loan modification or trial loan modification.

- 11.8 percent resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 6.9 percent were paid off through either a refinance or by selling the home.

- The remaining 1.4 percent resulted in repayment plans, short sales, deeds-in-lieu or other reasons.

MBA's new monthly Loan Monitoring Survey covers the period from November 1 through November 30, 2021, and represents 73 percent of the first-mortgage servicing market