Fannie Mae's Economic and Strategic Research Group (ESR) upped their projection for economic growth slightly, to 3.1 percent this year, but say housing will probably have little to do with it. The first estimate for the third quarter GDP came in at an annualized 3.5 percent, off a bit from 4.2 percent in the second quarter. Consumer and government spending and a building up in private inventories contributed to growth while business fixed investment was soft, residential fixed investment was down for the third straight quarter and the trade deficit widened.

The ESR, in its November Economic Developments, says they expect solid gains in employment and wages to continue, but growth will slow to 2.3 percent next year due to further increases in short-term interest rates and the diminishing effects of last February's fiscal stimulus. They see some downside risks if business investment slows further or consumer confidence loses ground. Either could be triggered by a too aggressive Federal Reserve approach to increasing interest rates or equity market reversals and they stress the possibility of trade issues as a downside risk.

Residential fixed investment should grow modestly as the industry recovers from natural disaster disruptions - hurricanes in the Southeast and wildfires in California - and from the impact of rising mortgage rates.

Then there is housing. The sector has continued to struggle, with sales of existing homes down for the third consecutive quarter and for the sixth consecutive month in September, and new homes posting the sharpest quarterly drop in five years. Prospective buyers are contending with rising prices and interest rates and low inventories of available homes while weather has been a factor with hurricanes in the South and wildfires in the West.

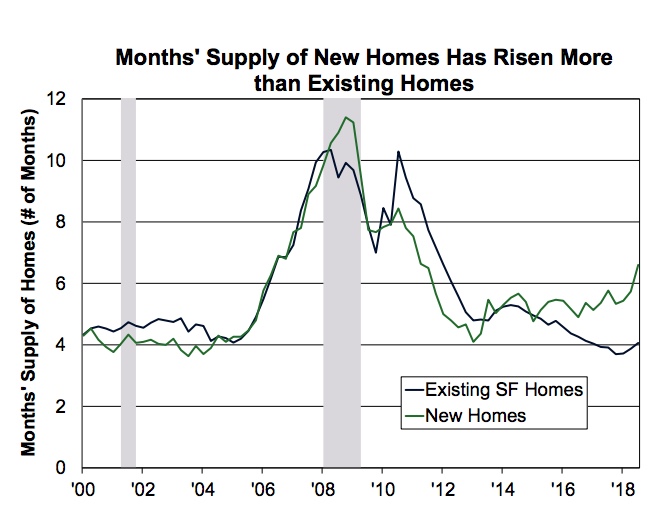

Mortgage rates averaged 4.57 percent in the third quarter, the highest quarterly level in more than seven years, and existing home listings were considered to be a 4.3 supply at the current sales rate; six months is considered a balanced market. New home inventories did cross that line for the first time since 2011, growing to a 6.6-month supply in the third quarter. While inventories of homes have increased recently, the growth has been concentrated in California; remaining constrained in much of the rest of the country.

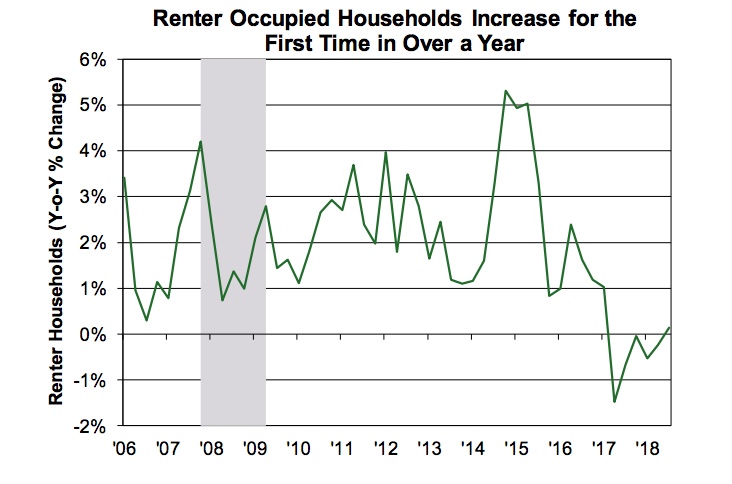

There was good news for the housing sector's long-range future in the Census Bureau's Housing Vacancy Survey for the third quarter. Household growth increased by 1.56 million year-over-year and renter-occupied households posted the first year-over-year increase since the first quarter of 2017. Owner occupied households posted the 13th quarter of annual growth, up 1.5 million. The homeownership rate has increased on an annual basis over seven consecutive quarters, reaching 64.4 percent in the third quarter. The report calls household formation and headship rates key determinants of housing production and a challenge for the construction industry.

Speaking of which, single-family housing starts fell during the third quarter as rising rates and construction worker wage increases contributed to builders' costs. Prices of softwood lumber have dropped by about 27 percent from their record levels in June, helping a bit. Weather was probably a factor here as well; the 0.9 drop in single-family starts in September was driven by a 6.8 percent plunge in the South. Multifamily starts, always volatile, also pulled back in September.

Fannie Mae says its presumptions about 2019 "are premised on the view that mortgage rates will recede as a headwind" and when coupled with its overall outlook or the economy, they expect sales will stabilize in 2019. This will get an assist from moderating home price appreciation. The anticipated end-of year average for 2018 of 5.4 percent (down from 6.9 percent growth in the 2017 FHFA Purchase-Only Index) will ratchet down to 4.1 percent next year,

The operating environment for mortgage lenders will remain challenging. The ESR revised its estimates for purchase mortgage volumes from their earlier forecast by about 1.0 percent for this year and 2.0 percent next year but expect volume to pick up by almost 3.0 percent in 2019. The result was a $11 billion decline in their 2018 forecast to $1.624 trillion and a $21 billion revision to the 2019 forecast to $1.603 trillion.

In other areas, the 250,000 new jobs created in October was a strong improvement over the 118,000 jobs in September, putting the year-to-date number above 2.1 million. Unemployment held steady at 3.7 percent.

Even as average hourly earnings accelerated in many sectors, personal consumption expenditures (PCE) indicate that inflation pressures are manageable. The annual growth in the PCE index slowed for the second month to 2.0 percent in September while the core PCE inflation was at 2.0 percent for the fifth month. The recent decline in oil prices and the stronger dollar add to the downward pressures.

The Fed, at their meeting this month, left the fed funds rate unchanged at a 2.0 to 2.25 percent range. The Fed considers the risks to its economic outlook to be "roughly balanced," and still expects "further gradual increases in the target range for the federal funds rate."

Volatility in the stock market has intensified; moves at or above 1.0 percent up or down in the S&P 500 Index occurred on 10 trading days in October compared with none in September. For all of October, the S&P 500 Index fell 6.9 percent, largely reversing its 2018 gains. The report says that sustained declines in the stock market pose downside risks to its outlook as a contraction in households' financial wealth could lead consumers to be more cautious.