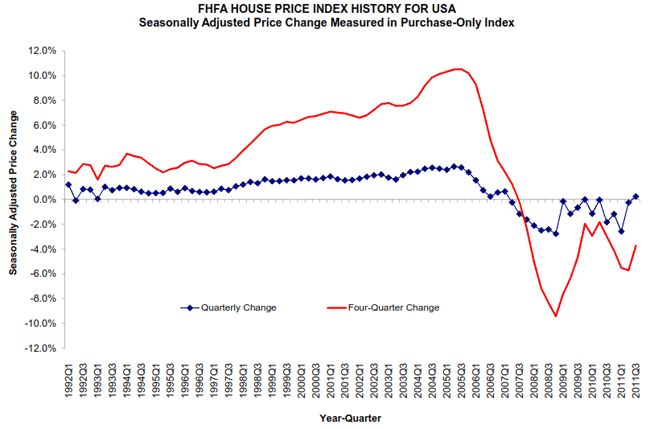

The Federal Housing Finance Agency's seasonally adjusted purchase only price index (HPI) shows that U.S. house prices rose slightly in the third quarter of 2011. The HPI is calculated from data on home sales obtained from Freddie Mac and Fannie Mae acquired purchase money mortgages where previous mortgages were also held by one of the government sponsored enterprise (GSE). In addition to its usual analysis of home price data, the report looks at the effects of supplementary information added to the analysis last quarter and at the impact of the increase in the prices of and demand for certain commodities in recent years.

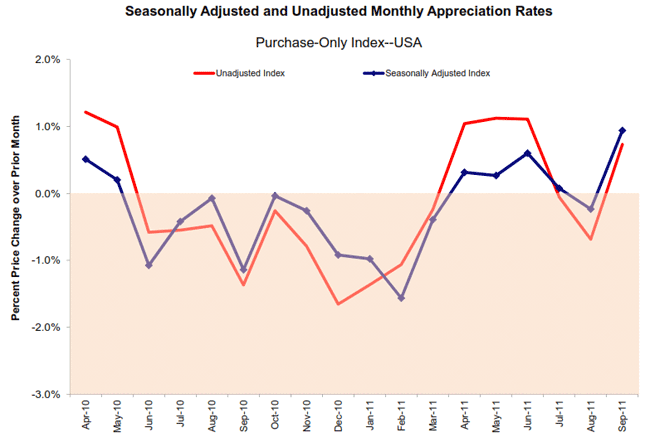

Home prices rose 0.2 percent on a seasonally adjusted basis from prices in the second quarter. On an unadjusted basis prices were up 0.7 percent. Prices in the third quarter were 3.7 percent lower than in the third quarter of 2011. The index which tracks monthly prices showed an increase of 0.9 percent on a seasonally adjusted basis from August to September and 0.7 percent on an unadjusted basis.

Month-to-month, prices rose to varying degrees in eight of the nine census divisions. Only the East South Central division lost ground during September, a slight 0.2 percent decline. Increases in most of the census divisions were under 1 percent but the East North Central division had a 1.5 percent increase and the West North Central division a 2.5 percent jump. The quarterly index declined in 21 states and the District of Columbia.

FHFA Principal Economist Andrew Leventis said, "In most regions of the country, third-quarter home values were relatively stable, even in some areas that experienced sharp price declines in preceding quarters. While most housing markets still face stiff headwinds, the fact that some beleaguered states - such as Idaho, Florida, and Utah - saw quarterly price increases is a positive development."

The -3.7 percent price change in the national purchase-only index since the third quarter of 2010, when combined with the 4.8 percent increase in the price of other goods and services over that period, results in an inflation-adjusted price of homes that is down approximately 8.1 percent over the last year.

FHFA also produces an all-transactions index which combines purchase data with data from GSE acquired mortgages used for refinancing. This index was up 0.9 percent quarter-over-quarter but down 4.3 percent on an annual basis.

