Apparently it is time to shift our total attention from the Millennial generation. A new survey from Freddie Mac introduces the housing hopes and dreams of its successor - Generation Z. This group, defined as those Americans who are now aged 14 to 33, is smaller than the massive cohort that preceded them, partially because the generation is defined narrowly as those born over a ten-year span as opposed to the usual 15-year definition, 1981 to 1996, of Millennials.

The survey was conducted online last summer with 1,531 members of Generation Z. Two-thirds of the sample, which contained both Hispanic and African American respondents and was available in Spanish, was recruited through parents, the remainder were recruited directly. The sample was dived into two groups by age, those 14 to 17 and those 18 to 23 with the latter group having a slightly larger share.

The company says "The dream of homeownership is alive and well" within the generation. It has a more positive perception of what it means to own a home than Millennials at the same age. Eighty-six percent want to own a home someday and 89 percent believe it is at least somewhat likely they will be able to do so. Among that latter group the median estimate as to when they will achieve that goal is age 30, three years younger than the current median homebuying age of 33.

Of note, more than one-quarter of respondents think that owning a home at any point in their life seems out of reach financially. This is higher among those who report that money has been a stressful topic in their family (36 percent). It is also higher among those currently living in a rented home.

Freddie Mac's survey data and other research show that the generation believes owning a home provides more privacy, control and independence than renting. They feel owning a home is a sign of success, is something to be proud of and provides stability and/or financial security.

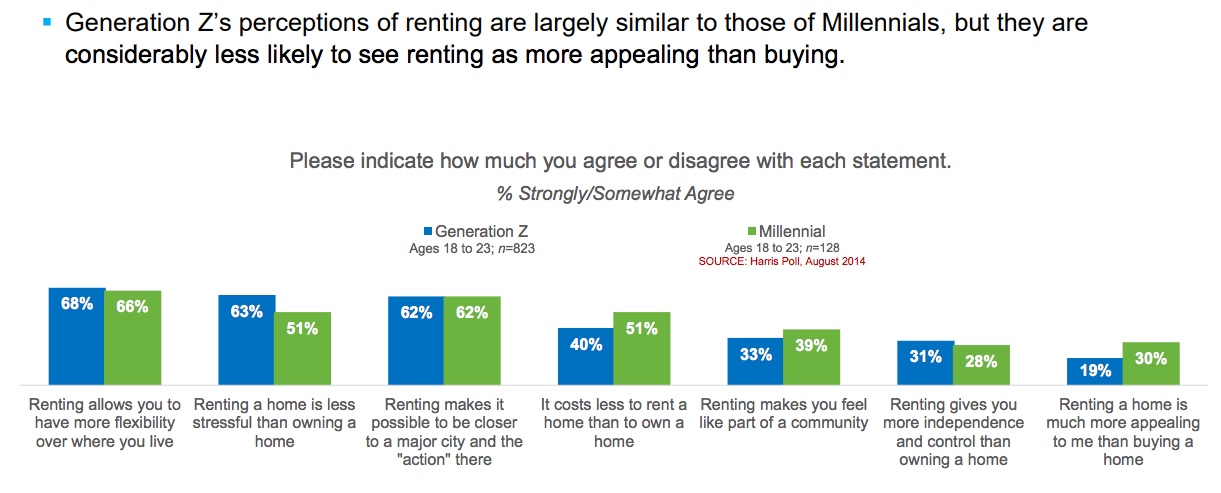

Comparing this survey with earlier ones, Freddie Mac found 19 percent of Gen Z respondents seeing renting as more appealing than buying compared to 30 percent of Millennials at the same age. Fewer see renting as making one feel part of a community (33 percent of Gen Z vs. 39 percent of Millennials) or that it costs less to rent than to buy (40 percent compared to 51 percent.)

While they want and plan to own a home, they view access to that goal more negatively than did Millennials in a separate survey. Thirty-eight percent thought homeownership was less accessible than it was three years ago compared to 31 percent of Millennials who were asked the question.

