Homeowner equity rose again in the third quarter of 2020, reaching the highest total in over six years. CoreLogic's quarterly report on that asset says that those homeowners with mortgages, about 63 percent of the total, saw their equity grow by 10.8 percent since the third quarter of 2019. This equates to an increase in homeowner wealth of about $17,000 per household, the largest since the first quarter of 2014, and an aggregate national gain of about $1 trillion. At the same time, the number of mortgages that were in negative equity fell by 18.3 percent on an annual basis.

The equity growth was due to a surge in home prices during the summer and fall, as homebuyers emerged from the pandemic lockdown and competed for a low supply of homes on the market. CoreLogic says these equity gains are likely to persist over the next several months as home purchase demand is expected to remain high, pushing prices up. However, the company expects appreciation to slow over the next 12 months as new home construction and more existing for-sale homes ease supply pressures.

The largest gains were in Washington, where homeowners gained an average of $35,800; California, an average of $33,800 and in Massachusetts, where gains averaged $31,200. Meanwhile, North Dakota, which was hit hard by the pandemic, experienced the lowest annual gain ($5,400) in the third quarter of 2020.

"Over the past year, strong home price growth has created a record level of home equity for homeowners," said Dr. Frank Nothaft, chief economist for CoreLogic. "The average family with a home mortgage loan had $194,000 in home equity in the third quarter. This provides an important buffer to protect families if they experience financial difficulties and is one reason for the generational-low foreclosure rates (0.3 percent) reported in September.

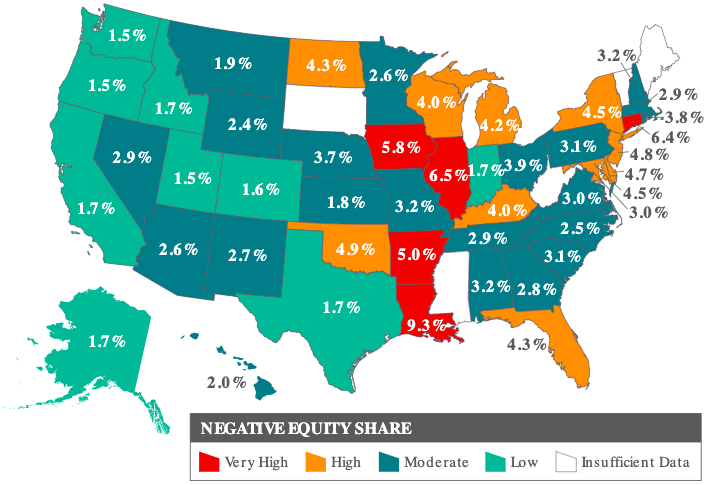

From Q2 to Q3, the negative equity share, the term applied to properties where the unpaid mortgage balance exceeds the property value, decreased by 6.9 percent. An estimated 1.6 million homes or 3 percent of all mortgaged properties are underwater, i.e. in negative equity. This is an 18.3 percent change since the third quarter of 2019 when there were 2 million underwater homes, 3.7 percent of all mortgaged properties.

The national aggregate value of negative equity was approximately $283.3 billion at the end of the third quarter of 2020. This is down by approximately $2.2 billion, or 0.8 percent, from $285.5 billion in the second quarter of 2020 and a year-over-year change of approximately -$21.4 billion, or 7 percent.

Because home equity is affected by home price changes, borrowers with equity positions near (+/-5 percent) the negative equity cutoff are most likely to move out of or into negative equity as prices change. Looking at the third quarter of 2020 book of mortgages, if home prices increase by 5 percent, 247,000 homes would regain equity; if home prices decline by the same amount, 337,000 would fall underwater.

"The housing market has remained a strong pillar in an otherwise tumultuous economic year," said Frank Martell, president and CEO of CoreLogic. "A sharp rise in demand, spurred by record-low interest rates, continues to bolster homeowner equity. And with many people now spending more time than ever before at home, some homeowners have tapped into their strengthening equity to fund renovations."