You can cut the numbers in several ways, but no matter the way it is reported, American households are in relatively good shape when it comes to mortgage debt. While this isn't a number many homeowners think about after they get up from the closing table, CoreLogic points out that it could be very important in the inevitable next recession.

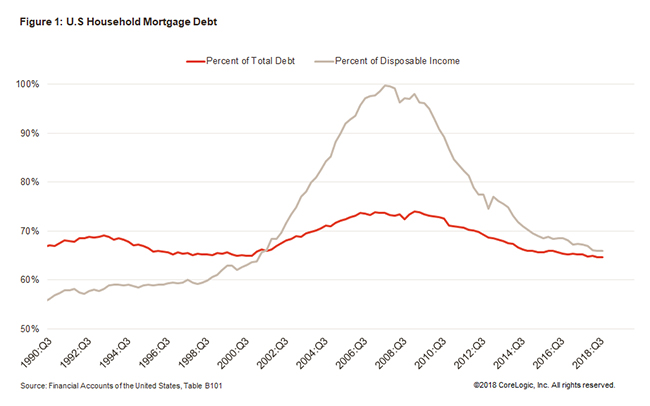

Ralph McLaughlin, writing in CoreLogic's Insights blog, says that mortgage debt fell to 64.6 percent of total household debt in the third quarter of this year, the lowest share since the first quarter of 1988. Looked at another way, mortgage debt as a share of disposable household income it at 65.9 percent, the lowest since the second quarter of 2001.

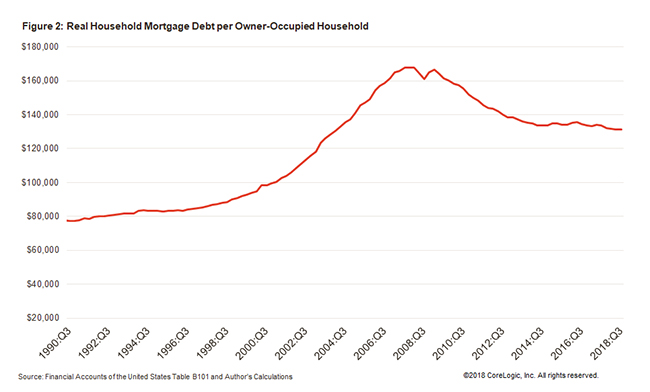

The total mortgage debt grew by a slight 0.1 percent in the third quarter to $10.3 trillion or $131,463 per owner-occupied household. The per-household figure is only slightly higher than in the second quarter which was the lowest since 2004.

Then of course there is the increase in the value of homes. Equity grew by an inflation-adjusted 3.6 percent over the past year and homeowner's real estate assets as a share of their total worth held steady at 20.5 percent.

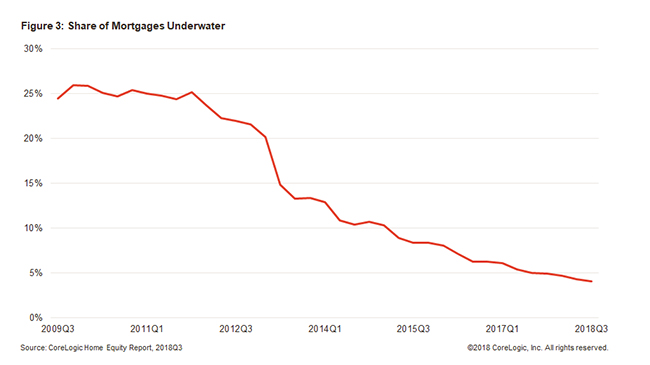

The prolonged recovery and expansion have helped households who were underwater due to the housing crisis and the recession that followed float to the surface. CoreLogic notes that only 4.1 percent of households nationwide are in a negative equity position, down from 5.0 percent last year, and a far cry from the 25.9 percent that were underwater in the first quarter of 2010.

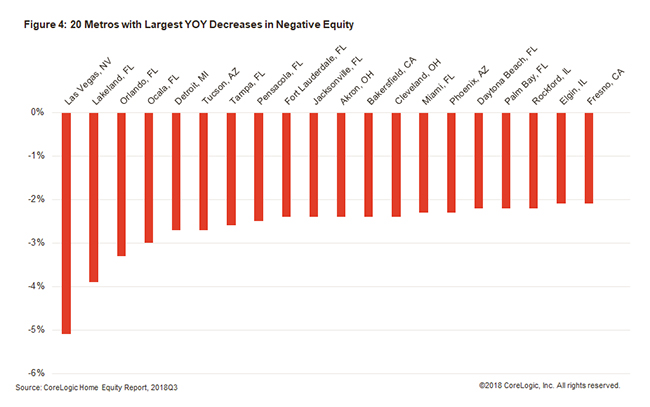

Still, there are areas in the country, primarily large Florida cities, that still have elevated rates of negative equity. But this situation has improved dramatically in some of those places over the last year. Las Vegas which, along with Phoenix, led the nation in foreclosures for several years as housing prices collapsed, has seen the share of households in negative equity drop from 10.3 percent to 5.1 percent over the last year. Three Florida cities, Lakeland, Orlando, and Ocala along with Detroit have seen improvements ranging from 2.7 to 3.9 percent.

McLaughlin says all of this means that households could be in much better shape than they were ten years ago should a recession happen. "Low homeowner equity at the cusp of the Great Recession put many households at risk of foreclosure, so increases in equity puts them in a better position to weather the impact of an economic downturn."

A second benefit could accrue to investors and lenders. Holders of mortgage notes can have a degree of certainty that their portfolios are in better shape now than during the last round. Last, housing markets that were hit hard during the Great Recession are seeing significant increases in homeowner equity, which will help these areas minimize concentrated risk of foreclosures