Consistency can be boring, but in crazy times it can also be reassuring, even comforting. While they differ on the specifics, economists, at least those in the housing industry, seem to be coming together with much the same outlook and many of the same caveats for the next year or so. Fannie Mae's Economic and Strategic Research (ESR) team is among those who see economic growth slowing in a more-or-less natural way, and housing's current woes settling into stability. Unless....

ESR's December Economic Developments forecasts the economy will finish the fourth quarter with 2.6 percent annualized growth, down from 3.5 percent in Q3. Over the entirety of 2018, growth will have been at a 3.1% rate, the fastest of the current expansion, slowing to 2.3 percent next year as the boost from federal fiscal policies wanes, the trade deficit widens, and growth in business investment slows."

The projection for business investment in the 4th quarter has been downgraded, partially in response to softness in core capital goods orders and lower oil prices and residential looks to also drag on the economy given the forecasts for home sales and housing starts. The report notes the same key risks as seen in other forecasts; uncertainty about the country's trade negotiations with China, the direction of oil prices, and stock market volatility.

Consumer spending was the largest contributor to GDP growth in the third quarter and so far, looks to be playing a leading role in the fourth. Consumer confidence dipped slightly in November due to dampening in its forward-looking component, perhaps due to unease about trade tensions and stock market volatility.

Another big contribution to third quarter results came from increases in local, state, and federal spending, with the federal portion due largely to the Budget Reconciliation Act. Those positive effects on GDP growth will probably peak this quarter then wane over the next 18 months before subtracting from growth in the second half of 2020.

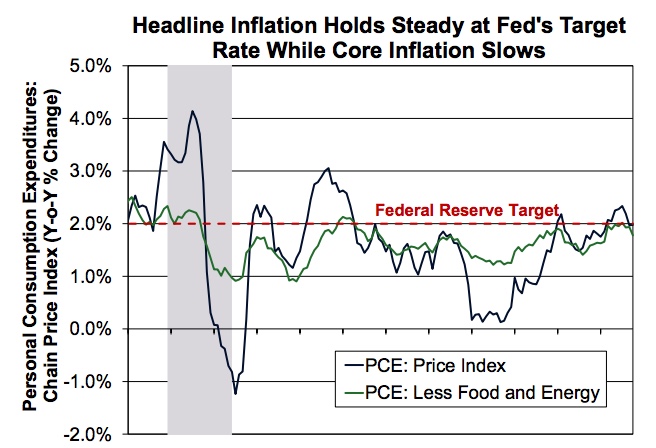

Annual growth in the PCE index, the Fed's preferred measure of inflation, was unchanged at the 2.0 percent target for the second consecutive month in October while core PCE inflation decelerated to 1.8 percent. Recent developments; lower oil prices and a stronger dollar, should put downward pressure on inflation.

The recent inversion between the 2-year and 5-year Treasury yield curves, stock market volatility, and weakness across the housing industry have sparked speculation that the Fed may pause its rate increases in 2019. Fed Chairman Powell recently noted that "Interest rates are still low by historical standards and remain just below the broad range of estimates of the level that would be neutral for the economy." This seems a departure from an earlier comment that interest rates were "a long way from neutral." He also acknowledged that the "economic effects of our gradual rate increases are uncertain and may take a year or more to be fully realized." These statements suggest that the FOMC is likely to grow increasingly data-dependent during its deliberations.

The outlook for housing is a moderate one. With the caveat that inflation remains in control, the ESR team expects both mortgage rates and home sales to stabilize. The increase in inventories should help moderate home price appreciation and a slowdown is already showing up in some indices. For example, the Federal Housing Finance Agency's Purchase-Only Index was an annualized 6.0 percent in September, the slowest since January 2017. Consumers are expecting less as well; the net share of respondents to Fannie Mae's November National Housing Survey expecting further price increases dropped to the lowest reading since October 2016.

