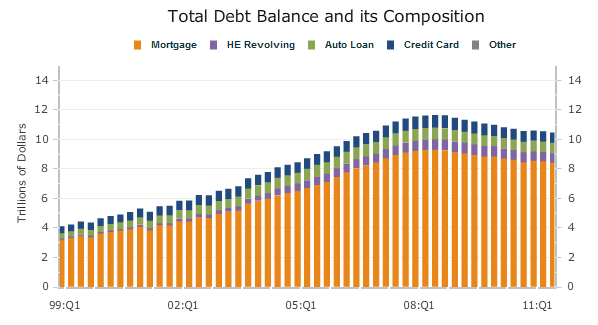

Overall consumer debt continued to fall in the third quarter of 2011, decreasing to 11.6 trillion from revised second quarter levels of $11.72 trillion, a decline of 0.6 percent. While the Federal Reserve Bank of New York's latest Quarterly Report on Household Debt and Credit shows that debt has steadily declined from the peak of over $12 trillion reached in the third quarter of 2008, the current figures are skewed by the recent incorporation of a number of categories of student loan debt not historically a part of the computation. Over the last two quarters this has added about 7 percent to debt totals.

"The decline in outstanding consumer debt reveals that households continue to try and deleverage in the wake of a challenging economic environment and large declines in home values," said Andrew Haughwout, vice president in the Research and Statistics Group at the New York Fed. "However, our findings also provide evidence that consumer credit demand continues to increase, a positive sign for consumer sentiment."

Mortgages balances fell by 1.3 percent during the third quarter, a decline of $114 billion but home equity loans increased by $14 billion or 2.3 percent. Mortgages represent about 72 percent of outstanding debt in the U.S. The balance, non-real estate indebtedness now stands at $2.62 trillion, about 1.3 percent above its Q2 level.

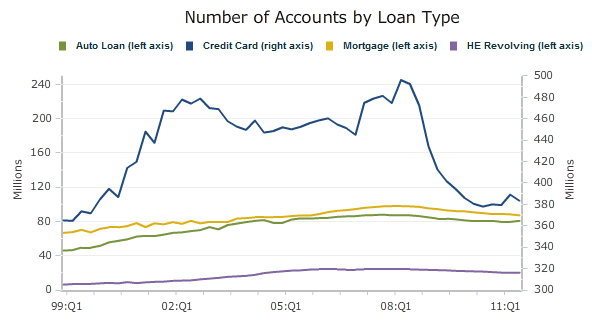

The total number of outstanding credit cards declined by 6 million to 383 million in the third quarter and aggregate card limits were down $25 billion. The number of open credit card accounts and their balances has plummeted since 2008; open card balances are now 20 percent below the 2008 peak. However, account inquiries rose for the second straight quarter, an indicator of credit demand.

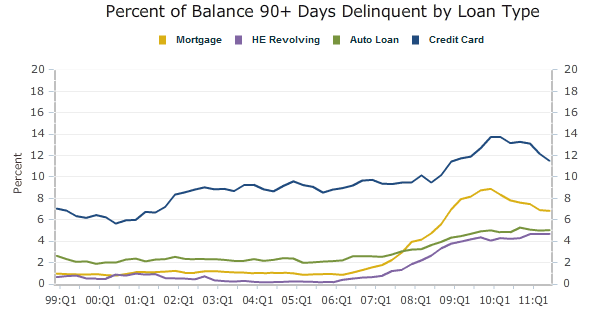

The overall delinquency rate was 10 percent at the end of September compared to 9.8 at the end of the second quarter. Approximately $1.2 trillion of consumer debt was delinquent at the end of the quarter with $834 billion more than 90 days overdue. About 2.5 percent of mortgage balances become delinquent during the quarter, reversing recent trends. New foreclosures were down 7 percent from the 2nd quarter and bankruptcies declined 18.8 percent year over year.

The new student loan data which has impacted the last two quarters of Federal Reserve reporting reflects the inclusion of student loan accounts previously excluded. This change has resulted in an estimate of $845 billion in aggregate student loan debt, a number $290 billion or 53.7 percent higher than had been reported prior to Q2. This debt was also previously excluded from the estimate of total debt outstanding. The Fed is working on similarly adjusting quarters prior to the two most current periods which will give a more accurate picture of historical debt for comparison purposes.