September marked additional improvement in loan performance nationwide. CoreLogic says the national delinquency rate, loans that were 30 or more days past due, including those in foreclosure, was 3.9 percent. This was down from the 4.0 rate the company reported in August and 2.4 percentage points lower than delinquencies in September 2020.

Frank Nothaft, CoreLogic's chief economist said, "The economic recovery has pushed down the percent of delinquent borrowers to the lowest level since the pandemic began. The number of borrowers past due on their mortgage doubled between March and May 2020. The past due rate in September 2021 was the lowest since March 2020."

The rate for early-stage delinquencies - defined as 30 to 59 days past due - was 1.1 percent in September, unchanged from August but 0.4 point lower than a year earlier. The next stage, loans 60 to 89 days past due was 0.3 percent, also unchanged from the rate CoreLogic reported a month earlier, but down from 0.7 percent in September 2020. The serious delinquency rate, defined as 90 days or more past due, including loans in foreclosure, declined from 2.6 percent in August and 4.2 percent the previous September to 2.4 percent during the recent month.

Also, as of September, the foreclosure inventory, the percentage of mortgages in process of foreclosure, was 0.2 percent. Despite that the COVID-19 foreclosure moratorium was lifted at the end of July, this declined from a 0.3 percent rate in September 2020.

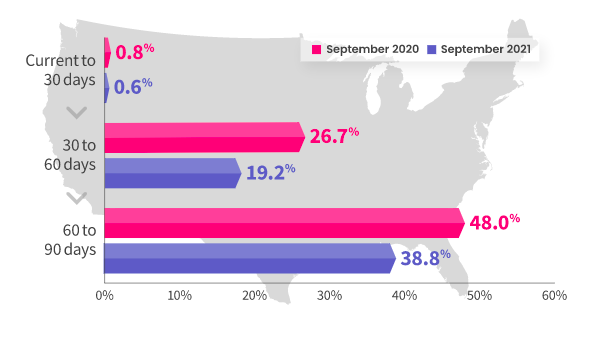

The share of mortgages that transitioned from current to 30-days past due was 0.6 percent, down from 0.8 percent in September 2020. The transition rates for more seriously delinquent homeowners were also down significantly from a year earlier.

As CoreLogic reported earlier this month, home equity has continued to soar in recent months in concert with home prices. The company says that nearly one out of two delinquent borrowers who are behind in their mortgages by six months or more have sufficiently high levels of equity to ensure few will fall into foreclosure as they exit forbearance. Additionally, the November unemployment rate of 4.2 percent, nearly 11 points lower than in the early months of the pandemic, will provide employment and income growth to assist borrowers to remain current on their mortgages.