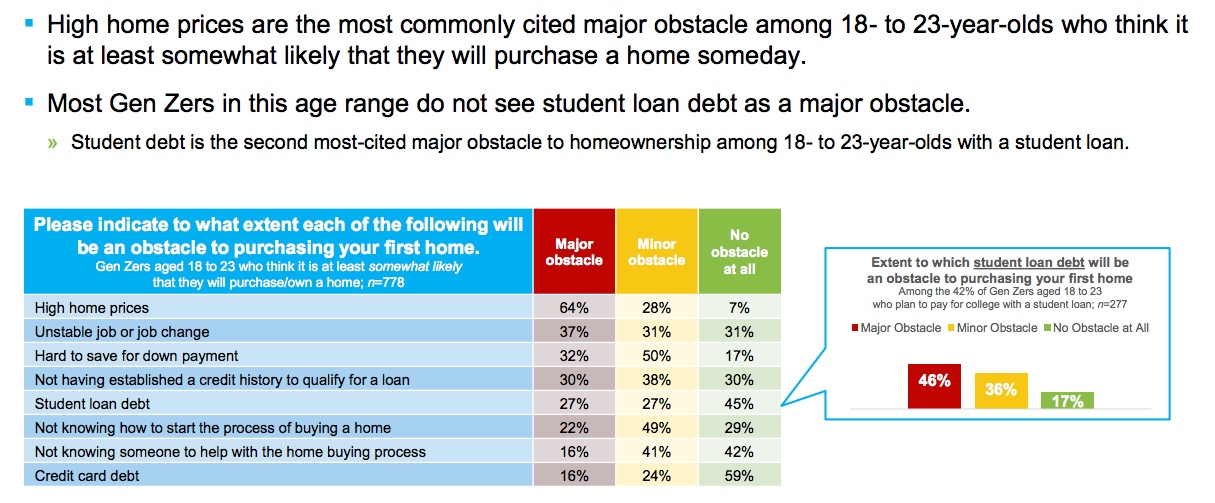

High home prices was the most commonly cited barrier to homeownership. Fewer than half of the older share of Gen Z saw student debt as a major hurdle, but that may be because many in that age group would not yet have yet completed college.

"The data show that while members of Gen Z clearly aspire to homeownership, they are realistic about potential barriers and understand the potential benefits of renting," said David Brickman, CEO of Freddie Mac. "Although these results are good news for the housing markets, they also highlight the challenges many in Gen Z will face as they enter the market to rent or buy."

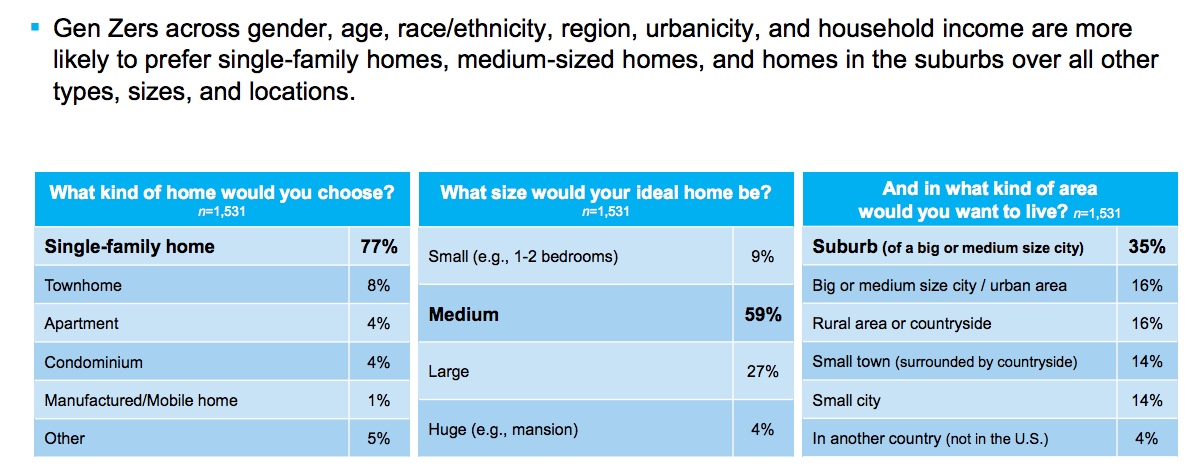

The survey data show that about three-quarters of Gen Z would choose to live in a single-family home over other types of homes, and more than half (59 percent) report their ideal home would be medium-sized. Additionally, 35 percent would choose to live in a suburb of a big or medium-sized city, with an additional 30 percent preferring to live in a rural area or small town.

"One of the biggest challenges Millennials face today is the lack of affordable starter homes," said Sam Khater, Freddie Mac's Chief Economist. "Given Gen Z's desire for suburban medium sized homes close to urban areas with amenities, demand for entry-level homes will intensify."

The survey shows the generation has received financial education at home, but

65 percent say they are not confident in their knowledge of the mortgage

process. Perhaps surprisingly for this digital generation, when they are ready

to purchase their first home, a significant majority of Gen Z (79 percent)

would rather have face-to-face interactions with professionals than carry out

the process fully online. The majority would consult parents (71 percent) to

obtain more information while around one-third to half would talk with a real

estate agent, family or friends or a bank or mortgage lender. Slightly more

than half would utilize the internet.

Brickman added, "It's clear that many in Gen Z reflect the times in which they have lived. They were generally young children during the economic crisis of 2008 but have grown up during a remarkable period of sustained economic growth and prosperity. In general, they are more financially educated and aware than previous generations, and they appear to have a clear understanding of the benefits offered by our nation's housing market - and some of its challenges. We will continue to follow this emerging generation closely, to ensure Freddie Mac is leading the industry towards new and innovative ways to serve them."