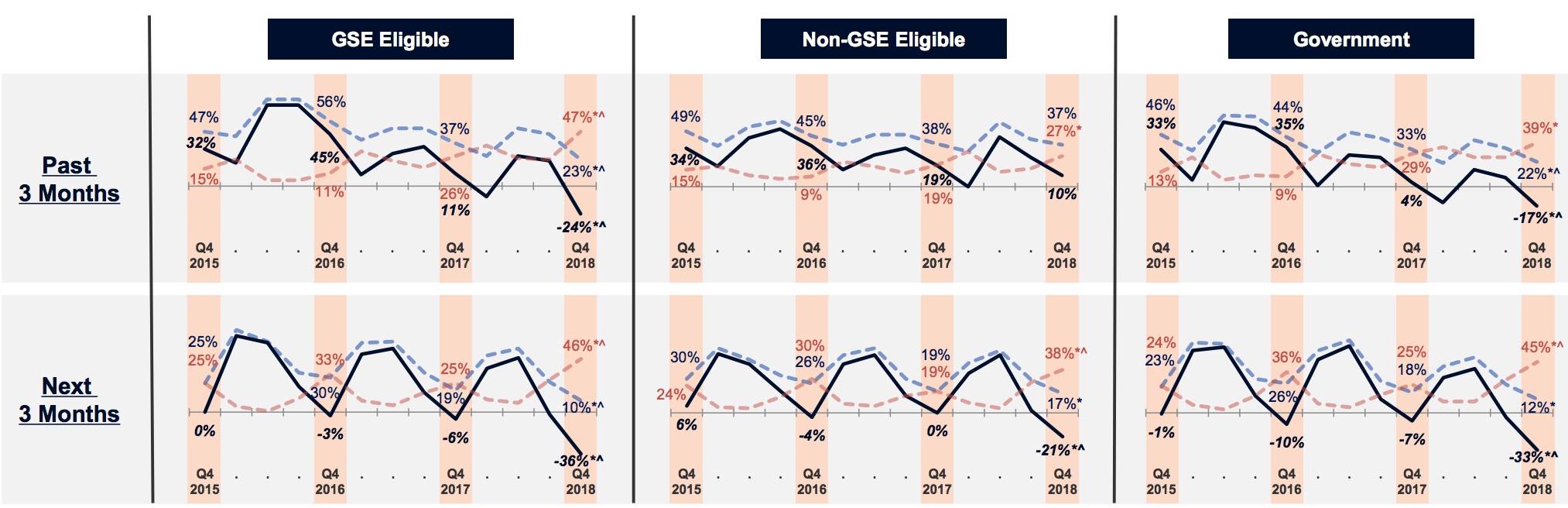

Lenders continue to be pessimistic about their profit outlook as 2018 draws to an end. Fannie Mae said its fourth quarter 2018 Mortgage Lender Sentiment Survey found the profit outlook reported by respondents at an all-time survey low. This was true whether they were talking about purchase or refinance mortgages or about GSE-eligible, non-GSE-eligible, or government loans. It was the ninth consecutive quarter that lender outlook has declined.

