The Census Bureau regularly issues a vacant properties report which is generally covered by MND, and less extensive data on vacancies is kept by other government agencies - even the U.S. Post Office. However there is no solid agreement about what constitutes a vacant property nor is there any way to assess what may be a more or less benign vacancy such as a rental property merely languishing between tenants or a seldom-used seasonal property and one that can become a neighborhood blight, attract crime, and pose a threat to public safety.

While homeowners or mortgage owners--including the mortgage servicers that administer loans on behalf of loan owners--are responsible for maintaining vacant properties where mortgages are undergoing foreclosure, the costs local governments incur to mitigate any unsafe conditions can be significant.

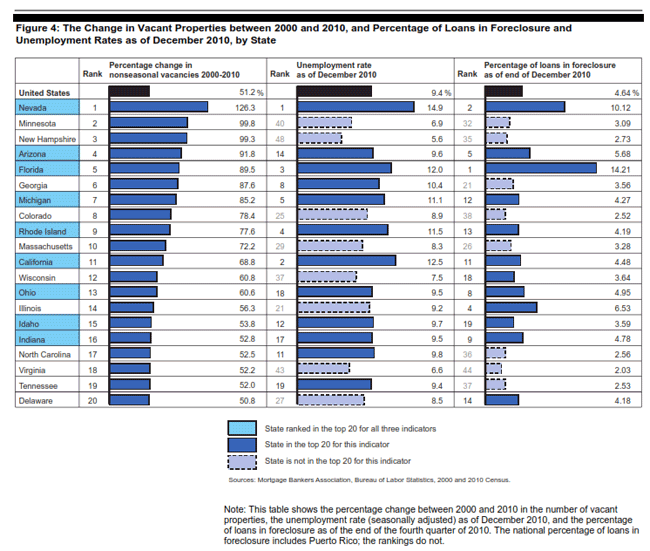

According to the Census Bureau, non-seasonal vacant properties have increased 51 percent nationally from about 7 million in 2000 to 10 million in April 2010. Ten states saw increased vacancies of 70 percent or more. With the incidence of vacant residential properties rising, the Government Accountability Office (GAO) was asked to conduct a study to determine the relationship between trends in vacancies and the recent increase in foreclosure. Using data from the Federal Housing Administration (FHA), the two government sponsored enterprises (GSEs) and the Census Bureau, GAO looked at the costs accruing to vacant properties, who is responsible for those costs, various state and local government strategies to deal with the problem and how the federal government might assist in their efforts.

GAO found a number of causes for the increased vacancies. Some cities had big population shifts even before 2000 as manufacturing and other jobs disappeared. These cities have been joined by many others as unemployment has risen nationally; people have moved to other locations in search of jobs, moved in with friends or relatives to save money or lost their homes to foreclosure. The correlation among vacancies, unemployment, and foreclosure can be seen in the following table.

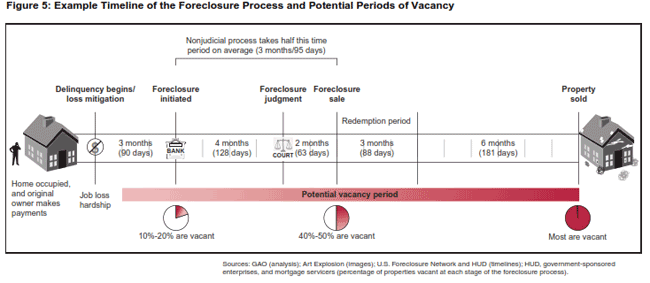

GAO found that the longer a foreclosure

takes to complete, the greater the impact on the vacancy rate. Homeowners may misunderstand their rights

under a foreclosure and move out long before they are legally required to do so

or just become disheartened by the process.

A Federal Reserve study found that homeowners tend to leave their homes

earlier in the process in non-judicial foreclosure states than in judicial

states.

Foreclosed homes tend to remain vacant for long periods after a foreclosure sale as well. One study found that homes foreclosed by HUD in 2010 remained in REO for 181 days before being sold. Another found a house sold through a foreclosure sale in Cuyahoga County, Ohio was more likely to be vacant 60 months later than a home sold via an ordinary transaction.

Another factor leading to vacancies is the lower demand for housing in general. Persons who would typically be in the market for housing may be unemployed or otherwise unable to afford it or unable to obtain the necessary credit. In some parts of the country households are forming at historically low rates.

Regardless of how or why a property becomes vacant, it needs to be maintained. Communities have a code of standards for property to ensure health and safety and communities generally enforce the code with fines and can, if necessary, secure a building, remove hazards, even demolish the structure and bill the owner. But an owner who has abandoned his home is probably unwilling or unable to pay for further maintenance even if located and, while mortgage documents give the lender the right to enter, maintain, and secure the property, they do not confer an obligation to do so.

FHA and the GSEs have standards for their services regarding inspection and maintenance of vacant properties and servicers for privately owned loans are supposedly guided by the pool and servicing agreements for those loans.

