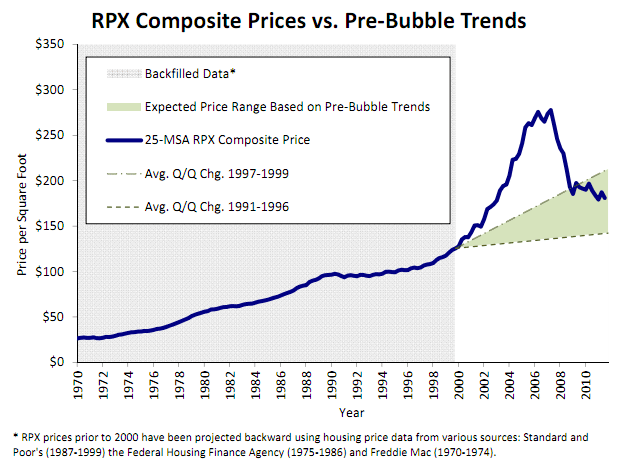

Radar Logic has headlined its September RPX 25-MSA Composite with the disquieting headline "We May be Witnessing the End of the Beginning of the Housing Crisis." The report says that the RPX Index along with a few other housing indicators released over the past week (S&P/Case-Shiller and the Federal Housing Finance Agencies Home Price Index) all show more or less the same thing; the long term trend in house prices remains negative. The company says it expects the year over year trend to remain negative but the rate of decline will slow until prices finally touch rock bottom.

Radar Logic quotes housing prices in the 25-MSA Composite on a per square foot basis (PSFT). The national composite in September was $180.76 PSFT, down 4.4 percent since September 2010 and down 1.7 percent from August. The year-over-year index has consistently declined by more than four percent on a year-over-year basis since last February.

In the 25 MSA the index ranged from a high of $323 PSFT in San Jose, California to a low of 64.33 in Detroit. Only two MSA's saw an increase in the index over the last year - Detroit was up 7.1 percent and Washington DC increased 1.8 percent.

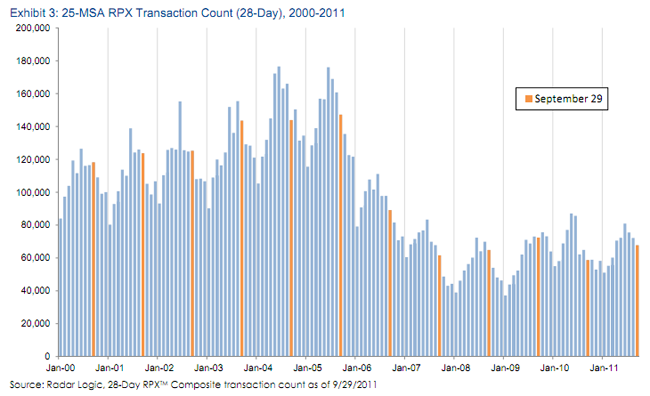

Home prices have been battered because of a persistent imbalance of supply and demand in the housing market but, even as it remains severe, Radar Logic said there are signs that the two factors are beginning to equalize. Demand, as measured by the 25-MSA transaction count from January to September 2011 was greater than the change measured during the same period in 2010 and the year-over-year gain through September - 15.4 percent - was the largest seen for this time period since 2003. Transaction counts increased in all but one of the 25 MSA's, Jacksonville, Florida which declined a mere 0.8 percent. Increases in transactions in 18 of the MSAs were in double digits and were over 60 percent in both Minneapolis and Boston.

While demand is increasing, inventories of available homes for sale as reported by the National Association of Realtors® are decreasing slowly - its October figure of 3.33 million units was 3.6 percent below the previous month and 13.8 percent lower than the number a year earlier.

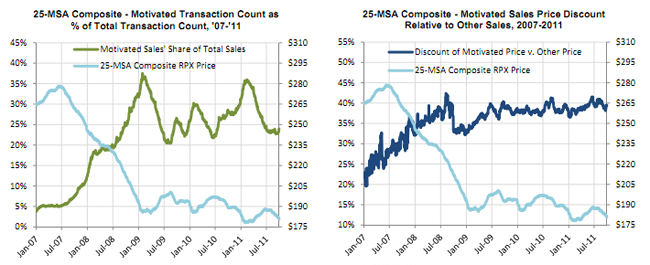

Supplies of distressed homes - REO and potential short sales - are still in enormous supply but are also decreasing as are several measures of mortgage delinquency. What Radar Logic calls "motivated sales" represent 25 percent of transactions, down from 40 percent at the beginning of 2011. The average price of a motivated sale is around 40 percent less than the RPX Composite number.

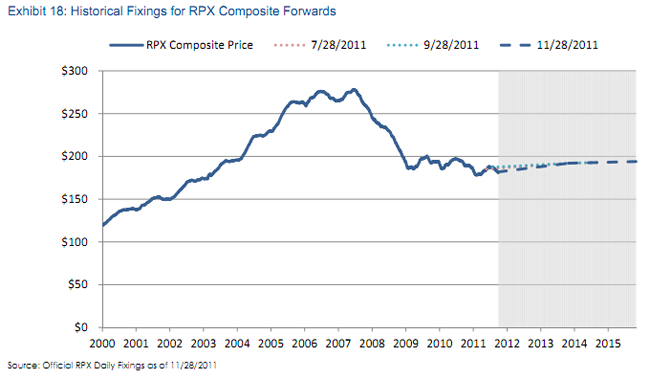

Looking forward, Radar Logic has computed forward price fixings based on the September $180.76 PSFT. Appreciation by the end of 2011 is expected to be 2.3 percent. At the end of each subsequent year the appreciation is projected as follows: 2012, 2.9 percent; 2013, 3.4 percent; 2014, 3.9 percent and 2015, 4.5 percent.