The Office of Comptroller of the Currency released its Quarterly Mortgage Metrics Report on Wednesday showing that delinquencies among mortgages serviced by the large financial institutions it supervises were stable but still elevated during the third quarter.

While delinquencies have declined from one year earlier, the number of new foreclosures increased by 21.1 percent during the quarter as alternatives for loan modifications and other efforts to mitigate delinquencies were exhausted and some of the voluntary moratoria that were implemented in the fall of 2010 in the wake of the robo-signing controversy were lifted. The increase in new foreclosures along with the increasing amount of time each takes to process has brought the number of loans in foreclosure to 1.33 million or 4.1 percent of the overall portfolio.

At the end of the quarter 88 percent of the 32.4 million mortgages in the portfolio were current and performing, about the same as in Q2, and the percentages of loans that were 30-59 days delinquent and over 60 days delinquent were also unchanged quarter over quarter. Both categories of delinquencies are down, however, from a year earlier.

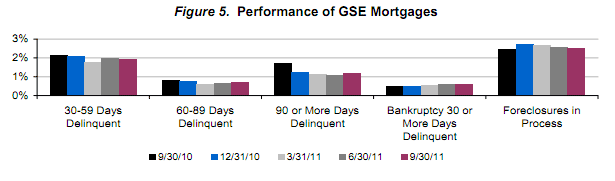

Mortgages belonging to Freddie Mac and Fannie Mae (the GSEs) performed better than the overall portfolio because of the higher percentage of prime loans. The percentage of these loans that were current and performing was 93.1 percent, unchanged from the previous quarter and up from 92.3 percent a year earlier. Of the GSE mortgages, 58 percent were serviced for Fannie Mae and 42 percent for Freddie Mac.

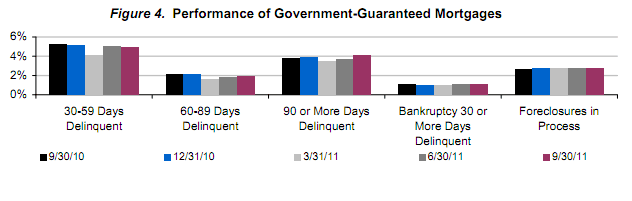

The performance of government guaranteed mortgages declined in the third quarter with current and performing loans dropping to 85.2 percent of the portfolio from 85.7 percent in the second quarter but improving from 85.7 percent in Q3 of 2010. The percentage in the process of foreclosure increased to 2.8 percent from 2.7 percent in the second quarter. Government-guaranteed mortgages represent more than 21 percent of the portfolio compared with 19 percent a year earlier.

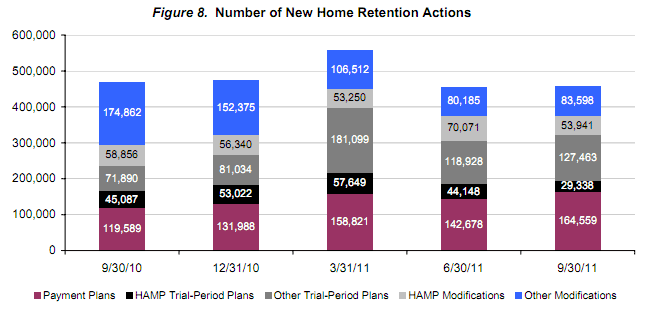

Servicers implemented 458,899 new home retention actions during the quarter, a slight increase from Quarter 2 but down by 2.4 percent from a year earlier. Servicers implemented 137,549 loan modifications, down 8.5 percent from the previous quarter and new HAMP modifications decreased by 23 percent to 53,941. This was partially offset by the 4.3 increase in other modifications. During the past five quarters more than 2.4 million home retention actions have been implemented.

On average, the modifications implemented in the third quarter of 2011 reduced borrowers' monthly principal and interest payments by 24.4 percent, or $382. Modifications made under HAMP reduced payments by 35.1 percent on average, or $567.

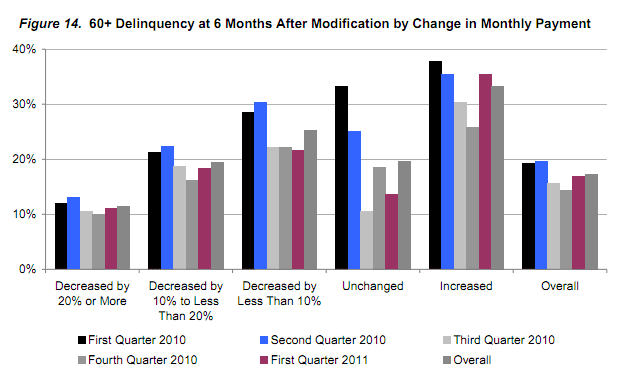

Those modifications that reduced payments by at least 10 percent performed better than those that reduced payments by less. At the end of the third quarter 58.8 percent of modifications made since the beginning of 2008 with a 10+ percent reduction were current and performing compared with 36.4 percent of the modifications made in the same period with a less than 10 percent payment reduction.