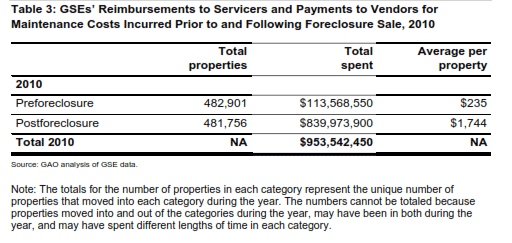

Servicers incur various costs to maintain properties in lieu of homeowners doing so and the owner or insurer of the loans typically reimburses servicers for those expenses. The tables below show the property maintenance costs for which the GSEs reimbursed servicers in 2010 and the purposes for which those funds were expended. FHA requires a higher standard of attention and its per property expense prior to conveyance to FHA in 2010 was $1,982. After conveyance FHA turns responsibility for property maintenance over to private contractors to whom they paid a total of $38 million or $234 per property in 2010.

When the legally responsible parties do not maintain their properties sufficiently to comply with local codes or public safety standards local governments spend millions in direct costs to mitigate the resulting problems. GAO cited a recent Chicago study that found that 69 percent of over 18,000 vacant properties in the city were associated with a foreclosure filed in the preceding four years. For many properties the responsibility was unclear and the city likely had to incur the cost of any work.

Among the issues local communities have to contend with are:

Exterior Maintenance. Reducing the negative or hazardous impact of vacant properties by boarding up and securing them can cost between $233 and $1,400. Chicago officials estimated that it cost them $785,000 to board up 627 properties in 2010. Detroit estimated they had spent $1.4 million boarding up 6,000 properties in the last year.

Demolition of vacant buildings is another significant expense. Demolishing a detached single-family home costs $4,800 to $7,000 per property but the presence of lead paint or asbestos can drive the cost much higher. Detroit has spent about $20 million in demolitions since May 2009, $5,000 per property. In Baltimore where many homes are row houses with common walls, the costs to raze a single row house could be $13,000 to $40,000.

Administrative and Judicial Costs. Local governments also bear the costs of identifying responsible parties against whom to levee code violation fines or liens and cities such as Chicago that have housing courts spend additional resources on enforcing laws governing vacant properties through the courts. Cleveland is said to spend $3 million a year on housing court costs for vacant properties.

Vacant properties have other costs which are difficult to quantify but burden the community. There are increased public safety costs related to code-enforcement, police, and fire services. One code-enforcement officer in Las Vegas told GAO that they have four to five calls per month on vacant property issues. Some academic studies also have found relationships between vacant or foreclosed properties and crime. Vandalism can occur quickly, homes are stripped of copper pipes, wiring, AC units and appliances. Squatters in properties without heat or electricity cause fires with alternative energy sources or candles. Even buildings being maintained by servicers can develop problems between inspections.

Vacant properties also reduce the value of houses around them. One federal study estimated a foreclosed home can depress the prices of nearby homes from 0.9 to 8.7 percent. Another study in Chicago found that a single foreclosed and demolished property may have reduced the value of 13 nearby homes by $17,000 each.

Declining property values and unpaid taxes on vacant properties lead to reduced revenues for local governments. Local property tax revenues declined nationally by 2 percent in 2010 compared to 2009 and likely will decline further in the next few years as assessments are adjusted to reflect falling property values. Further, these declining values means that local governments will collect less money on properties they seize and sell for unpaid taxes.

Local governments throughout the country are developing strategies to manage the problems associated with vacant buildings. GAO identified some common themes.

In Depth Data Gathering. This includes compiling and analyzing data from existing sources such as city departments, courts, and registries to determine where vacant or potentially vacant properties are located; leveraging resources from local universities and research organizations to acquire social, demographic and property data, and collecting new data.

Property Acquisition and Development Strategies. Eight of the nine cities GAO studied were engaged in actively acquiring vacant properties, often with federal funds. Typically these are acquired at foreclosure then turned over to a community organization for rehabilitation and use or resale. These efforts can stabilize a neighborhood better than home purchases by investors who may flip and run without doing all of the repairs necessary. They also allow the local government to target its efforts, perhaps investing in an area that has strengths to bolster the property.

While many view acquisition and rehabilitation as a strong strategy to combat the problems of vacant properties, there are problems such as lack of the capacity to complete sales quickly or complete enough of them, poor property conditions, and the large volume of foreclosures each of which can complicate efforts at the local level.

Some communities are unable to sell properties in the current market and have instead established land banks to hold properties for extended periods and then reuse them in non-housing contexts. Cuyahoga County for example has an agreement with Fannie Mae where its land bank receives all of the GSEs low-value properties for $1 and Fannie Mae contributes about $3,500 per property toward demolition costs.

Laws, Local Ordinances and Dedicated Housing Courts are Utilized d to Increase Accountability for Vacant Properties. With the increase of vacant properties in many communities, local governments are passing stronger maintenance requirements and property registration ordinances to increase their leverage over servicers and using local resources to enforce them.

GAO found that many local governments were overburdened by the vacant homes in their jurisdiction and most wanted the federal government to help with the costs they were incurring but also to increase oversight of loan servicers to ensure that they comply with local property maintenance codes.