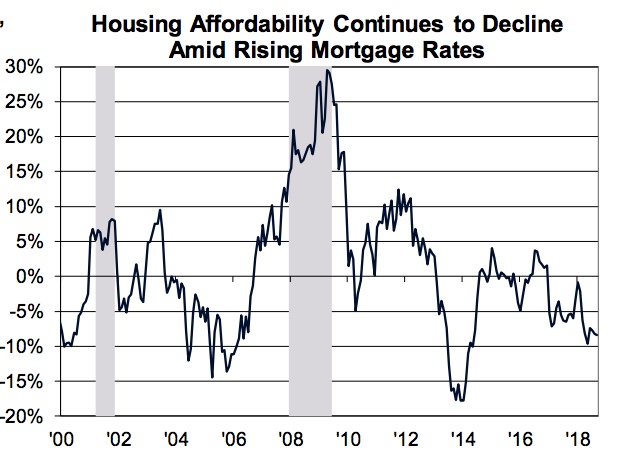

Existing home sales were slightly higher in October, but new home sales fell sharply. Pending home sales, which represent contract signings of existing homes and precede closings of existing homes by a month or two, fell by 2.6 percent in October. Year-to-date sales are down overall because of the increase in mortgage rate which soared by 92 basis points in October compared to a year earlier. Those rates then stabilized in November, rising only 4 basis points over the month, to 4.87 percent and have declined this month. The December 13 Freddie Mac report put the 30-year fixed-rate at 4.63 percent. In September, before this volatility began, the National Association of Realtors Affordability Index was down 8.4 percent compared to a year earlier.

Applications for home purchases fell in October as rates rose, but recovered in November, rising by 2.5 percent, as rates flattened. Fannie Mae projects that purchase mortgage originations will increase by more than 2 percent next year, but refinancing will drop by nearly 11 percent. The result will be a small decline in total originations to $1.605 trillion.

While housing demand has moderated, for-sale inventories have risen, especially for newly constructed homes. The existing home inventory grew 2.8 percent year-over-year in October compared to 18.0 percent for new homes. Translated into months supply existing homes went from 3.9 months in October 2017 to 4.3 months and new homes from 5.9 to 8.1 months. A six-month supply is considered the long-term average.

Residential construction continues to be weak; single-family starts fell 1.8 percent in October and are 1.5 percent lower than a year ago and permits were also down. As builders look at the growing inventory, they may not be inclined to pick up the pace. The National Association of Home Builders/Wells Fargo Housing Market Index (HMI), a measure of builder confidence, dipped 8 points in November to a reading of 60, the lowest since August 2016.

To round up the ESR team's latest projections:

- Residential fixed investment will fall in the fourth quarter, the fourth consecutive quarterly decrease.

- Home sales will be little changed next year, but single-family construction will grow.

- Home prices will rise 5.4 percent this year and 4.1 percent in 2019.

- Mortgage rates will stabilize in 2019, allowing potential homebuyers time to adjust to the higher rate levels and should, in combination with a slower pace of house price growth, support affordability.

- The labor market should remain solid as job growth is expected to keep the unemployment rate near historically low levels which is positive for income growth.

- The purchase mortgage originations forecast has been lowered by $4 billion this year and $11 billion next due to weaker-than-expected incoming data for average home sale prices and the downward revision of existing home sales and single-family housing start forecasts.

- Expectations continue that this year's purchase originations will be lower than last, ($1.17 trillion vs $1.18 trillion), with a recovery into 2019 and 2020 ($1.19 trillion and $1.25 trillion, respectively). Refinance originations forecasts for 2018, 2019, and 2020 have been revised slightly higher based on incoming data and lower assumptions about interest rates, but it will still decline over the forecast horizon, dropping from $461 billion in 2018 to $413 billion in 2019 and $404 billion in 2020.

- Despite the slowdown in job creation in November, labor market and broader economic conditions remain solid and the pace of inflation is at or near the Fed's target. The team still expects the Fed to raise rates at its meeting next week and twice more next year.