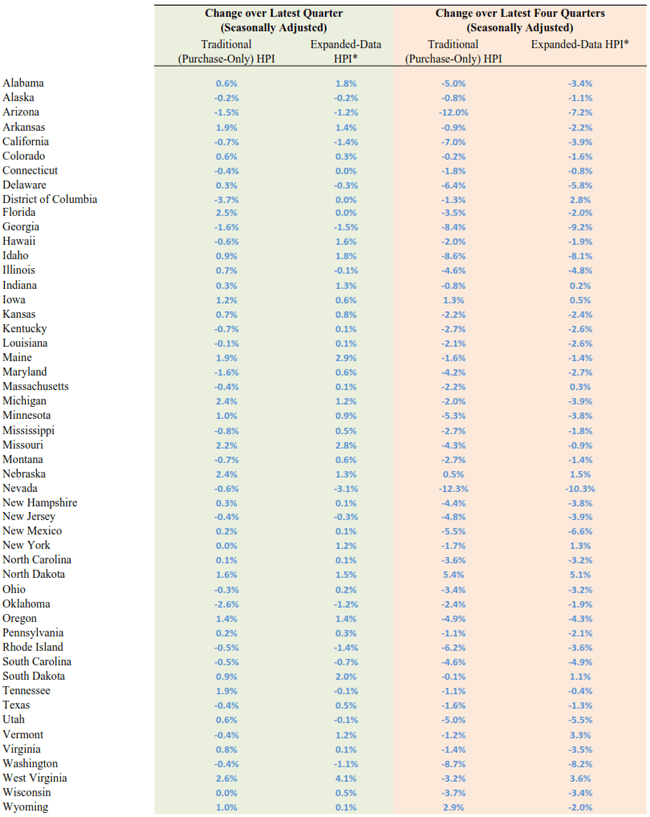

Beginning in the second quarter of 2011, FHFA published an "expanded data" HPI which supplements GSE mortgage data with information from FHA endorsed loans and with county recorder information. To the extent that differences exist, it is hoped that the expanded data will better reflect price trends for houses not financed by the GSEs.

As the table shows, both the original and the expanded index posted a 0.2 percent change between the second and third quarters of 2011. However, over the last four quarters, the two measures diverge somewhat; the expanded index measure evidences a slightly less severe decline of 2.9 percent instead of the 3.7 percent drop in the purchase only index.

The differences for individual states is more pronounced but tends to be less dramatic over the four-quarter time period which may indicate that some of the difference between the two indexes is the result of statistical noise from sampling variation.

The report notes that the housing bust of the last five years coincided with a boom in commodities prices, especially oil and petroleum products but also coal, precious metals, copper, and agricultural products. While this boom has negatively affected much of the country, some areas have benefitted from the price increases and, in areas that are net producers of these goods, the commodity price increases have worked to offset the effects of the housing bust. In fact, in some such states the increases in employment and income have driven up housing prices.

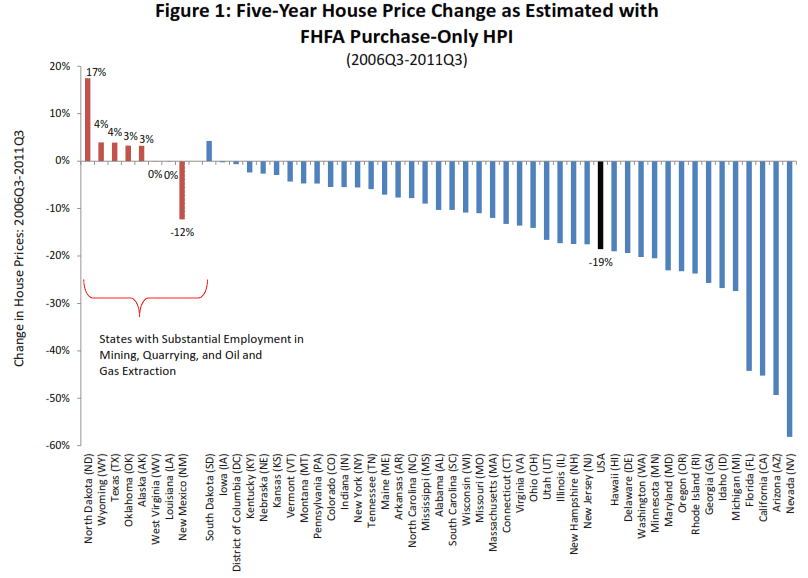

FHFA did a special analysis of the rise in commodity prices by identifying states where more than 2 percent of the population is employed in "mining, quarrying, and oil and gas extraction (the MQOGE Sector). Eight states, Alaska, Wyoming, North Dakota, West Virginia, New Mexico, Oklahoma, Louisiana, and Texas were identified as MQOGE sector states.

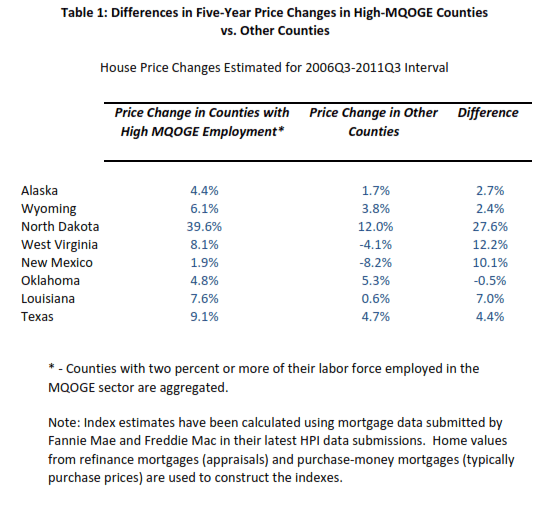

The table

above compared five-year house price changes for the eight high MQOGE states

against price changes in the other states using FHFA's purchase-only house

price index. The average five year

decline for the nation as a whole was 19 percent while the price changes for

high MQOGE states ranged from -12 in New Mexico, the only state with a negative

change, and +17 percent in North Dakota.

While this is interesting it is

not definitive as rural states in general have fared better during the housing

bust and the eight high-MQOGE states are relatively rural so the observed

phenomenon might be a function of their rural nature. However, when these

states are examined on the county level, the difference between housing price

changes in counties with high MQOGE employment and those without, the positive impact

of the employment becomes more apparent.