Access to jumbo mortgage credit continued to increase in November, but the Mortgage Bankers Association (MBA) says it is still down significantly from pre-pandemic levels. Overall access fell during the month according to MBA's Mortgage Credit Availability Index (MCAI) which dipped by 0.6 percent. The decrease, however, was due solely to a constriction on the government loan side.

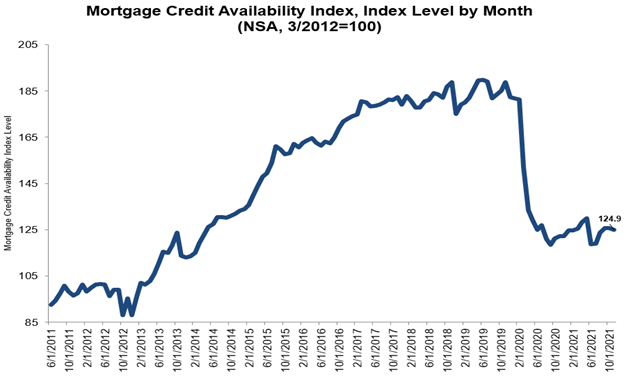

The MCAI was at 124.9 in November. In February 2020, as the pandemic was taking hold, it had a reading of 181.3. A decline in the index is indicative of tightening credit.

The index has four components. The Conventional MCAI increased 1.9 percent last month, while the Government MCAI decreased by 2.7 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 3.0 percent, and the Conforming MCAI rose by 0.2 percent.

Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting commented, "Credit availability in November was down slightly, even as the housing market continues to thrive amidst the improving job market. However, the picture was different depending on the market segment. An increase in conventional credit availability was offset by a decrease in government credit, as lenders reduced their offerings of government loan programs with lower credit scores, as well as those for investment homes.

"Credit supply for jumbo loans increased for the fifth straight month. Lenders scaled back on jumbo supply at the onset of the pandemic, and even with the recent growth in credit availability, the jumbo index remains more than 40 percent below February 2020 levels. As home-price growth continues, and mortgage rates creep higher, increased credit availability is needed for qualified borrowers looking to purchase a home - especially for first-time homebuyers, who rely heavily on government mortage programs," Kan said.

The MCAI and each of its components are calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via a proprietary product from Ellie Mae. The resulting calculations are summary measures which indicate the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.