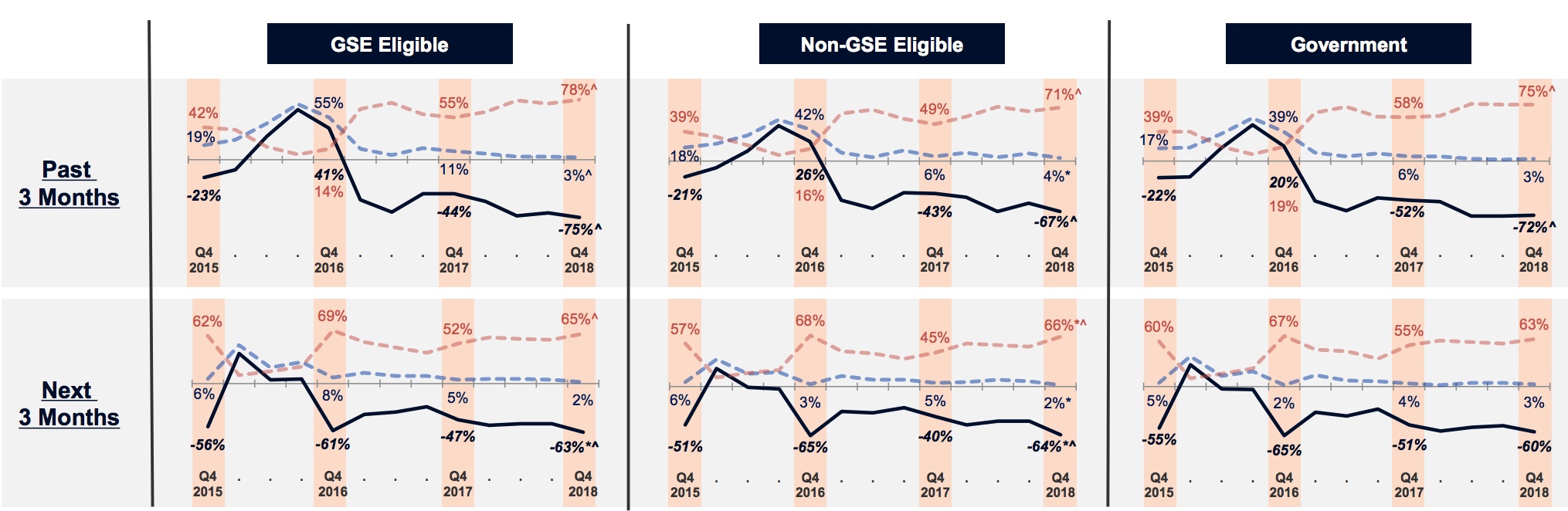

Smaller slices of a shrinking pie sums up the reasons given by lenders for their lowering outlook, especially for refinancing. When asked whether refinancing demand had increased over the past three months for any loan type, or if they expected it would over the next three months, positive answers did not break 5 percent.

Responses to the same questions about purchase mortgage demand were a little more positive, but across all loan types the net share of lenders reporting demand growth over the prior three months reached the lowest reading for any fourth quarter since the survey's inception in 2014. Responses about growth expectations for the next three months reached was the lowest for all loan types in the entire survey history.

"Stressful conditions continue to hang over the mortgage industry," Doug Duncan, senior vice president and chief economist at Fannie Mae said. "Lenders are reporting the lowest purchase mortgage demand expectations across all loans types and the worst refinance demand expectations for GSE-eligible loans in the survey's five-year history. Rising mortgage rates and lean inventory amid solid home price appreciation have discouraged both first-time and trade-up homebuyers. However, mortgage rates have shown signs of stabilization, and annual home price gains have slowed from the red-hot pace seen earlier this year. While 2018 is likely to end up a disappointing year for the housing and mortgage industries, continued strength in demographics and the labor market offers hope that conditions should stabilize and may even improve next year."

While only a sliver (11 percent) of respondents thought their profit margins would increase over the next quarter, those who did overwhelmingly (65 percent) said it would be because of improved use of technology. Trailing far behind was savings through staff reductions and increased demand, better pricing from non-GSE investors, and less competition were each mentioned by about one-fifth of lenders.

Of the 49 percent of lenders who said they expected profits to fall, competition from other lenders was the top reason cited for the eighth consecutive quarter, mentioned by 74 percent of respondents. Thirty-eight percent named falling demand while staffing costs, the shift from refinancing to purchase mortgages, and GSE policies and pricing all were cited as contributing to the negative outlook.

The Mortgage Lender Sentiment Survey by Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. Over 200 lending institutions participated in the fourth quarter survey, 76 mortgage banks, 88 depository institutions, and 38 credit unions. The survey was conducted between October 31, 2018 and November 12, 2018 by PSB in coordination with Fannie Mae.