The National Mortgage Licensing System reports that, as of the end of the third quarter of 2011, over one-quarter million mortgage licenses are held by companies and individuals under its purview. NMLS is the legal system of record for part or the mortgage licensing in 47 states, Puerto Rico, and the District of Columbia. It does not grant or deny license authority but manages licenses for the various state agencies.

According to the report covering the

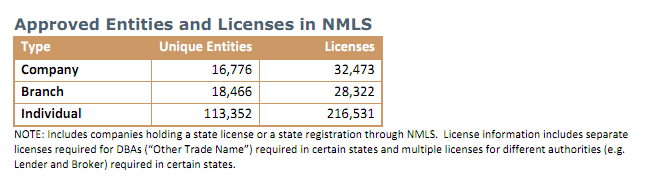

first three quarters of the year, 16,776 companies, 18,366 branch offices, and

113,352 individuals now hold one or more licenses through NMLS. This is a total of 148,594 unique entities

holding an aggregate of 277,326 licenses.

During the third quarter the system added 8,173 new entities and 18,707

licenses. There are an average of 5.5

licensed mortgage loan officers in each company and an average of 1.1 branches.

During the quarter licensing applications were denied to 25 companies, two branches, and 1,344 individuals. The vast majority of the denials were for licenses in Florida where 23 companies and 1,091 mortgage loan officers were denied approval. In addition, 53 companies, 197 branches, and 1,194 loan officers withdrew their applications in Florida, nearly 1/3 of those who did so nationwide.

Licenses were revoked during the quarter for 11 companies, three in Wisconsin, two each in Rhode Island, California, and Washington and one in Illinois and Virginia. Seven individuals also had licenses revoked.

NMLS was created in 2004 by the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators in response to the increased volume and variety of residential mortgage originators and the need to address these changes with modern tools and authorities. NMLS streamlines the licensing process for both regulatory agencies and the mortgage industry by providing a centralized and standardized system for mortgage licensing.