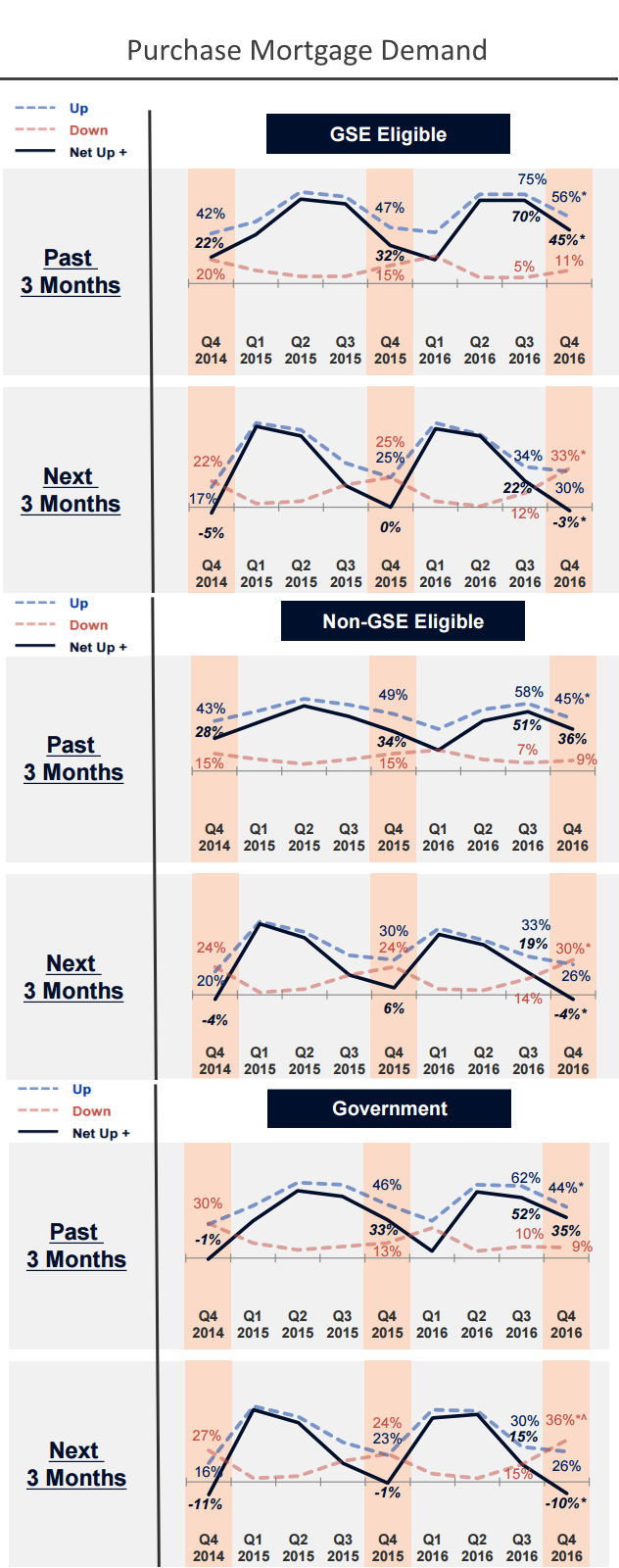

Post-election interest rate changes have considerably dampened mortgage lenders' expectations for mortgage demand. Fannie Mae's fourth quarter Mortgage Lender Sentiment Survey showed the net share of lenders expecting demand to increase over the next three months was at or near survey lows regardless of loan types. The top reason for worsening near-term outlook across all mortgage types was "Mortgage rates are not favorable," cited by two-thirds of lenders for conventional loans and slightly more than half of those for government loans - a survey high.

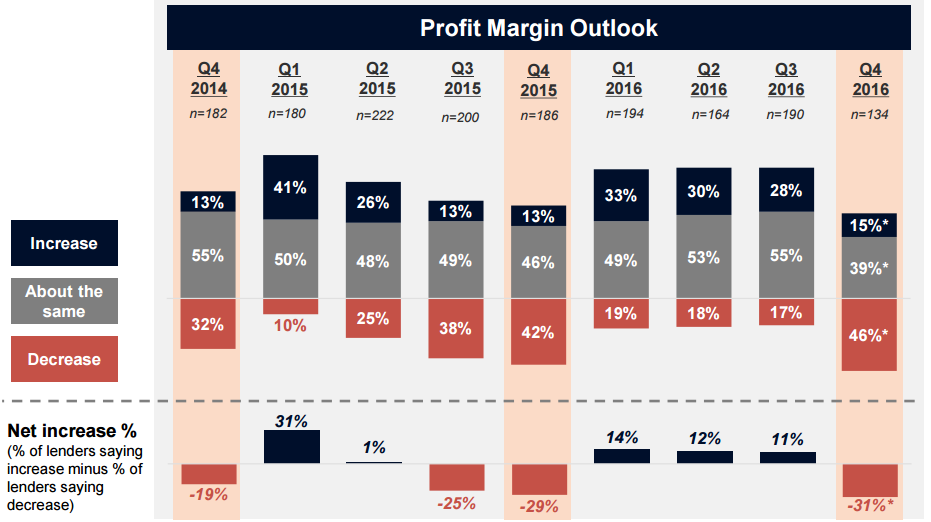

The net share of lenders reporting growth expectations also fell. After three straight quarters of a positive profit margin outlook those expectations also hit a new survey low across all loan types

"The survey captured lenders' bearish sentiment driven by the recent surge in mortgage rates - a level of bearishness last seen in the summer of 2013 during the taper tantrum," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "The sudden surge in mortgage rates weighed on expected future purchase and refinance volume. Downbeat production expectations suppressed lenders' profit margin outlook to the worst showing in the survey's short history. Rates could slowly unwind in coming quarters, reversing some of the expected decline in volume. However, the potential normalization of interest rates after a sustained period of strong refinancing volumes presents the biggest business challenge facing mortgage lenders in some time."

The second reason most often cited for lower demand for government mortgages was the economy (i.e.jobs.) That however was only cited in 26 percent of answers regarding GSE loans and 30 percent for non-GSE loans. Too-high home prices were also named by many lenders for decreasing demand, accounting for about a third of the answers related to GSE eligible and non-eligible lending and 29 percent of government loans.

There were mixed and smaller numbers across loan types blaming either tight inventories or tight credit for diminished demand.

Lenders continued to report modest net easing of credit standards across all loan types for the prior three months, and also to report expectations for modestly easing those standards over the next three months. The majority of lenders expect their credit standards to stay about the same.

The net negative profit margin outlook likely reflects lower mortgage demand expectations. While the responses set a survey low they were not out of line with survey results a year earlier which reflected concerns over TRID implementation.

Lenders expecting a lower profit margin outlook pointed primarily to market trend changes (e.g., shift from refinance to purchase) as the top reason. Government regulatory compliance has historically been one of the top two reasons for lenders' decreased profit margin outlook, but in the recent survey it was down significantly from the surveys in Q3 and from this time last year (Q4 2015), reaching a new survey low. "Changes in market trends" is now the top reason for lenders' decreased profit margin outlook, reaching a new survey high.

Lenders continued to report they expect to grow their GSE and Ginnie Mae shares of business and reduce portfolio retention shares. They also continue to report they expect to slightly decrease the share of MSR sold and retained in-house and slightly increase the share serviced by a sub-servicer.

The Mortgage Lender Sentiment Survey by Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The Fannie Mae fourth quarter 2016 Mortgage Lender Sentiment Survey was conducted between November 10, 2016 and November 20, 2016.